Equity investors generally look for stocks that will outperform the overall market. Active stock selection involves risk (and diversification is necessary), but it can also produce excess returns. For example, over the long term, Bradbarth Education (International) Investment Group Limited (HKG:1082) shareholders have seen the share price rise by 59% in the last five years, well ahead of the market decline of around 7.7% (not including dividends).

The past week has proven to be a profitable one for Bradaverse Education (Int’l) Investments Group investors, so let’s take a look at whether fundamentals have driven the company’s five-year performance.

Check out our latest analysis for Bradaverse Education (Int’l) Investments Group

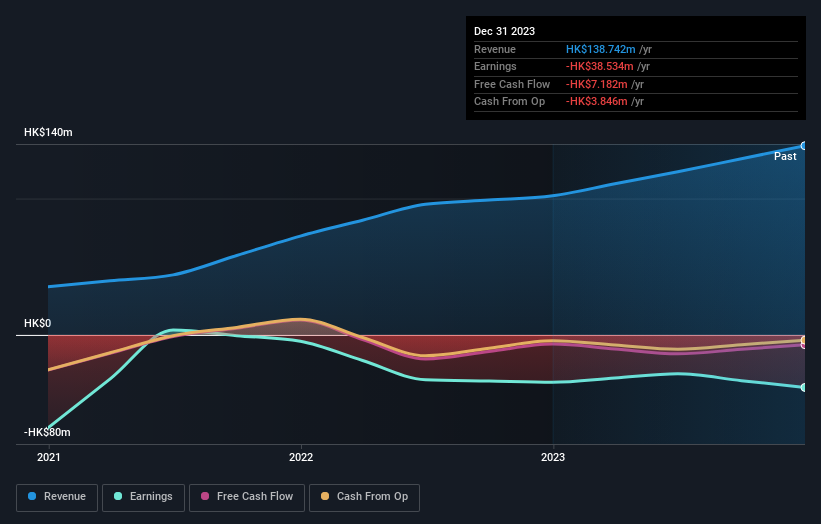

Because Bradaverse Education (Int’l) Investments Group made a loss in the last twelve months, the market is probably more focused on revenue and revenue growth, at least for now. When a company doesn’t make a profit, good revenue growth is usually expected, as rapid revenue growth is easy to extrapolate and often translates into sizeable profits.

Over the past five years, Bradaverse Education (Int’l) Investments Group has boasted earnings growth of 0.07% per year. Simply put, this growth rate is uninspiring. We don’t know how much value the company has added over five years, but a 10% annual share price increase seems reasonable. While this business may be worth keeping an eye on, we generally prefer faster earnings growth.

The company’s revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

this free This interactive report on Bradaverse Education (Int’l) Investments Group’s balance sheet strength is a great starting point, if you want to investigate this stock further.

A different perspective

While the broader market is up 4.8% in the last year, Bradaverse Education (Int’l) Investments Group shareholders have lost 0.6%. However, remember that even the best stocks can underperform the market over a twelve month period. On the bright side, long term shareholders have made a 10% annualized return over five years. The recent sell-off could be an opportunity, so it might be worth looking at the fundamental data for signs of a longer term growth trend. We can get a better understanding of Bradaverse Education (Int’l) Investments Group’s growth by looking at a more detailed historical graph of earnings, revenue and cash flow.

of course Bradbury Education (International) Investments Group may not be the best stock to buySo you might want to take a look at this free A collection of growing stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complicated, but we can help make it simple.

investigate Bradbury Education (International) Investment Group By checking our comprehensive analysis, you can see whether it may be overvalued or undervalued. Fair value estimates, risks and warnings, dividends, insider trading, financial strength.

View your free analysis

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.