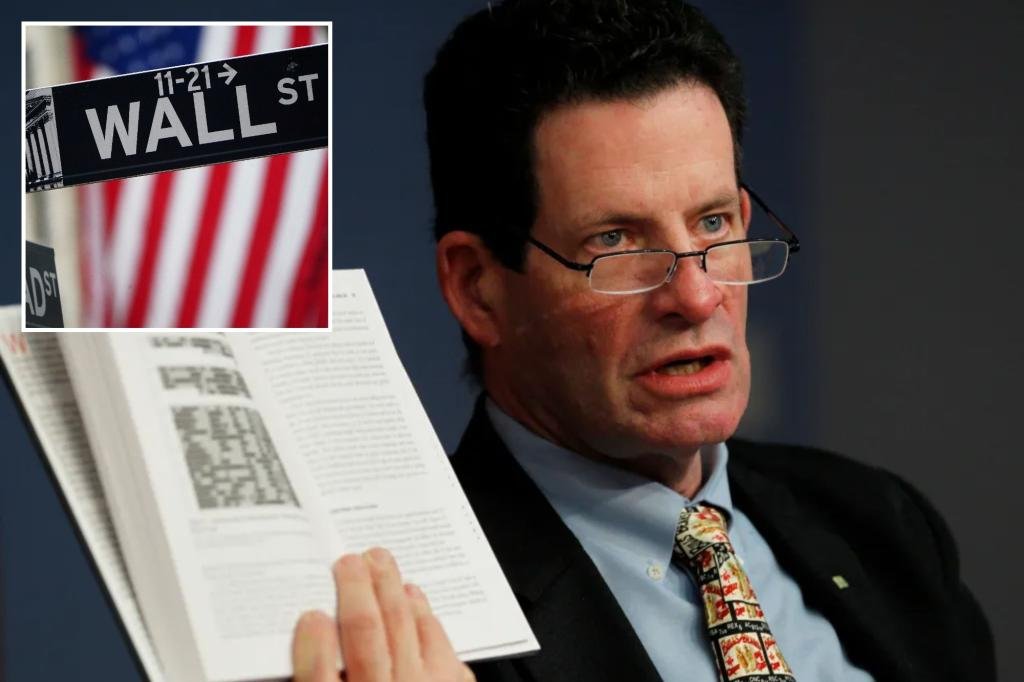

Fisher Investments, the giant investment fund run by billionaire Ken Fisher, sold a minority stake in the company valuing it at nearly $13 billion.

Under the agreement, Boston-based private equity firm Advent International and the Abu Dhabi Investment Authority will invest at least $2.5 billion in privately held Fisher Investments, which has an enterprise value of $12.75 billion, the company said in a statement on Monday.

The company’s founder and chairman, who is worth an estimated $5 billion, said the agreement would ensure the company’s “independence” even if he were to step down.

“While I am in good health, this transaction, which involves an unusually long holding period for a private equity transaction, will ensure Mr. Fisher’s long-term private independence and culture in the event of my unfortunate occurrence,” he said in a statement.

The company, which Fisher, 73, has run since 1979, will limit shareholders to Fisher family members and employees and welcome outside investment for the first time in its history.

Fisher, who will run the company and is also a regular financial columnist for The Washington Post, plans to retain a 70 percent stake in the company, according to The Wall Street Journal.

Fisher Investments says it manages approximately $275 billion in investments for more than 150,000 clients worldwide.

Reports that a minority stake in Fisher Investments was being targeted first surfaced in January of this year.

The company moved its headquarters from Washington state to Texas last year due to rising capital gains taxes.

Fisher served as CEO for 37 years before handing over the reins to Damian Ornani in 2016.

Advent, founded in 1984, in April acquired Canadian payments technology company NuVay, which is backed by actor Ryan Reynolds, in a deal worth nearly $6 billion.