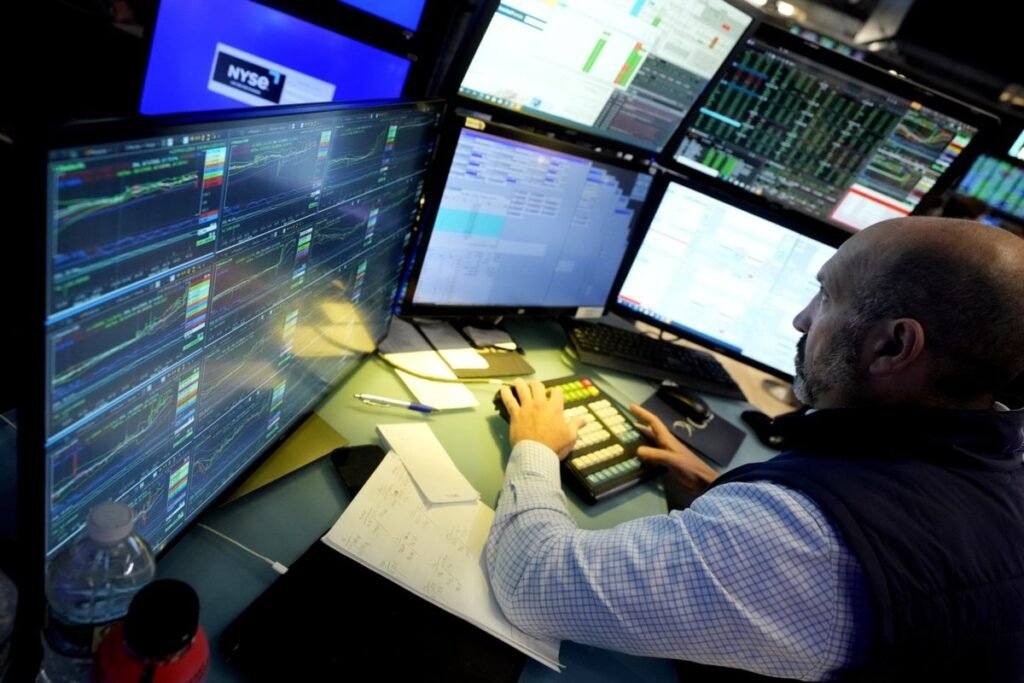

NEW YORK (AP) — U.S. stocks closed mixed as caution spread in financial markets heading into the weekend. The S&P 500, which hit new all-time highs for two straight days this week, fell less than 0.1% on Friday. The Dow Jones Industrial Average fell 0.1%, while the Nasdaq Composite Index rose 0.1%, returning to a record high. The declines were bigger across the Atlantic, with European stocks reeling from recent election results on the continent. France’s CAC 40 index fell to its lowest level in more than two years. U.S. Treasury yields fell after a report on U.S. consumer confidence.

This is breaking news. See AP’s previous coverage below.

NEW YORK (AP) — U.S. stocks were trading near record highs on Friday as caution spread in financial markets heading into the weekend.

The S&P 500 was down 0.1% in late trading and is on track to be the first day this week not to hit a new all-time high. The Dow Jones Industrial Average was down 85 points, or 0.2%, with an hour left to close, while the Nasdaq Composite Index was stabilizing near the record high it recorded the previous day.

Across the Atlantic, losses were greater as European markets were reeling from the continent’s recent election results. The far-right’s victory has increased pressure on the French president in particular, and investors worry it could weaken the European Union, stall fiscal plans and ultimately reduce France’s ability to repay its debts. Recent elections have also rocked markets in other countries, including Mexico and India.

France’s CAC 40 index fell 2.7%, taking its weekly decline to 6.2% for its worst drop in more than two years, while Germany’s DAX index fell 1.4%.

On Wall Street, RH fell 18.1% after reporting a worse loss for its latest quarter than financial analysts had expected, in what the home furnishings retailer called “the toughest housing market in 30 years.”

Rising mortgage rates are hurting the housing market as the Federal Reserve keeps its key interest rate at its highest in more than two decades, as the central bank artificially tries to slow the economy and sap fuel for inflation through high interest rates.

Cruise lines were the market’s biggest losers after analysts at Bank of America said cruise prices were on the decline. Norwegian Cruise Line fell 7.5%, the biggest drop in the S&P 500. Carnival fell 7.4%.

Still, stocks are hitting records on growing hopes that inflation is slowing and the Federal Reserve will cut interest rates later this year, while big technology stocks continue to soar, largely unaffected by what’s happening in the economy or interest rates.

Adobe reported that its latest quarterly profit beat analyst expectations, sending its shares up 14.4%.

Broadcom rose 3.5%, heading for a second straight day of gains after it announced better-than-expected profits and a 10-for-1 stock split to make its shares more affordable. Nvidia, a poster child for a rapid entry into artificial intelligence technology, rose 1.9%, as its market capitalization looks set to rise further beyond $3 trillion.

In the bond market, Treasury yields edged lower after a preliminary report from the University of Michigan suggested U.S. consumer sentiment did not improve this month as economists had expected.

While strong spending by U.S. households is one of the main drivers of averting a recession, “somewhat increased concerns about rising prices and lower incomes led to lower ratings of personal financial situations,” said Joan Hsu, director of the Bureau of Consumer Research.

Perhaps more importantly for financial markets, U.S. consumers’ expectations of future inflation, while relatively high, appear to have changed little — an encouraging signal that the economy may be able to avoid a self-fulfilling cycle in which expectations of higher inflation spur behavior that creates even more inflation.

The yield on the 10-year Treasury note fell to 4.21% from Thursday’s close of 4.25%. It had risen to as high as 4.60% late last month before several encouraging reports on inflation.

Overseas stock markets, Asian stock indexes were mixed. Japan’s Nikkei rose 0.2 percent after the central bank kept interest rates unchanged.

___

AP Business Writer Yuri Kageyama contributed.

Stan Cho, The Associated Press