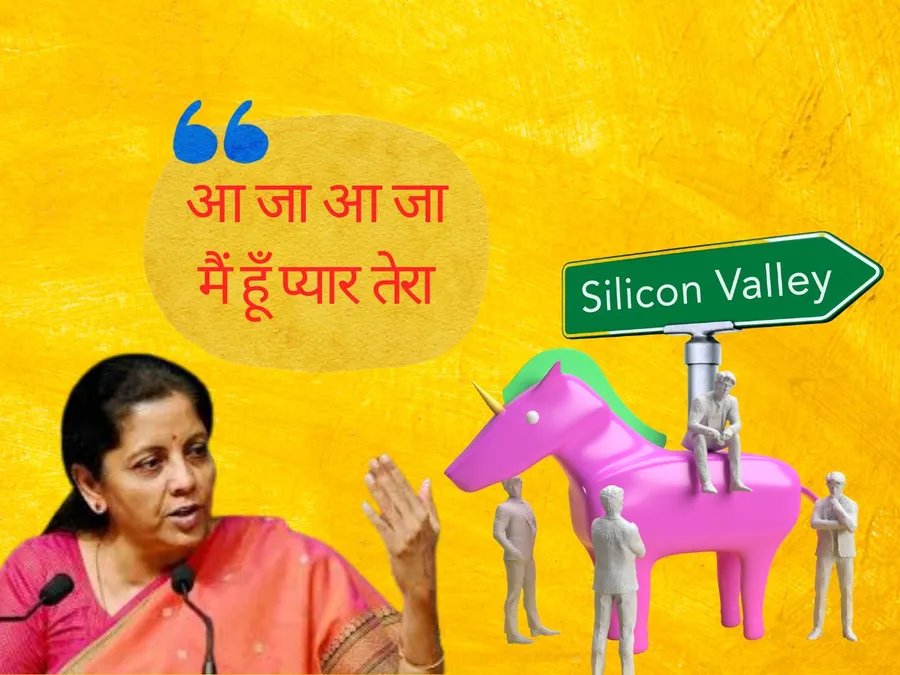

Remember the wave of Indian startups flocking to Silicon Valley and Singapore in search of better prospects? Well, get ready for the story to unfold! The narrative is changing and a potential “Ghar Wapsi” is on the horizon.

Get ready for a startup homecoming! Industry insiders are buzzing about a possible game-changer in the upcoming Union Budget – a plan that could trigger a massive “reverse flip” for Indian companies currently based overseas. The initiative aims to attract Indian startups currently based abroad and spark a reverse flip phenomenon. But is all good and well? What’s driving this trend and is it on track? Let’s take a closer look at the exciting developments and potential hurdles.

Desi Unicorn Ghar Wapsi: Gift City Calls

Imagine a scenario where Indian startups thriving in Silicon Valley or basking in the sun in Singapore could seamlessly return to their home countries with minimal tax burden. This dream is The government plans to leverage GIFT City (Gujarat International Finance Tech City) and is reportedly considering tax benefits and other attractive incentives to lure back these “Desi unicorns” with an aim to transform GIFT City into a global financial hub on par with Dubai and Singapore.

The gift that keeps on giving: Unprecedented access to the Indian market

According to the leak The government may announce policies to bridge the gap between GIFT City and India’s mainstream stock exchanges like the BSE and NSE. This unprecedented access could be a goldmine for these returning startups. Don’t forget that GIFT City’s Special Economic Zone (SEZ) status already boasts significant tax benefits. Moreover, recent legal changes now allow unlisted companies to list directly at the GIFT International Financial Services Centre (IFSC).

This strategic move is not just about tax cuts, but also about facilitating the growth of Indian startups within a familiar ecosystem. The government aims to connect these companies with India’s fast-growing mutual fund and retail investor base by facilitating smooth returns through GIFT City. This return will enable startups to tap into the expanding pool of domestic capital and align their growth trajectory with the local investment environment.

Is the reverse flip revolution on the horizon?

The upcoming Union Budget holds the key. If these rumours turn out to be reality, we may see a massive influx of Indian startups doing strategic “Ghar Wapsi” through GIFT City. This could be a pivotal moment in boosting India’s position as a global tech leader and injecting a new wave of innovation into the domestic ecosystem. Stay tuned, startup lovers. The story is getting more and more complicated!

Understanding Reverse Flipping

Reverse Flip HQ relocation to India refers to the process by which Indian startups, initially based overseas, move their parent company headquarters back to India. Driven by a combination of regulatory, financial and operational incentives, this trend is gaining momentum. The Indian government’s new scheme could be a catalyst for this migration by leveraging the benefits of GIFT City to make the transition seamless and efficient.

