South Africa’s strong fintech sector, financial system and regulatory system present opportunities for foreign investors, but local businesses need to help foster the startup ecosystem.

South Africa could be a key entry point for international investors wanting to enter Africa’s startup ecosystem. With renowned research universities and strong fiscal and regulatory regimes, the country has many of the necessary ingredients for a tech ecosystem. However, venture capital remains limited, meaning corporate venture capital (CVC) investors could be key to driving the market forward.

Africa as a whole is seeing increased interest from international investors. While the tech scene across the continent is still in its infancy, it has the fastest growing population and, according to data from Bpifrance, investment in startups is set to grow by 150% between 2019 and 2022, making South Africa one of the top three markets alongside Kenya and Egypt.

When Sony expanded into the continent this year with a $10 million fund, its first investment was in South African mobile games publisher Carry1st, and for Founders Factory Africa, a pan-African seed-stage venture firm headquartered in the country, the business has big potential.

“We believe Africa represents a huge opportunity for CVCs and South Africa is probably one of the easiest markets for them to operate in,” said Sam Sturm, the firm’s chief portfolio officer.

“If you don’t know the local players, the market and the customer base, it can be really difficult to engage. But if you look at the market, it is one of the relatively easier markets to do business in and get into on the African continent, even if you’re not there.”

South Africa is home to 14 of Africa’s 20 largest companies by revenue, and while few have CVC arms, these large companies can become clients of local startups even if they don’t provide equity funding.

“Overall, it has a much more developed enterprise ecosystem than places like Kenya or Nigeria, where the startup ecosystem has evolved in large part around it, for better or worse,” Sturm says.

“There are a lot of smart, really talented people in banks, insurance companies and consultancies. There are a lot of other markets where entrepreneurship is more needed as a job than in South Africa. On the flip side, there is a strong corporate ecosystem that supports and partners with startups.”

Vuyo Mphako, who runs Next176, the venture investment and studio unit of South African financial services group Old Mutual, says South Africa has other advantages too: It has a young, tech-savvy population, a stable and mature financial system and a reliable regulatory environment.

“Globally, we have a thorough regulatory system that ensures the rule of law is upheld,” he says, “When we do something, we know that the contracts are enforceable, and our judicial system is very much immune from any political influence.”

Old Mutual invests in a variety of sectors, including health, education and employment, but in South Africa it is most focused on fintech, as can be seen from this table listing some of its largest investment rounds over the past three years: Old Mutual’s fintech success stories in South Africa include TymeBank, a digital bank that closed a Tencent-backed round last year at a valuation approaching $1 billion, and Onafriq, a digital payments company that raised $100 million in 2022 from investors including Commerzbank and AXA.

South Africa’s Top VC Rounds 2021-2024

| Company Name | Trading day | sector | Deal size ($) |

| All-weather road engineering | December 1, 2024 | Industry/Construction | 200 |

