Nvidia (NASDAQ:NVDAWith Nvidia’s stock price dropping below $120, investors are starting to realize that the stock can actually fall. This is a surprising development, as chasing stock price rallies has long been a profitable strategy. However, some stock traders will learn that Nvidia is not invincible. To be sure, the company remains a very profitable business, but until the stock price falls further, I am neutral on NVDA stock.

Nvidia designs powerful processors that can be used in artificial intelligence (AI) applications. The company is a stock market darling, and as we’ll see later, analysts are generally enamored with Nvidia.

However, some Wall Street experts are even going so far as to give Nvidia stock a negative rating (more on this topic later). I’m not going to be completely bearish, as I’m just neutral and hoping for some drop in Nvidia’s market cap and valuation. To me, this is a case of “right company, right stock, wrong price.”

Nvidia may conquer another part of the world

If Nvidia wasn’t already taking over the world, the company is reportedly about to make a big move in the Middle East, where it has agreed to deploy its AI technology in data centers owned by Qatar-based telecommunications company Ooredoo.

Specifically, Ooredoo’s data centers in Qatar, Algeria, Tunisia, Oman, Kuwait and the Maldives will have access to Nvidia’s powerful AI and graphics processing technology. Financial details of Nvidia’s deal with Ooredoo are currently unknown.

The deal comes at a politically contentious time, to say the least: the US government may not be too happy about Nvidia and Ooredoo’s deal, given concerns that Middle Eastern countries could give China access to high-performance AI processors.

The US can restrict the export of high-end AI chips to China, but it can’t restrict what every company does in every country, so it’ll be interesting to see if any fallout emerges from the Nvidia-Ooredoo deal, but for now it’s safe to assume Nvidia will plant its flag in the Middle East and with it a new revenue stream.

Controversy over Nvidia stock

In the interest of providing a fair and balanced view, I started with some good news for Nvidia shareholders. However, not everyone is bullish on Nvidia stock. There are some true contrarian voices on Wall Street, and investor and blogger Johnny Zhang has actually given NVDA stock a strong sell rating.

Is it even legal to do something like this in 2024? Nvidia is considered an unassailable and unassailable behemoth in the white-hot AI hardware market, so Zhang may be guilty of stock market sacrilege.

Meanwhile, I’m inclined to agree with Zhang’s reasons for being bearish on Nvidia stock: Market expectations about Nvidia’s future growth may be “overly optimistic, with potential risks including front-loaded demand, competition, and geopolitical tensions,” Zhang explained.

In the niche market of AI-enabled graphics processing units (GPUs), Nvidia doesn’t currently have many “competitors,” but it’s hard for one to come out on top, and in such a lucrative industry, it’s not all that surprising to see rival upstarts pop up — and they might not all be American.

Still, for the time being, investors shouldn’t be overly worried about Nvidia facing stiff competition. Rather, it’s the company’s valuation and overwhelmingly enthusiastic market sentiment that should worry Nvidia perpetual bulls.

In that regard, Zhang’s words resonated deeply with me: “Remember, Wall Street pitchmen will always recommend you be most bullish on a stock when its price is rising or when it is supposed to be a big story in the future,” Zhang warned.

This quote is worth writing down and remembering: Currently, Nvidia’s stock is showing signs of fatigue, but it still trades at 65.6 times trailing 12-month earnings (based on combined earnings of $1.80 over the last four quarters), compared to the average sector P/E ratio of 23.5.

Is Nvidia stock a buy according to analysts?

On TipRanks, NVDA is rated a Strong Buy, with 38 Buy and 3 Hold ratings from analysts in the past three months. The average price target for Nvidia is $156.35, suggesting an upside potential of 32.4%.

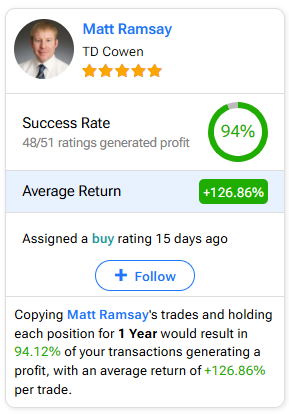

If you want to buy or sell NVDA shares and are wondering which analysts to follow, the most profitable analyst covering this stock (over a 1-year period) is Matt Ramsay of TD Cowen, with an average return per rating of 126.86% and a success rate of 94%. Click on the image below for more details.

Conclusion: Should you consider Nvidia stock?

Nvidia is a big company in a niche market, and there’s no point in denying that. At the same time, I agree with Zhang that the market may be “overly optimistic” about Nvidia’s future growth assumptions.

Many analysts still rate Nvidia highly, and I don’t blame them. In my view, investing in Nvidia could make a lot of sense, but not at the current stock price. Therefore, I am neutral on NVDA stock and would like to see a 20% or 25% drop before I would consider buying shares.

Disclosure

Source link