Why startups want to reverse flip to India

There are several factors that are forcing Indian startups to consider reverse flipping.

/tice-news-prod/media/media_files/onbg62luG9Qvpw9CyxII.jpg)

- Investor comfort and market familiarityInitially, startups such as Razorpay and Zepto chose overseas domiciles such as the US and Singapore to take advantage of investor comfort and market familiarity, with many investors feeling more comfortable in jurisdictions they were familiar with.

- Regulatory BenefitsCountries like Singapore offered favorable tax regimes, strong intellectual property protections, and other regulatory advantages. For example, in Singapore, dividends are not taxed at the holding level and there is no withholding tax on shareholders.

- Operational Reality: Despite being based overseas, core operations of these startups often remain in India. Bringing them back to India simplifies operational complexities and ensures corporate structures are aligned with business realities.

- India’s evolving regulatory environment: Recent changes in Indian regulations have made the local market more attractive. Simplified ESOP tax, favourable capital gains tax regime and streamlined capital flow procedures are encouraging startups to return to India.

- Patriotism pays off: National pride is on the rise among Indian entrepreneurs, many of whom are now driven by a desire to directly contribute to the country’s burgeoning technology industry and foster innovation at home.

- Investors will adapt: As the regulatory environment in India evolves positively, global investors will become more comfortable with domestic structures, reducing the need for complex offshore regimes and simplifying the operating environment.

The other side of the coin: challenges on the road to Ghar Wapsi

While the idea of returning home sounds appealing, the reverse flip process is not without challenges.

/tice-news-prod/media/media_files/Tn6MZblGwIojjZ0SGSdB.jpg)

Weighing the Balance: Reverse Flip Profits and Losses

The decision to reverse flip requires careful consideration of both the potential gains and losses.

/tice-news-prod/media/media_files/EDkPonwqa8GvVXcJdTi8.jpg)

Choosing the right exit route for your startup

Navigating legal, regulatory and tax complexities can be a daunting task. Here are two main ways to derive strategic returns.

Inbound Mergers: A Streamlined (But Slow) Path

An inbound merger involves combining a foreign holding company (H corporation) with its Indian subsidiary (S corporation). The non-resident shareholders of the H corporation simply exchange their shares for shares in the newly combined Indian company. Although this method is a streamlined approach, it requires careful planning because:

- Company Law Approval: Getting approvals from the Reserve Bank of India (RBI) and the National Company Law Tribunal (NCLT) will take around seven to nine months.

- Forex Compliance: Ensure compliance with the Foreign Exchange Management (Cross-Border Mergers) Regulations, 2018.

- Income Tax Considerations: Exemption from capital gains tax may be available under Sections 47(vi) and 47(vii) of the Income Tax Act, 1961, subject to certain conditions.

Share exchange agreements: a more flexible (but potentially taxable) option

This method involves a strategic share swap, where shareholders exchange their shares in Company H for shares in a new Indian company (Company N) which then takes control of Company H. This provides greater flexibility, but there are some important points to consider:

- Foreign Exchange Regulations: The Foreign Exchange Management (Overseas Investment) Regulations, 2022 require compliance with the arm’s length valuation principle.

- Income Tax Impact: A share exchange may be deemed to be a “transfer” under Section 2(47)(i) of the Income Tax Act and may be subject to capital gains tax.

FY2024 Budget: A potential turning point?

The “Ghar Wapsi” scheme proposed in the 2024 Budget could be a game-changer. The government can significantly ease the complexities associated with reverse flips by offering tax benefits, simplified regulatory approvals, and other incentives. This could bring a flood of startups back to India, strengthening the domestic ecosystem and reinforcing India’s position as a global tech powerhouse.

The Indian startup world is all set for a pivotal moment. Will Budget 2024 herald a new era of ‘Ghar Wapsi’? Only time will tell.

Join our vibrant community of entrepreneurs

/tice-news-prod/media/post_attachments/d6f49974b14cdb8e5b093792b19c3a395cb6b0c8667220693ab46b88f9e89ea2.png)

Follow TICE News on social media and help build a stronger community of talent, ideas, capital and entrepreneurship. to follow X (Twitter) | Facebook | Newsletter

/tice-news-prod/media/media_files/7bpAIFnA17YEfYZUZ20f.png)

/tice-news-prod/media/media_files/H2SjTQ5JPQVDDBrWehjW.jpg)