When investing, you generally look for stocks that outperform the market average. Buying undervalued companies is one way to earn excess returns. For example, Bechtel AG (ETR:BC8) shareholders have enjoyed a 34% share price rise in the past five years, well above the market return of around 1.4% (not including dividends). Meanwhile, more recent gains have been less impressive, with shareholders only gaining 27% including dividends.

Let’s take a look at the underlying fundamentals over the long term and see if they are aligned with shareholder interests.

View our latest analysis for Bechtle

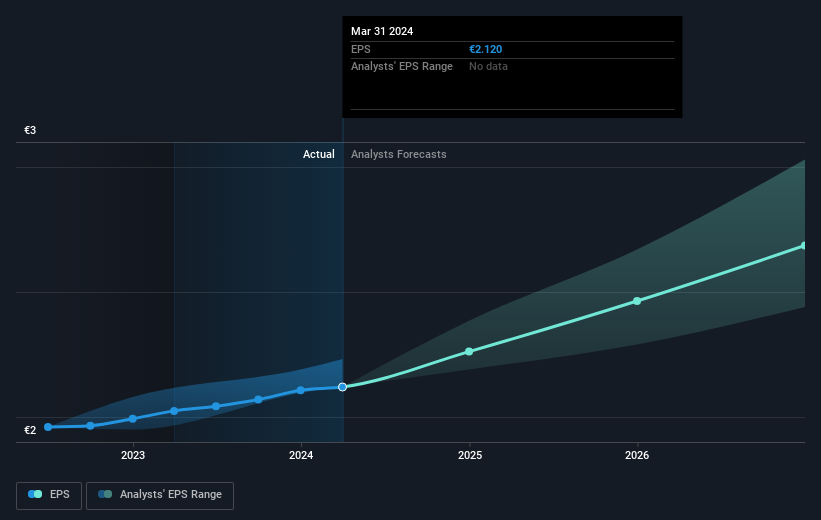

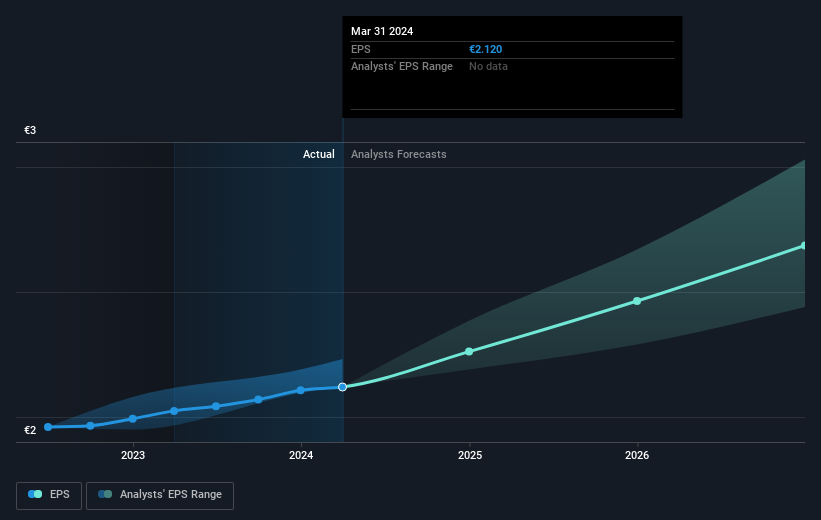

There’s no denying that markets are efficient sometimes, but prices do not necessarily reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

Over the five years that the share price has grown, Vector has achieved compound earnings per share (EPS) growth of 13% per year. That EPS growth is more impressive than the 6% annual share price increase over the same period. As such, it seems the market is relatively pessimistic about the company.

The image below shows how EPS has changed over time (if you click on the image you can see greater detail).

this free This interactive report on Bechtle’s earnings, revenue and cash flow is a great starting point, if you want to investigate the stock further.

What about dividends?

It is important to consider the price return, as well as the total shareholder return, for a given stock. While the price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Thus, for companies that pay generous dividends, the TSR is often much higher than the price return. Coincidentally, Vector’s TSR for the last 5 years was 42%, which exceeds the price return mentioned earlier. Therefore, the dividends paid by the company total Shareholder returns.

A different perspective

It’s good to see that Bechtle shareholders have received a total shareholder return of 27% over the past year, which includes dividends. This is higher than the five-year annualized return of 7%, suggesting that the company has been performing well recently. Those with an optimistic view might view the recent improvement in TSR as an indication that the business itself is getting stronger over time. Is Bechtle undervalued relative to other companies? The following three valuation metrics may help you decide:

of course Vector may not be the best stock to buySo you might want to take a look at this free A collection of growing stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Please contact us directly. Or email us at editorial-team@simplywallst.com