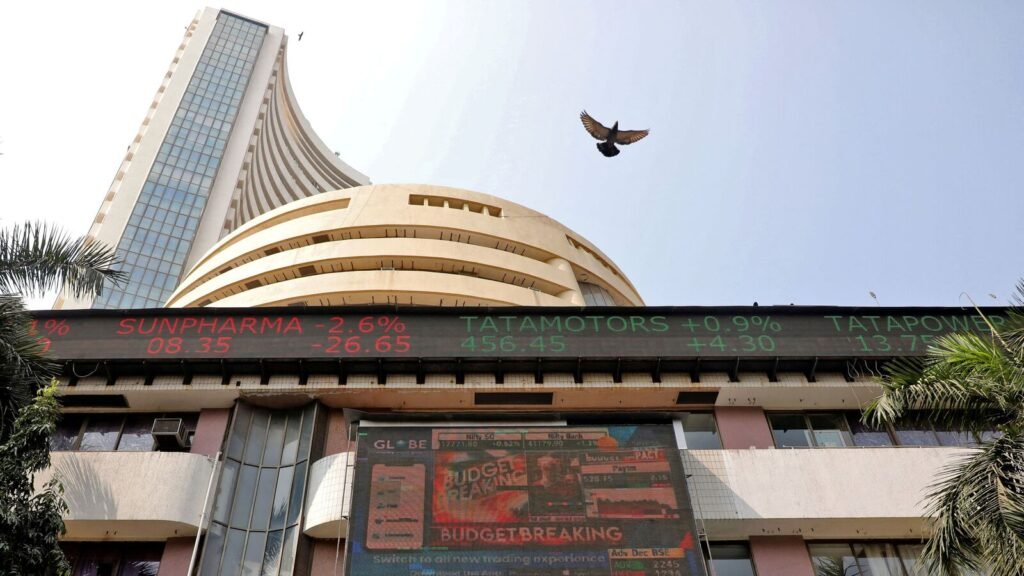

Stock Market Holiday: Indian stock market exchanges BSE and National Stock Exchange (NSE) will be closed today on account of Eid-ul-Adha 2024. All segments including equities, derivatives and SLBs will also be closed today on account of Bakri Eid. The stock market holidays calendar 2024 shows June 17 (Monday) as a trading holiday for Bakri Eid.

Trading in shares on the Indian stock market will resume on Tuesday, June 18.

Moreover, commodity trading on the Commodity Exchange of India (MCX) will close for morning trading today and evening trading will commence from 5 pm to 11.55 pm.

Please read this: Eid-ul-Adha 2024: Will Indian stock markets continue trading today?

According to the stock market holiday list, there will be only one stock market holiday in June 2024 and the next trading holiday will be Muharram on July 17. There will be a total of 15 holidays in the calendar year 2024.

The remaining trading holidays this year are Muharram on July 17, Independence Day on August 15, Mahatma Gandhi Day on October 2, Diwali on November 1, Gurunanaksha Festival on November 15 and Christmas on December 25.

Friday Stock Market

Indian equity market benchmark indices Sensex and Nifty 50 closed higher on Friday, June 14, led by gains in auto, consumer durables and financial stocks. The BSE Sensex rose 181.87 points or 0.24% to close at 76,992.77 while the Nifty 50 rose 66.70 points or 0.29% to close at 23,465.60. The benchmark Nifty 50 hit an all-time high of 23,490.40 during trading hours.

The broader market was supported by gains, with the Nifty Midcap 100 surging 1.05 per cent and the Nifty Smallcap 100 rising 0.8 per cent, outperforming the major stocks.

Read also: Today, June 17th, is a bank holiday. Are banks closed today for Eid al-Adha? Check here for more details

The Nifty 50 remained in a narrow range throughout the last week, with volatility declining after the election results were announced as traders focused on a stock-specific approach.The Nifty closed just below 23,500, up 0.3% on the weekly basis.

“Markets continued to rally after hitting a new milestone after the volatility of the recent election week. The upside was fuelled by FIIs unwinding many of their short positions and adding fresh long positions. Meanwhile, confidence regarding political stability has been restored among market participants, hence, many stocks are witnessing inherent positive momentum,” said Ruchit Jain, Principal Researcher, 5paisa.com.

Read also: FPI outflows fall, selling declines in June ₹Indian Equities at Rs 3,064 crore. When will inflows resume?

He believes the first hurdle for the Nifty 50 next week will be around 23,500, which was a hurdle last week.

“Above this level, Nifty can rise towards 23,900-24,000, the retracement zone of the recent correction. On the downside, support is expected at 23,300, followed by the 23,000-23,900 zone. Any dip towards support should be considered as a buying opportunity,” Jain said.

He advises traders to look for trading opportunities in specific stocks and trade with a positive bias.

Find all the latest stock market news here

Disclaimer: The views and recommendations expressed above are those of the individual analysts or brokerage firms and not that of Mint. We recommend checking with a certified professional before making any investment decisions.

3.6 Million Indians visited us in a single day and chose us as their platform for Indian General Election Results. Check out the latest updates here!