Do you want to turn a little bit of money now into a lot of money later? Investing in the right stocks is one way to do just that. The question is, which stocks to invest in?

Some veteran investors might recommend focusing on the leaders in their respective industries to start with. But that advice presents a bit of a conundrum for those familiar with the tech giants. Many of these stocks are expensive and already large, which can limit their growth potential somewhat. How do you grow a company that’s already huge?

Advanced Micro Devices (NASDAQ: AMD) AMD is not a leader in either the computer processor or graphics processor markets. But the company and its stock price have both done surprisingly well. Can this growth continue long enough to turn a $50,000 investment in AMD into a seven-figure fortune at some point in your life? Read on.

Two reasons for Advanced Micro Devices’ unexpected success

It’s true: Advanced Micro Devices is not a dominant name in any market. NVIDIA (NASDAQ: NVDA) It is far ahead of other companies in terms of graphics processing and data center processors (especially artificial intelligence hardware), and despite recent challenges, Intel (Nasdaq: INTC) When it comes to general computer processors, Intel remains the leader, controlling roughly 80% of the CPU market, according to a report by market research firm Canalys. And this leading market share isn’t just down to luck.

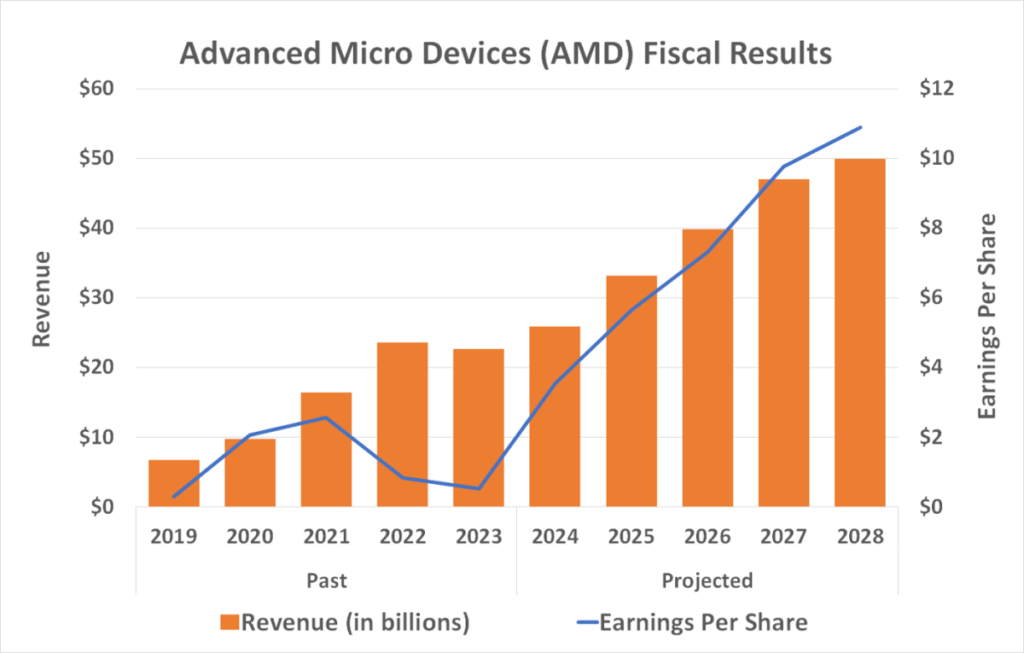

However, Advanced Micro Devices teeth It’s doing something right: The company’s revenue is expected to grow another 13% this year, accelerate to 28% growth next year, and then continue at a similar double-digit pace for at least a few more years after that. Revenue is expected to improve accordingly.

What is going on? How can a company that has always had to play second fiddle to bigger, more established brands grow so much?

There are two relevant explanations. The first is simply that technology and intellectual property are the great equalizers. alphabetTake Google for example. Google wasn’t the first search engine. became It is the most used search tool in the world because its search algorithms provide users with meaningful and relevant results. Advanced Micro Devices may not be the world’s largest processor manufacturer, but its technology and IP are do This will allow low-cost processors to be manufactured in large quantities that are perfectly suited to their intended applications.

