Roger Federer recently gave a spectacular commencement speech at Dartmouth College.

This part surprised me:

Perfection is impossible in tennis… In the 1,526 singles matches I have played in my career, I have won almost 80% of the matches… Now, a question for you all… What percentage of points do you think I won in those matches?

Only 54%.

In other words, even the top-ranked tennis players win just over half of the points they play.

On average, if you lose every two points, you learn not to dwell on every shot.

Teach yourself to think: “Okay, I double-faulted. It’s just one point.”

Okay, I came to the net but I got beat again. Just one point.

Federer won 80% of his matches but only 54% of the points in those matches.

Crazy right?

One of the most dominant tennis players of all time won most of his matches, but he didn’t always do so in a dominant fashion – he had small short-term advantages that added up over the long term with increasing consistency.

Of course, when I heard this part of the speech, my financial brain immediately went to the stock market.1

Federer’s win rate and points percentage are basically the same as the stock market!

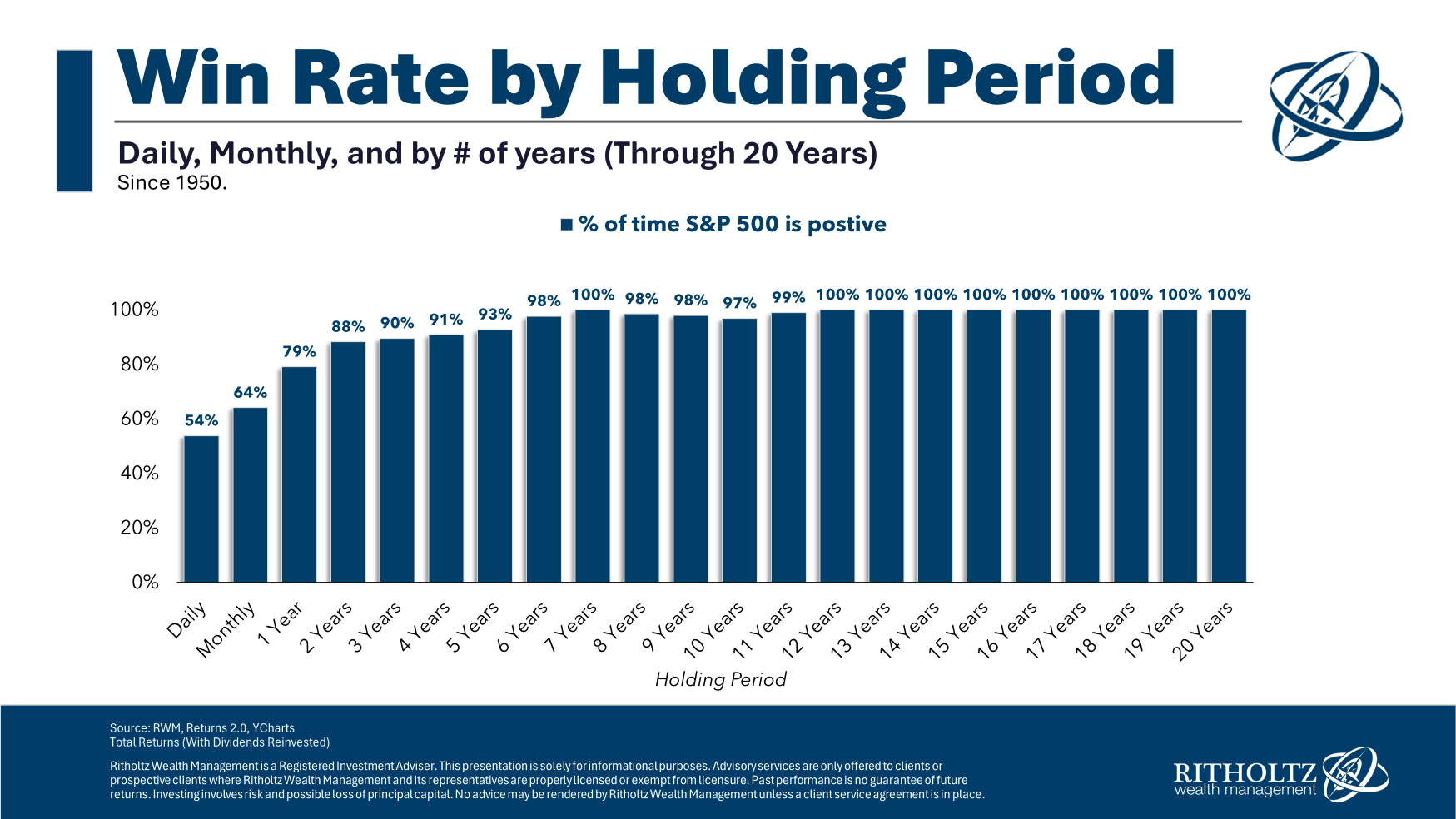

I always tout the fact that the stock market is essentially a 50/50 trade-off in the short term, but has an incredible winning record in the long term.

