Hinterhaus Productions/DigitalVision via Getty Images

Co-author: Treading Softly

As you plant your garden, consider adding companion plants — not just your run-of-the-mill emotional support plants, like the flowers you buy for your wife when she’s sick. It’s debatable. These companion plants work together to mutually benefit. First Nations peoples in Canada frequently planted three different companion plants together. Pole beans, squash, and corn were grown together because they benefited and supported each other. Today, you can plant several different types of companion plants to repel aphids, deflect moths, attract more pollinators, and revitalize the soil.

In terms of the market, you need to make different investments that work together to benefit each other. You may not benefit from the same economic environment. While they benefit equally from changes in interest rates, they should be able to offset and support each other. Today, we look at two potential portfolio companions, both of which can provide excellent income whether interest rates are high or low, the economy is booming or in a recession, mortgages are soaring or the housing market is stagnating.

Let’s begin!

Pick #1: AGNC – Yield 14.7%

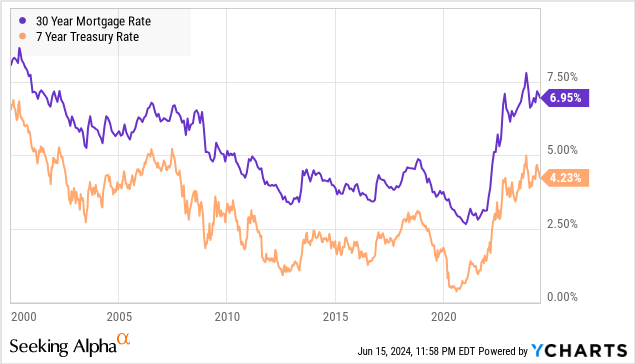

Mortgage rates are approaching 20-year highs and have risen sharply in recent years after a decades-long decline, in a pattern that is similar to that of Treasury rates.

Higher yields mean lower prices for outstanding debt. If you have mortgages or Treasury bonds issued in 2020, you can now buy mortgages and bonds with higher yields, so they are trading at significantly less than face value.

Stock market traders often get caught up in current prices and unrealized losses. Is it reasonable to worry about prices falling if you know for certain that your investment will be repaid at par on or before maturity? All U.S. Treasury bonds are repaid at par. Certain types of mortgages are also guaranteed to be repaid at par. These are called “agency” mortgage-backed securities. If an agency mortgage defaults, the agency will buy it back at par. If the borrower refinances, the mortgage will be repaid at par. As a result, prices of MBS and U.S. Treasury bonds tend to rise (and yields fall) in times of uncertainty and fear. Demand for these bonds increases when investors are scared and looking for certainty.

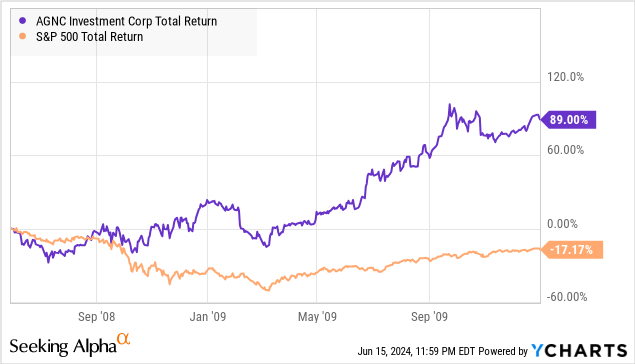

This is why agency MBS tend to outperform during downturns. AGNC Investments Co., Ltd. AGNC picked the perfect time to IPO. It did so just before the global financial crisis brought markets to a halt. As the S&P crashed, AGN They surged as investors sought the safety and security of government MBS.

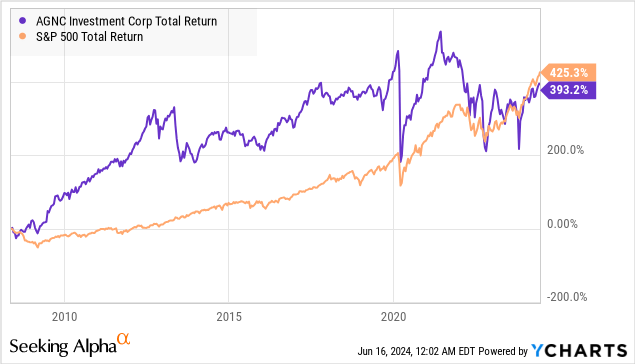

Starting around 2012, the economy was doing well and investors were generally optimistic. The S&P 500 was doing well, but AGNC was rather mediocre.

