There’s no doubt that investing in the stock market is a really great way to build wealth. But if you choose to go down that path, you’ll end up buying stocks below market price. For example, Kinder Morgan Co., Ltd. (NYSE:KMI) shares have risen over the last year, but the 21% increase is below the market return, and the longer term returns haven’t been much better, with the stock only 7.8% higher than it was three years ago.

With that in mind, it’s worth looking at whether a company’s underlying fundamentals are driving its long-term performance, or if there are any inconsistencies.

Check out our latest analysis for Kinder Morgan

To quote Buffett, “Ships will sail around the world, but the Flat Earth Society will thrive. There will continue to be a wide disconnect between price and value in the marketplace…” One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

Over the last year, Kinder Morgan’s earnings per share actually fell 2.9%.

Sometimes a company sacrifices EPS in the short term for long term gains, in which case you might be able to find other positives. Because changes in EPS don’t seem to correlate with changes in share price, it’s worth looking at other metrics.

Unless we see improvement, we don’t think the hunger for dividends is driving Kinder Morgan’s share price higher – the company’s revenue fell 19% over the trailing twelve months – and it’s fair to say we’re a bit surprised and cautious to see the share price rising.

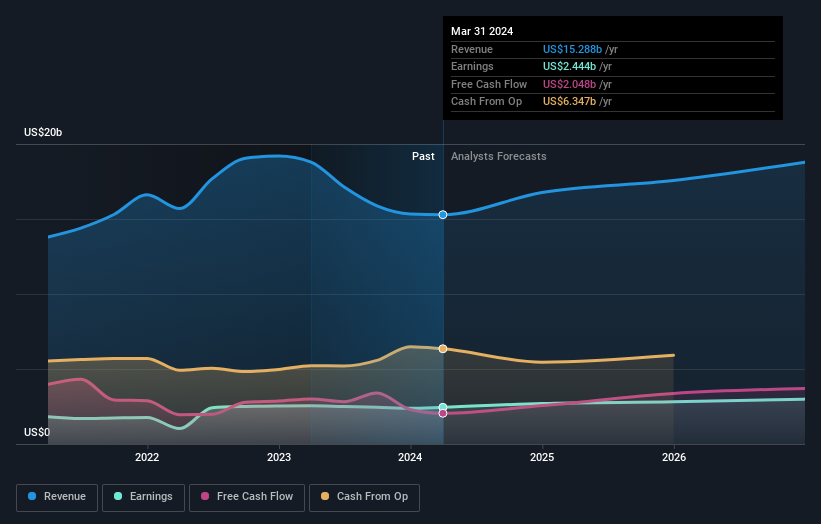

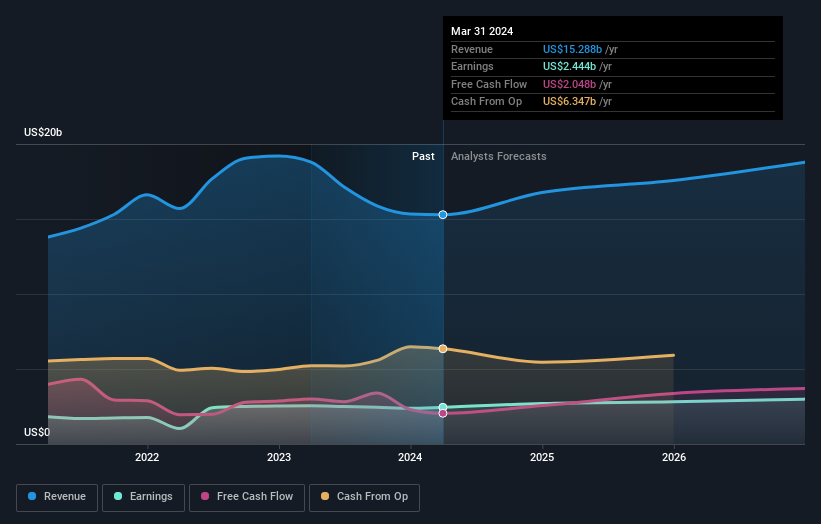

The company’s revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is important. free Report how your financial situation has changed over time.

What about dividends?

In addition to measuring the price-to-earnings ratio, investors should also consider the total shareholder return (TSR). While the price-to-earnings ratio only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the gains of any discounted capital raisings or spin-offs. Thus, for companies that pay large dividends, the TSR is often much higher than the price-to-earnings ratio. In the case of Kinder Morgan, the TSR for the past year is 29%, which exceeds the price-to-earnings ratio mentioned earlier. The dividends paid by the company have thus boosted the price-to-earnings ratio. total Shareholder returns.

A different perspective

It’s good to see that Kinder Morgan shareholders have received a total shareholder return of 29% over the past year. This of course includes dividends. The share price performance appears to have improved recently, as the one-year TSR is better than the five-year TSR (the latter at 5% per year). An optimistic person might view the recent improvement in TSR as an indication that the business itself is getting better over time. I find it very interesting to look at share price as a proxy for business performance over the long term. But to gain true insight, other information needs to be considered. To do so, Three Warning Signs I found some at Kinder Morgan (including two important ones).

If you’re like me do not have You don’t want to miss this free A list of undervalued small-cap stocks that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Please contact us directly. Or email us at editorial-team@simplywallst.com