If you’re planning on holding a stock for the long term, you’ll no doubt want to see a positive return. Even better, you’ll want the stock price to rise above the market average. Unfortunately for shareholders, Universal Health Services Co., Ltd. (NYSE:UHS) shares are up 45% over the past five years, below the market return, but some buyers are happy with the 25% gain in the past year.

It’s also worth looking at the company’s fundamentals here, since it can help determine whether long term shareholder interests are aligned with the performance of the underlying business.

View our latest analysis for Universal Health Services

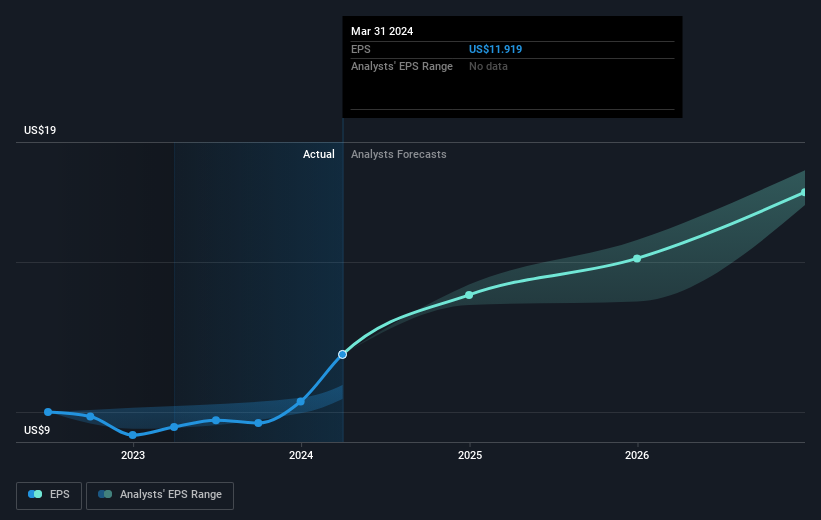

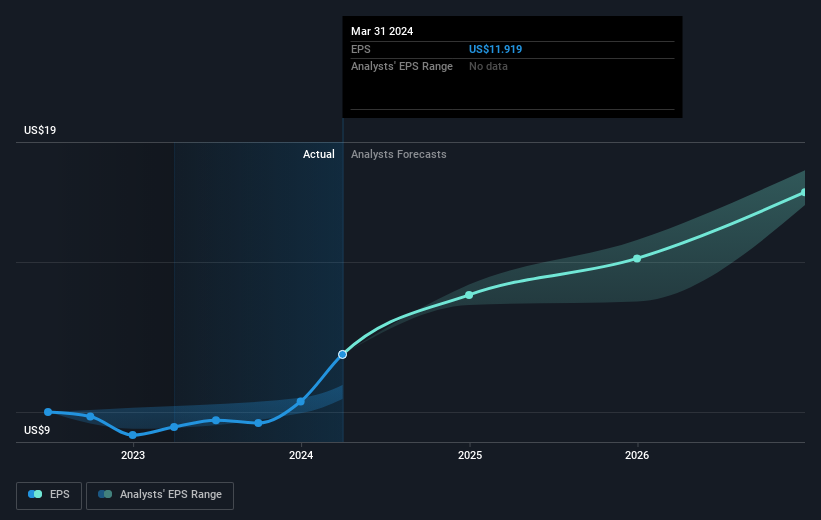

There’s no denying that markets are sometimes efficient, but share price does not necessarily reflect underlying business performance. One imperfect but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Universal Health Services has grown its earnings per share at 7.4% per year over five years. This makes the EPS growth rate very close to the annual share price growth rate of 8%. We can therefore conclude that sentiment towards the stock has not changed much; in fact, the share price seems to be roughly reflecting the EPS growth rate.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that the Universal Health Service has recently improved its bottom line, but will it increase revenue? free A report showing analyst revenue forecasts can help you gauge whether the EPS growth is sustainable.

What about dividends?

When looking at investment returns, it’s important to consider the following differences: Total shareholder return (TSR) and Price Earnings RatioThe TSR incorporates the value of any spin-offs or discounted capital raisings, along with dividends, based on the assumption that the dividends are reinvested. As such, for companies that pay large dividends, the TSR is often a lot higher than the share price return. In the case of Universal Health Services, the TSR for the last 5 years is 49%, which exceeds the share price return mentioned earlier. Dividends paid by the company have thus boosted the share price return. total Shareholder returns.

A different perspective

Universal Health Services’ annual TSR was 26%, roughly in line with the market average. This increase is quite satisfactory and better than the five-year TSR of 8% per year. Management’s foresight could see growth continue into the future, even if the share price stagnates. While it’s well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Nevertheless, Universal Health Services is One warning sign in investment analysis things you should know…

If you want to check out another company that may be financially superior, don’t miss this one. free A list of companies that have proven they can grow revenue.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Please contact us directly. Or email us at editorial-team@simplywallst.com