| Onafrican | 2022/06/14 | Financial Services | 200 |

| Red Rocket Energy | September 27, 2023 | energy | 160 |

| Humo | August 11, 2023 | Financial Services | 120 |

| Planet 42 | February 22, 2023 | transportation | 100 |

| side | July 27, 2021 | Financial Services | 83 |

| Time Bank | May 22, 2023 | Financial Services | 78 |

| side | January 12, 2022 | Financial Services | 70 |

| Cassava Technology | 2022/07/18 | communication | 50 |

| Val | January 3, 2022 | Financial Services | 50 |

| Wetility | July 9, 2023 | energy | 49 |

| Ozo | November 20, 2021 | Financial Services | 48 |

| Bio 2w | January 30, 2023 | energy | 39 |

| Lula SA | January 2, 2023 | service | 35 |

| Peach Payment | January 5, 2023 | Financial Services | 31 |

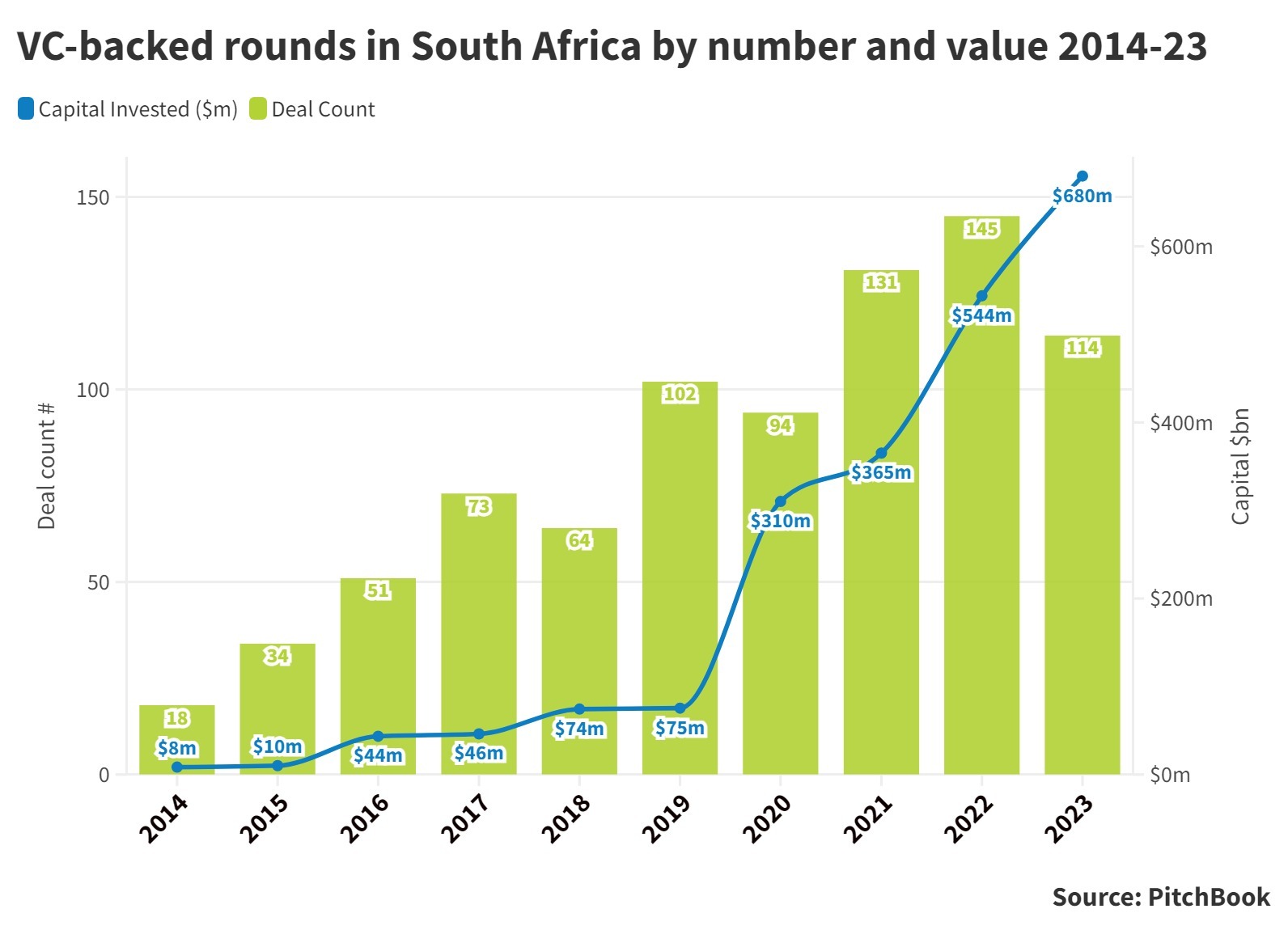

Like many other developing countries, startup funding in South Africa is limited. Although it is more than in neighbouring countries, local venture capital firms are few and far between, and those that do exist are focused on early stage investments.

“Purely from an investor perspective, it’s a very small market. There are a few players that have been around for 10 years, maybe a little longer, and they are well established,” Mpako said.

“The market is not yet fully mature and some of the fencing equipment that we’re used to in the Silicon Valley world is still fairly new to our market, so there are challenges. But it is evolving.”

Part of the problem is that South Africa has almost no history of venture capital. It was previously seen as “private equity guys in hoodies”, says Sturm. So investors like GCV Rising Star Bharati Maloele, who oversees the CVC activity for packaged food and beverage group Tiger Brands, have had to work hard to educate the market and broaden the scope of investments.

