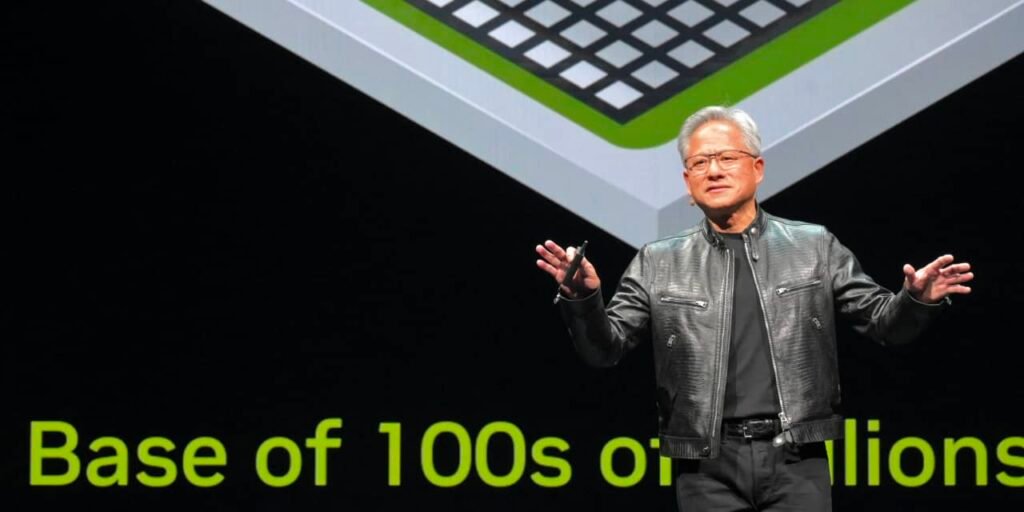

Nvidia recently became the most valuable company on the U.S. stock market, joining the ranks of some big names.

Lately, NVIDIA, Microsoft, and Apple have been vying for the top spot, with Microsoft currently leading the pack with a market cap of $3.3 trillion, slightly ahead of NVIDIA and Apple at $3.2 trillion.

Before being dethroned by Microsoft last year, Apple led the stock market for nearly a decade, followed by Exxon Mobil for nearly a decade before that.

Exxon Mobil (then called Exxon) also led the stock market for much of the 1990s before being overtaken by Microsoft and Cisco during the late 1990s tech boom, and then by GE at the height of its CEO Jack Welch’s powers, whose stock traded at about 40 times earnings, typical of a tech company.

The mid-1980s was IBM’s time. At one point, IBM made up 6% of the S&P 500, roughly the individual weightings of the big three technology stocks today. At the time, IBM was the ultimate blue chip and a darling of institutional investors. A leader in mainframe computers, IBM lost its technology crown and market dominance as the mainframe declined in the 1990s. IBM was a leading growth stock in the 1960s, taking the top spot in 1967.

Advertisement – Scroll to continue

AT&T briefly held the top spot in the early 1980s but was broken up in late 1983. For decades prior to that, AT&T had a virtual monopoly on telephone service, and its ticker, T, stood for telephone. AT&T was also a top stock in 1926 and has long been a key defensive stock for income-focused investors.

It’s worth noting that 30 years ago, IBM was the only technology stock in the market’s top 10 companies. At the time, the top 10 stocks included Coca-Cola.

,

Walmart, Procter & Gamble

,

Merck

,

Johnson & Johnson

.

Currently, the top six stocks are tech companies: Microsoft, Apple, Nvidia, and Alphabet.

,

Amazon.com and the Meta Platform

,

However, S&P does not classify all of these as technology.

When industrial companies dominated the stock market in the 1930s, 1940s, and 1950s, AT&T, General Motors, DuPont, and Exxon (then Standard Oil of New Jersey) were the leaders.

Advertisement – Scroll to continue

And one more historical footnote: when IBM was the top stock in 1980, the company’s market cap was less than $40 billion, roughly 1/80th of what today’s top stocks are worth.

And in 1989, at the height of Japan’s stock market bubble, the world’s five largest companies had a presence in Japan, led by Nippon Telegraph and Telephone.

.

Email Andrew Bary at andrew.bary@barrons.com.