It was the best of times, not the worst, but it was pretty bad. In a tale of two stock markets facing U.S. investors, the S&P 500 is soaring to new records driven by one company, Nvidia, while less important companies are falling and remain well below their all-time highs.

It was the best of times, not the worst, but it was pretty bad. In a tale of two stock markets facing U.S. investors, the S&P 500 is soaring to new records driven by one company, Nvidia, while less important companies are falling and remain well below their all-time highs.

The Russell 2000 index of smaller companies is down 17% from its November 2021 peak and hasn’t risen at all this year.

Hello! You’re reading a premium article! Subscribe now to continue reading.

Subscribe now

Premium Benefits

Premium for those aged 35 and over Daily Articles

Specially curated Newsletter every day

Access to 15+ Print Edition Daily Articles

Register-only webinar By expert journalists

E-Paper, Archives, Selection Wall Street Journal and Economist articles

Access to exclusive subscriber benefits: Infographic I Podcast

35+ Well-Researched Unlocks

Daily Premium Articles

Access to global insights

Over 100 exclusive articles

International Publications

Exclusive newsletter for 5+ subscribers

Specially curated by experts

Free access to e-paper and

WhatsApp updates

The Russell 2000 index of smaller companies is down 17% from its November 2021 peak and hasn’t risen at all this year.

For the S&P 500 index, which includes the biggest companies, the average stock price is trading roughly at the same level as it was at the start of 2022, with more than half of the current constituents having fallen since then. Making matters worse, only 198 stocks have managed to stay up this month, even as the index hit new intraday highs on 11 of the 13 trading days.

This market contraction has raised concerns among technical analysts, who believe the larger gains in many stocks, known as “breadth,” will make the bull market more sustainable.

In fact, it suggests there are two factors driving stock prices: demand for chips that power artificial intelligence, and concerns about the economy and interest rates.

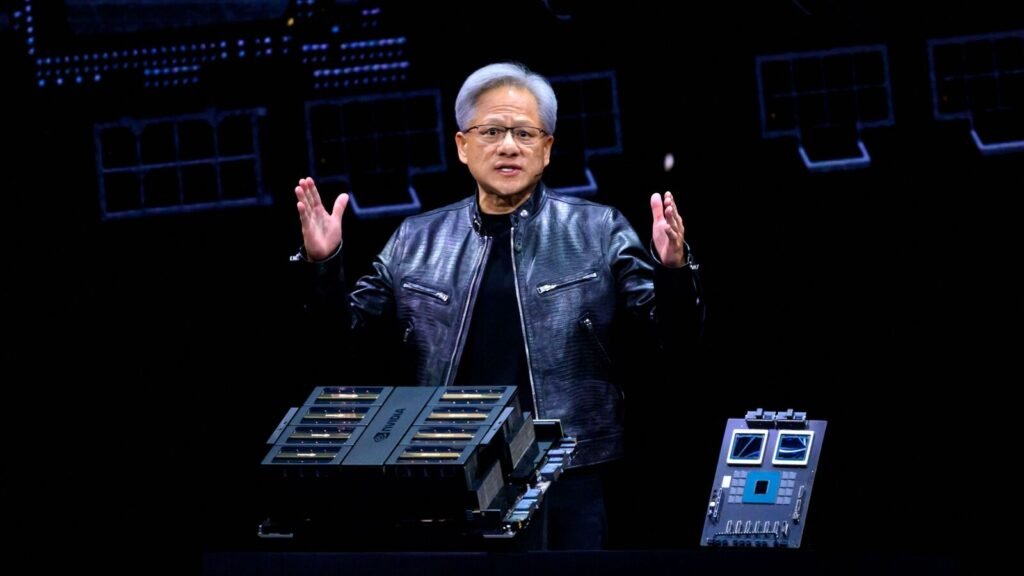

The former has driven Nvidia, several other stocks and the broader market to new highs, making it the world’s most valuable company. The latter has dragged most stocks down as weak data dampened growth expectations and the Fed remains concerned about inflation.

In this case, I agree that the lack of a broad upside puts the upside at risk, but for different reasons than some might think.

What worries me is the market’s over-reliance on just one stock: Nvidia, which accounted for a third of the S&P 500’s gains this month before Thursday’s pullback and 44% of its gains since the start of 2022. If Nvidia underperforms (due to weakening chip demand, AI hype coming to fruition, or simply because everyone already owns it), the index will be reliant on the rest of the market, which isn’t doing as well.

Investors buy the S&P through cheap, popular index ETFs because they want to spread their exposure across many companies. Now, they’re buying a lot of Nvidia-specific and broader AI risk. It’s worked out so far because the AI race has created a surge in demand for Nvidia chips, but the S&P isn’t as committed to risk diversification as it used to be.

If Nvidia falters, the broader market could rise. But other stocks rallying on AI hopes likely won’t do well if Nvidia slumps, so their gains will depend on cyclical stocks outside of the big tech companies. And Nvidia is now so big that a drop in its stock could drag down an otherwise healthy market. The S&P would have risen on Thursday if not for the chipmaker’s drop in stock.

The problem is that while investors are growing increasingly concerned about economic growth, they are also worried that the Fed won’t cut rates fast enough. Bond yields have fallen, with the interest-sensitive 2-year Treasury yield falling to 4.26% from more than 4.7% at the end of April. But traders have all but given up on a cut next month and in September, with Fed officials warning they need more evidence that inflation is on target.

That has changed the dynamics of the S&P’s small caps this month. Instead of being buoyed by lower bond yields, the average has fallen right along with them. Even the small caps in the Russell 2000, which have more debt and therefore tend to be more sensitive to yields, haven’t benefited. A weakening economy with few interest rate cuts at a time when high interest rates are already hurting low-income consumers and weak small and mid-sized businesses, is not a good prospect for investors.

The good news is that markets are fickle. They can easily switch from worrying about a weak economy to believing growth is strong, especially as the latest data is mixed. The Atlanta Fed’s GDPNow second-quarter growth forecast based on data released so far is over 3% annualized, which is very good.

Fortunately for passive buyers of the S&P 500, any worries about the economy were drowned out by big gains in Nvidia, Apple and Microsoft, which have risen in value this month more than all the other components of the S&P combined.

Will it really last? Charles Dickens wrote, “It was an age of faith and an age of disbelief.” I lean toward the latter.

Write to James Mackintosh at james.mackintosh@wsj.com.

Stay tuned for all business news, market news, breaking news events and breaking news on Live Mint. Download the Mint News App to get daily market news.