“There’s definitely a lot of opportunity and no shortage of innovative companies,” she says. “I think venture capital funds that have been in the market a long time have done a good job in this area, but other pools of capital still have a long way to go.”

“For example, we are currently working a lot on getting pension funds to invest in this asset class. There is also a lot of work being done with asset managers and educating them on the opportunities in this asset class. There are risks, but there are large potential rewards. The key is how to manage the risk/return profile to make it more attractive for additional pools of capital.”

“Corporations have a big role to play. We see them as a very important lever for growth going forward.”

“And companies play a big role. Tiger Brands announced this because they believe this will be a really important lever for their growth going forward.”

Another solution is to get more foreign funding for startups, perhaps where local partners can come in. Sony is working with the International Finance Corporation to find African startups, and Next176 is SingaporePartners also include the London-based SC Ventures division of Standard Chartered Bank, which will allow international companies to focus on the market and local CVCs to access deep pockets and global investors for startups.

“The risk/return profile and investment amounts may be a little bit beyond the upper limits of some local investors,” Maloele says, “but it’s very clear to international investors: if you want to invest in Southern Africa, East Africa or West Africa, partner with a VC fund or a corporate VC fund in that market and you’ll find opportunities available to you.”

But even if they are able to secure foreign funding, they have the added problem of currency instability: the South African rand has lost roughly half its value against the US dollar over the past decade, which could make it harder to pass on profits to investors if they raise money in US dollar-denominated funds and earn income in rand.

The Rainbow Nation needs to reach out to other African countries

Diversity is another inequality South Africa must address. Despite being called the “Rainbow Nation” for 30 years, some of South Africa’s old problems remain. According to the Harvard University Press’s 2022 Global Inequality Report, South Africa is ranked as the most unequal country in the world.

The firm’s funds vary in their levels of diversity, but many market observers point out, for example, that Naspers Foundry, the $100 million local investment arm of internet investment firm Naspers, had just one startup with a black co-founder among its nine portfolio companies before the unit was shut down last year.

South Africa’s inequality – the huge divide between big businesses and the majority of the population – could also limit startups’ customer base.

“Japan has a large corporate customer base that other markets don’t have, so there are some very promising startups serving those customers,” Sturm says, “but at the same time, they also have the needs of lower-income consumers at the bottom of the pyramid.”

For example, agtech startups may find affluent customers on large commercial farms in South Africa, but struggle to adapt their solutions to other parts of Africa.

“If you look at the size of the average farm in South Africa, it’s about 20 times larger than the rest of the continent. In other countries, we’re mostly talking about smallholder farms,” he says.

“There’s a big gap between the challenges and the users in South Africa, which is to say, if you invest in a solution in Nigeria, imagine it’s right for farmers in Ghana or Benin and across the region. In South Africa, you don’t see as many of those solutions because the smallholder farmer user base is not as viable due to consolidation, so there are fewer solutions locally that cater to their needs. [Africa-wide] market. “

Sturm, an American who spent a year in South Africa as head of new business for Founders Factory Africa and now covers the entire continent from an office in London, says what strikes him as an outsider is another issue that also ties into the country’s apartheid history: how isolated South Africa is from other African markets. Next176, for example, may be reaching beyond South Africa’s borders, but the rest of the market must follow suit.

“To get to the next level, stronger connections with the rest of the continent will be really important. We need to move from a venture built for South Africa to one built for Africa and beyond.”

“To get to the next level, stronger connections with the rest of the continent will be really important. We need to move from a venture built for South Africa to one built for Africa and beyond,” Sturm says.

Sturm sees an increased ability to see beyond county lines.

“The next wave of startups we’re seeing are looking to expand across Africa and even globally. Some South African startups are looking at the Philippines as their next destination because they see it as an interesting model,” he said.

He added that there is an opportunity for South African startups to make a difference because companies are making an impact in South Africa. Africa is a region where startups are solving interesting, practical problems, and South Africa has some great research universities working on innovative technologies. The potential is there and CVC can make a difference.

“There are some great venture capital funds out there, and they all have their role to play, but there are also a number of public companies with the capital to further develop the venture ecosystem,” Maloele says. “It’s important to continue to develop this ecosystem, but there’s no shortage of opportunities.”