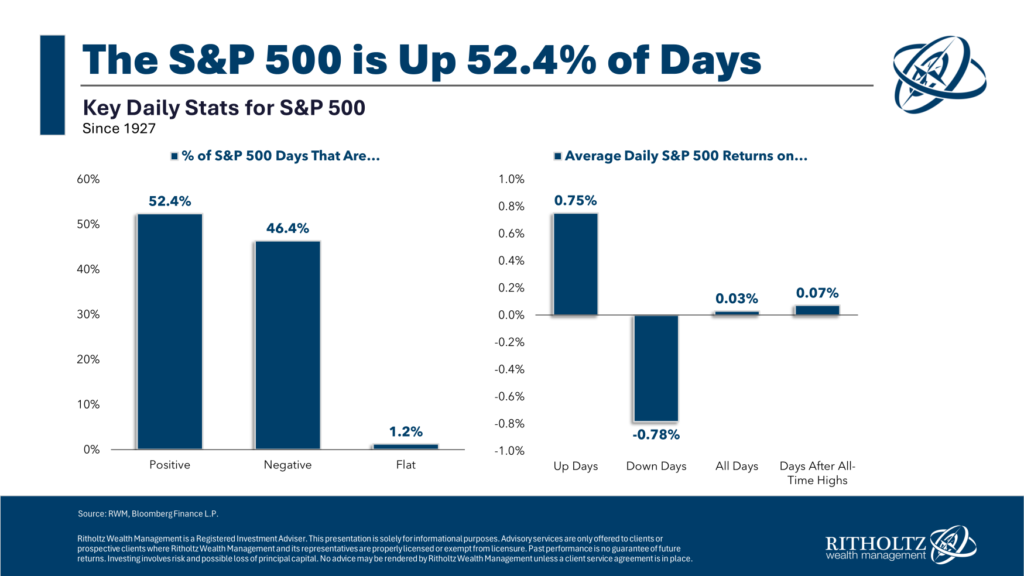

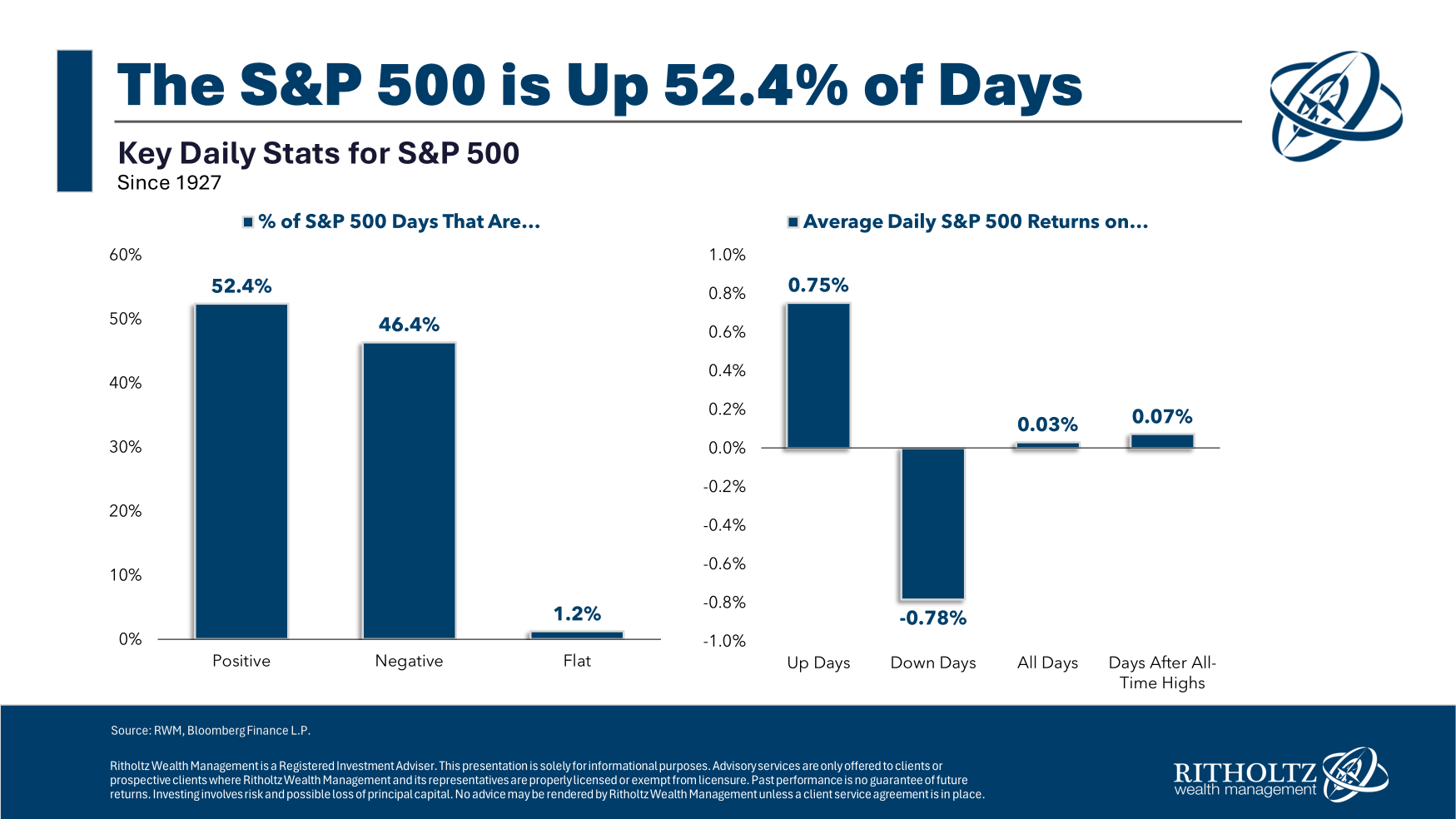

Over the past century or so, on a daily basis, the S&P 500 has remained flat or increased, just like Federer, roughly 54% of the time.

Surprisingly, the average down day is a little worse than the average up day.

Despite the average daily return being just 3 basis points, the long-term compounding effect of the stock market is astounding.

These daily figures are price only (i.e. no dividends). Looking at price alone, the S&P 500 is up nearly 39,000% since 1927.

The average dividend yield at the time was just under 3.7%. If you reinvest the dividends, your total gains since 1927 would jump to a staggering 1.3 million percent.

I know that no one actually has that long of a time horizon, but if you get out of your own way, the benefits of compound interest can be amazing.

And the further you go, the higher your chances of winning.

If Federer had given up every time he lost a point, tiebreak or set, he would never have won 20 Grand Slam titles.

If you place too much emphasis on short-term results in the stock market, it will be difficult to become a successful investor.

Small benefits can add up over time and produce amazing results.

References:

The stock market is not a casino

1For some reason, when it comes to investing, the tennis analogy is apt. I’ve used the tennis analogy of Andre Agassi and Charlie Ellis before.

This content, including any security-related opinions or information, is for informational purposes only and should not be relied upon in any way as professional advice or a recommendation of any practice, product or service. There is no guarantee or assurance that the views expressed herein will apply to any particular facts or circumstances and they should not be relied upon in any way. Please consult your own advisors regarding legal, business, tax and other related matters regarding investments.

Comments in this “Post” (including any associated blogs, podcasts, videos and social media) reflect the personal opinions, viewpoints and analysis of the Ritholtz Wealth Management employees providing the comments and should not be considered as the views of Ritholtz Wealth Management LLC or any of its affiliates, nor as a description of the advisory services provided by Ritholtz Wealth Management or the performance returns of any client of Ritholtz Wealth Management Investments.

References to securities or digital assets or performance data are for illustrative purposes only and do not constitute an investment recommendation or the provision of investment advisory services. Charts and graphs provided are for informational purposes only and should not be relied upon when making an investment decision. Past performance is not indicative of future results. Content speaks only as of the date indicated. Projections, estimates, forecasts, goals, prospects and/or opinions expressed in these materials are subject to change without notice and may differ from or be contrary to opinions expressed by others.

Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payments from various entities for advertising in affiliated podcasts, blogs and emails. The inclusion of such advertisements does not constitute or imply an endorsement, sponsorship, recommendation or affiliation of those advertisements by the content creator or Ritholtz Wealth Management or its employees. Investing in securities involves risk of loss. For additional advertising disclaimers, please see: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosure here.