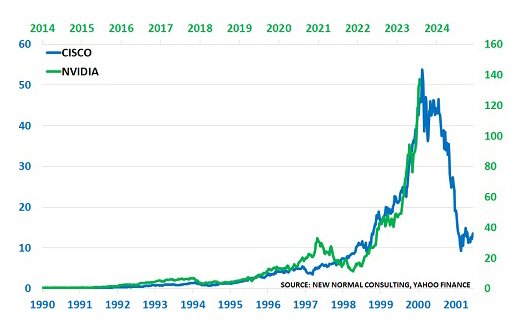

Cisco 1990 – 2000, NVIDIA 2014 – 2024

All stock market bubbles are the same; they just change names and themes. Today’s bubble is about NVIDIA and artificial intelligence (AI), which its proponents say will take over the world.

Twenty-four years ago, during the dot-com bubble, it was Cisco and Internet networking.

As the stock charts show, both companies saw similarly steep increases in their stock prices over the last decade before they peaked. Cisco’s stock price rose over 1000% before peaking. And, as the Financial Times points out in 2021:

“The theory was sound: Cisco, which provides networking equipment to both telecommunications carriers and other companies, had been a shovel seller in the dot-com gold rush. What could go wrong?

“In one sense, the investors were right. Cisco won big time. Over the next 21 years, Cisco’s revenues quadrupled to $49 billion and its profits grew five-fold to $11 billion.”

“The problem was the stock price – it was simply too expensive. At its peak in March 2000, Cisco’s price-to-earnings ratio was 201, its enterprise value-to-sales ratio was 31, and its price-to-free cash flow ratio was 176.

“And suddenly, everyone noticed. Over the next two years, Cisco’s stock price fell 80%, losing $431 billion in market cap.”

Cisco’s stock price peaked at $54 in March 2000 and took 21 years to (temporarily) recover from that level. Today, the stock is back down at $46.

NVIDIA’s market capitalization now exceeds that of major European stock markets

Figure 1: Nividia’s market capitalization compared to German, French and UK stock indexes

Nvidia is doing even better: Just two years ago, the company’s market cap was $400 billion, but since October, as AI fever has picked up, its value has skyrocketed, hitting $1 trillion earlier this year and continuing to climb.

- This month, it became the world’s most valuable stock with a market capitalization of $3.3 trillion, overtaking popular names like Microsoft and Apple.

- And as Deutsche Bank’s charts prove, its value is now greater than all listed shares in Germany, France and the UK.

This is the classic definition of a bubble: its value rose from $2 trillion to $3 trillion in just 30 business days as investors around the world feared missing out.

This was the fastest increase in history.

NVIDIA drives growth in US market

NVIDIA will account for 34.5% of the S&P 500’s return in 2024

Unsurprisingly, NVIDIA also has a major impact on the US S&P 500 index. As Apollo’s chief economist warned earlier this month:

“35% of the S&P 500 market capitalization increase since the start of the year has come from one stock.”

- Such high concentration suggests that things will be good for NVIDIA if it continues to rise.

- But if it starts to fall, the S&P 500 will take a big hit.

“After all, the extreme concentration of S&P 500 returns makes investors more vulnerable to a single headline that impacts one stock that drives the index’s returns.“

All bubbles eventually burst

Figure 1: Short Interest in SPY and QQQ US ETFs

The problem with soap bubbles is simple: soap bubbles are fun for everyone involved while they last, but just like blowing up a balloon, to keep the bubble getting bigger it needs more and more air.

Eventually, the supply of new air will outpace it.Famous investor Bob Farrell warns in his Rule #4:

“Markets that rise or fall sharply usually rise or fall more sharply than expected, but do not correct by leveling off.”

Eventually, everyone who wants to invest will place a bet, and at that point, the market will start to listen to new voices. Today, there are many who argue that AI is more about expectations than actual performance.

The JP Morgan chart is also alarming, showing that almost everyone who wanted to buy the Nasdaq and S&P 500 indexes has done so, with very few people left to short.

This doesn’t mean that Nvidia is a bad company, and there’s no doubt that AI can be extremely useful in many important areas.

For example, artificial intelligence has been used to fly airplanes for decades, and perhaps in the next few years, artificial intelligence will be used to drive self-driving cars.

The problem is that Silicon Valley is good at hyping up its own products, so rather than Nvidia’s stock continuing to rise forever, it’s more likely to follow Cisco’s path.