Every time I write about AGNC I get a ton of comments about its 5 or 10 year performance, people complain that it’s “just going down” or “it’s a trading stock” and make those kinds of comments.

AGNC buys agency MBS on a leveraged basis. In a downturn, there is no asset exposure we would rather have in our portfolio than agency MBS. In a downturn, we want to have as much agency MBS as we can and we want to leverage as much as we can because agency MBS are a flight to safety that will provide higher yields than Treasuries in a downturn. Every investor should have such assets in their portfolio at all times for the same reasons that they insure their home or car. We hope we never have to use insurance, but we know we appreciate it when we do.

The advantage of AGNC is that it provides insurance in the event that a recession causes a market crash and a massive flight to safety occurs. Anything with exposure to agency MBS or Treasury bonds may rise when all other holdings in the portfolio are plummeting. There are very few countercyclical investments in the market.

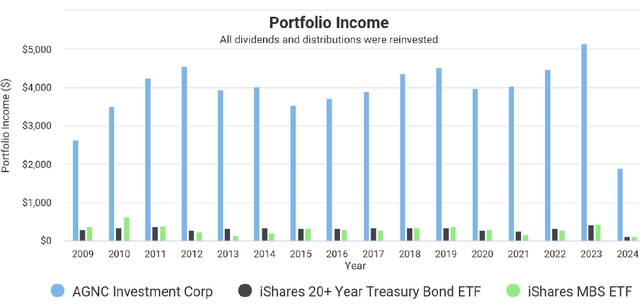

Investments such as the iShares 20+ Year Treasury Bond ETF (TLT) and iShares MBS ETF (MBB) offer similar benefits of rising during economic downturns and are much less volatile because they are not leveraged and do not require the use of hedges. AGNC’s leverage and use of leverage creates execution risk that is not present when buying Treasury bonds or MBS directly. However, in exchange for assuming that risk, AGNC generates more income.

Portfolio Visualizer

It also far outperforms its competitors in terms of total returns.

I don’t buy AGNC because I expect it to outperform the S&P 500. Maybe it will, maybe it won’t. I buy AGNC because the agency MBS that AGNC invests in are a premium asset class in times of economic turmoil and recession. When the rest of my portfolio tanks, AGNC will be the green island that churns out cash flow after cash flow so I can buy when everything else is cheap. AGNC’s role is that of the hero in an action movie, someone who doesn’t seem to fit in with everyone else but comes in and saves the day when things seem most dire.

I hope the economy never goes into another recession. It would be great if everyone who wants to work has a job, has the income they need to pay their bills, and the stock market keeps going up while we all HODL to the moon. But we all know that’s not the case. Recessions will come, the stock market will crash, and those of us who hold investments that thrive in recessions, like AGNC, will enjoy the income. Not a bad income to have while we wait.

Pick 2: ARCC – Yield 9.3%

Ares Capital Corporation ARCC has been performing well, paying a generous dividend while its stock price is near all-time highs. The main driver of this recent success is “higher interest rates over longer periods.” Like most BDCs, ARCC Borrow at a fixed rate and lend at a floating rate.

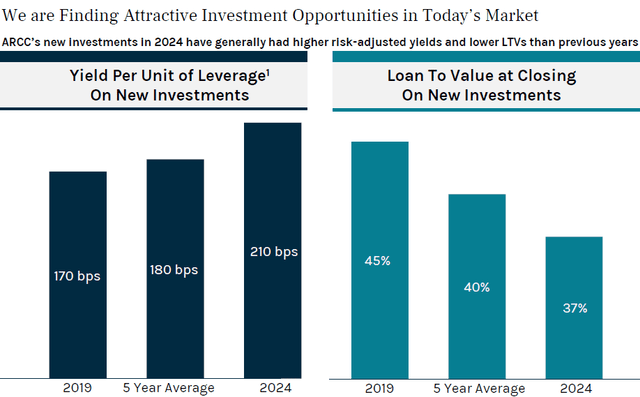

BDCs as a segment have had some strong years, and the momentum isn’t over yet. Interest rates remain high and there are some very attractive opportunities for new investments. In an investor presentation, ARCC noted that the spread between new investments and current leverage costs will average 210 bps in 2024, 40 bps higher than in 2019. At the same time, average LTV has fallen from 45% to 37%. sauce

ARCC Investor Day Presentation

In other words, ARCC is earning higher yields on lower-risk investments today than it was five years ago, thanks to a variety of macro factors that have led banks to tighten their lending appetite and created more opportunities for non-bank direct lending institutions like ARCC.

