If you are building a properly diversified stock portfolio, it is possible that the stocks you select may perform poorly. Seras Corporation (NASDAQ:CERS) has had a tough time over the past three years. Unfortunately, the stock has fallen 70% in that time but has held up. Recent news is not much comfort as the stock is down 32% in one year. Unfortunately, the stock’s momentum is still pretty weak, down 12% in 30 days.

It’s worth assessing whether the company’s economics are moving in lockstep with these disappointing shareholder returns, or whether there’s some disconnect between the two. Let’s do that.

Check out our latest analysis for Cerus

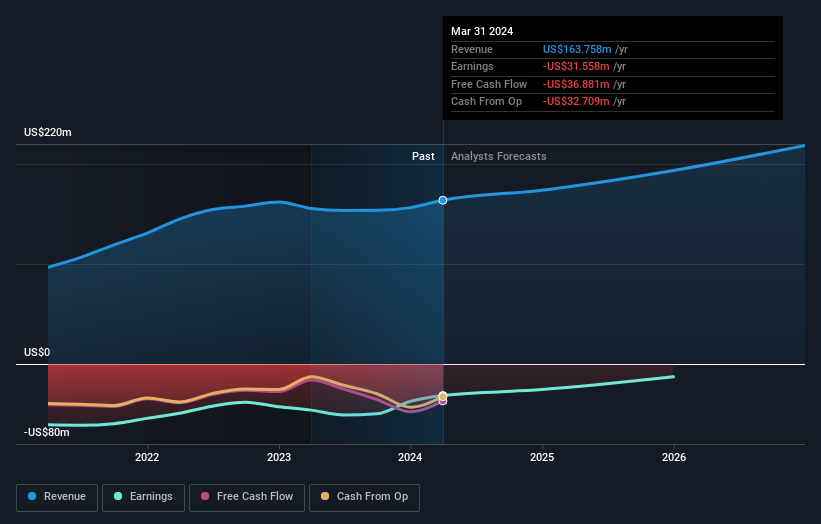

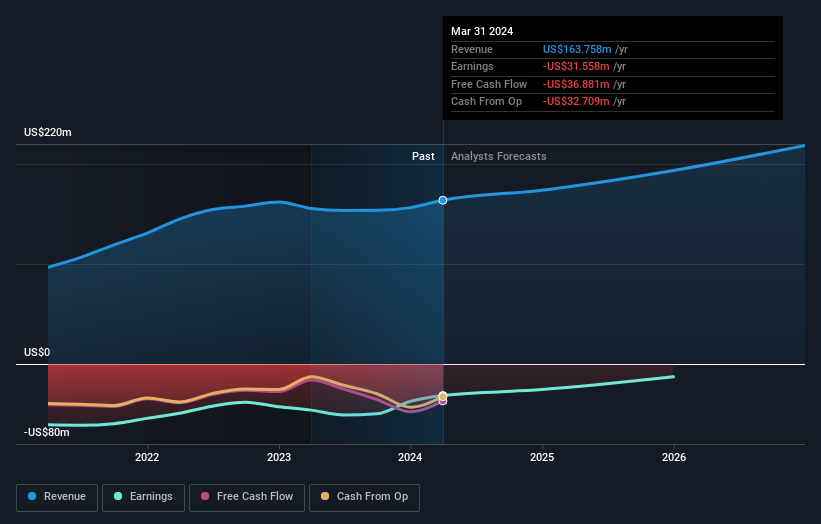

Cerus hasn’t made a profit in the last twelve months, so we’ll look at revenue growth to get a sense of how the company is doing. Shareholders of unprofitable companies typically want to see strong revenue growth, and as you’d expect, rapid revenue growth, if sustained, often translates into rapid profit growth.

Over the past three years, Cerus’s earnings have grown at a compound annual rate of 14%, which is a pretty respectable growth rate. Therefore, some shareholders will be unhappy with the compound annual loss of 19%. Frankly, we’re surprised to see such a wide disconnect between earnings growth and share price growth. It’s well worth taking a closer look at the company to determine its growth trends (and balance sheet strength).

The image below shows how earnings and revenue have changed over time (if you click on the image you can see greater detail).

Let’s take a closer look at Cerus’ financial situation free Report the balance sheet.

A different perspective

Cerus investors have had a tough year this year, losing a total of 32% while the market rose about 23%. Even blue chip stocks fall from time to time, but you want to see improvements in a company’s fundamental metrics before getting too interested. Unfortunately, last year was the apex of a poor performance, with shareholders facing an annualized loss of 11% over five years. We know Baron Rothschild says investors should “buy when the blood is flowing,” but we caution investors to first make sure they are buying high-quality companies. While it is well worth considering the different effects that market conditions can have on stock prices, there are other factors that are even more important. Consider, for example, the ever-present threat of investment risk. I noticed two warning signs At Cerus, understanding them should be part of your investment process.

of course Celas may not be the best stock to buySo you might want to take a look at this free A collection of growing stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com