The second reason AMD can weather adversity and continue to grow is that it has more than enough business.

The emergence of artificial intelligence (AI) is a clear opportunity in itself: CEO Lisa Su believes the world will be spending as much as $400 billion per year on AI accelerator technology by 2027. For reference, Advanced Micro Devices did roughly $23 billion worth of deals last year.

But it’s not just artificial intelligence-oriented data centers. The rise of AI is also driving demand for more powerful computers. As Su explained in the January earnings call, “Millions of AI PCs powered by Ryzen processors have been shipped to date, and more than 90 percent of AI-enabled PCs on the market today are powered by Ryzen CPUs.”

Big winner or not, AMD is edging out the competition

But the question remains: is AMD the kind of millionaire-creating stock if you’re starting out with a fairly modest amount of money, like $50,000?

I’m not saying never, but it’s probably not likely.

If you’ve already invested in Advanced Micro Devices stock with high hopes, don’t panic. You’re in luck. Turning your $50,000 into $1 million is a massive 2,000% return on your investment. That’s a 20x deal. rear The fundamental opportunity to generate such gains is being recognized and priced in. This is certainly a tall order, and one that will likely take a lifetime to realize from here. S&P 500 The average annual return is only about 10%.

But just because AMD is no longer a billionaire-maker doesn’t mean it’s not one of the top investments in the semiconductor industry right now.

It’s a strong claim, but one that’s backed up by strong evidence. Take last quarter’s growth in the desktop processor space: According to figures from Anandtech, AMD’s desktop CPU sales grew 4.7% in the first quarter, bringing the company’s share of this important part of the processor market to a multi-year high of 23.9%. The company’s server processor market share also grew, reaching a multi-year high of 23.6%, almost entirely at Intel’s expense.

Advanced Micro Devices is also making inroads in artificial intelligence hardware, which has done little to threaten Nvidia’s dominance there. Meta Platform and Microsoft More companies are becoming cost-conscious and looking to AMD for relief, which is why the company’s data center revenue grew 80% year-over-year in the three months through March.

And much of that growth has been driven by a relatively immature portfolio of products targeted at the AI market: Earlier this month, Advanced Micro Devices unveiled its new MD Instinct MI325X AI accelerator chip, which promises 30% more bandwidth and twice the total memory than rival Nvidia’s comparably priced offering.

It will also be interesting to see if the pace of Advanced Micro Devices’ new next-generation AI technology can match Nvidia’s current annual pace going forward.

Let’s connect the dots. AMD today is a different company than it was 10 years ago. It’s very different than it was just a few years ago. A large part of the market may be overlooking just how ready AMD is. Today’s AMD stands to take small chunks of market share from major players in both of its core markets.

AMD Stock Worth the Big Smash

If you want to invest in an undervalued growth company at a time when its share price has fallen more than 30% from its all-time high in March, know that the analyst community fully agrees with your choice. The analyst community’s current consensus price target is $190.02 per share, more than 20% above the current share price. Also, 35 of the 49 analysts covering the company consider the stock a Strong Buy. Get inspired.

That being said, even confident bulls should be aware that AMD stock may remain seasickly volatile for the time being, and this volatility could lead to further significant declines before hitting a final low.

Still, in the end, this intense movement will be worth it: Most of the market has not fully realized or priced into this potential, which signals an opportunity for you.

Should you invest $1,000 in Advanced Micro Devices right now?

Before buying Advanced Micro Devices shares, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy now…Advanced Micro Devices was not among them. The 10 selected stocks have the potential to generate big gains over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $801,365.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times S&P 500 Recovery Since 2002*.

View 10 stocks »

*Stock Advisor returns as of June 10, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and public relations at Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. James Brumley owns shares of Alphabet. The Motley Fool owns shares of and recommends Advanced Micro Devices, Alphabet, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Could Investing $50,000 in Advanced Micro Devices Make You a Millionaire? was originally published by The Motley Fool.