As a lender, one of your main concerns is whether your borrower will be able to repay as agreed. It’s great to get a high yield, but if the borrower doesn’t repay, then there’s no point in getting a high yield. Given the macroeconomic outlook that a recession may be on the way, credit quality is becoming more of a concern by the day.

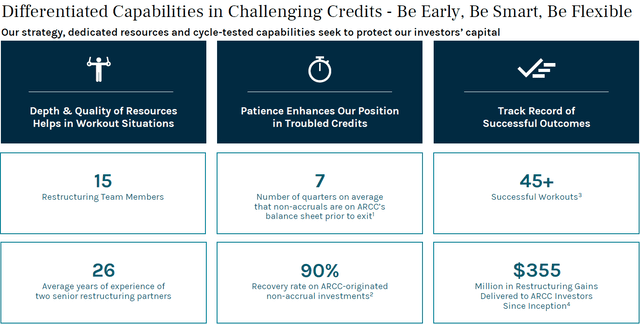

ARCC is one BDC that we have a lot of faith in, having weathered the Global Financial Crisis and with a very good track record of providing relief to borrowers as they repaid bad loans rather than interest payments. To date, ARCC has recovered 90% of borrowers following defaults and realized $355 million in restructuring gains.

ARCC Investor Day Presentation

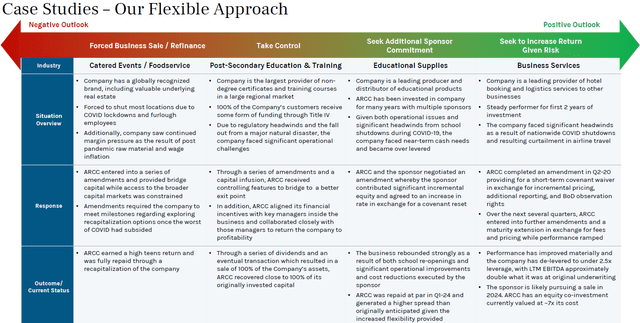

We’ve shown slides before showing how ARCC has realized gains from debt restructuring and equity holdings that exceed credit losses. In a recent investor presentation, ARCC shared several real-world examples of how it has worked with borrowers, ranging from the extremes of forcing a sale or taking control, to amending contracts to increase returns.

ARCC Investor Day Presentation

This is a real strength of the BDC structure compared to banks, and some BDCs apply it better than others. Banks are bound by a multitude of regulations designed to protect depositors. Banks have no flexibility whatsoever to deal with defaulting borrowers. ARCC can leverage the powerful resources of Ares (ARES) to figure out what is the best outcome for ARCC, or at least the best outcome for the borrowers. ARCC puts the “development” in “business development company.”

ARCC stands out as a premium BDC. While the price is near all-time highs, with the NAV at an all-time high of $19.53, the current premium to NAV is about 10%. ARCC has traded at premiums of over 20% in the past, and we believe fair value for ARCC is a premium of about 15%.

ARCC still has some room for capital appreciation, but most importantly, its dividend policy is conservative, leaving plenty of room between earnings and dividends. Over the past 12 months, the dividend has been covered 125%. Additionally, ARCC is a BDC that you can rely on to manage credit issues. From a credit risk perspective, we expect any upcoming downturn to be minor, but even if we’re wrong, it’s reassuring to know that the manager is top-notch.

If the Federal Reserve keeps interest rates high for an extended period of time, BDCs will remain one of the best options in the market.

Conclusion

Few would consider AGNC and ARCC a good match. AGNC thrives best when the economy is weak, and ARCC benefits best when the economy is strong. They are like a tag team of wrestlers who can trade with each other in your portfolio depending on the economic situation you are facing. You don’t want to be in a situation where you need one more tag team partner and you don’t have one because you are afraid to hold the other one in the ring. Similarly, the best time to grow compatible crops is when you have both at the same time, not when the aphids are already ruining the crop. That’s why I hold both AGNC and ARCC in my portfolio regardless of what the economy is doing now or in the future. Because I want these two buddies to work together to benefit my income streams.

No one will fight harder than you to secure a stream of income in retirement. It’s up to you to build a portfolio that will bring you the income you need. You can either slowly and methodically reduce your retirement savings, as many do with the 4% withdrawal rule, or you can have a solid portfolio that will provide you with a steady stream of income you need to survive. I’m firmly in the latter camp, and would love to have a lifetime stream of income without ever selling a single stock. That’s the beauty of my Income Method, and the beauty of income investing.