carnival (NYSE: CCL)(NYSE:CUK) is one of the world’s largest cruise operators. After seeing zero revenues early in the pandemic, the company has fully recovered, but investors have priced the company’s shares lower this year. While the stock is extremely cheap, the growth story is far from over. Here’s why you may not see another opportunity to buy the company at this price.

Carnival starts cruising again

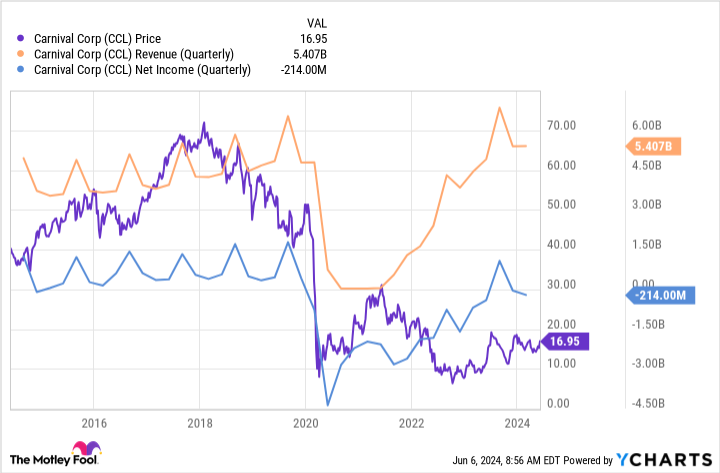

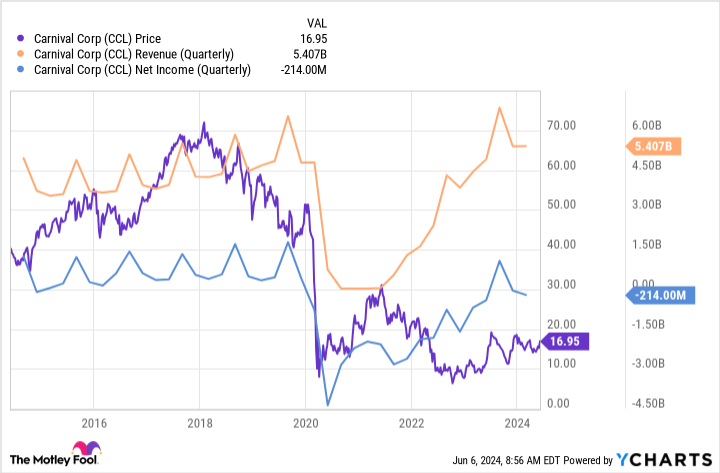

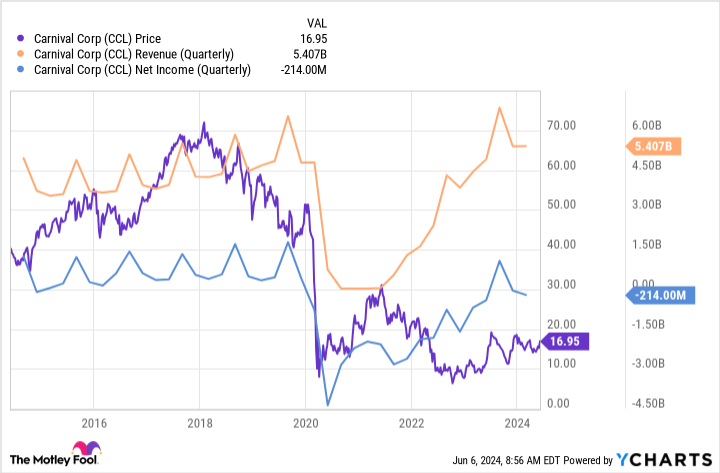

Investors sold off Carnival’s shares when it suspended sailings during the pandemic and revenue dwindled to zero. Those who bet on the company’s recovery made incredible gains, but the market seems to think it beat expectations last year, and Carnival shares are down 9% this year.

Business is booming. Revenue is at an all-time high, hitting a record $5.4 billion in the first quarter of fiscal 2024 (ended Feb. 29). Deposits are at an all-time high, hitting $7 billion in the first quarter. Strong demand and limited inventory have allowed the company to book longer, higher levels of reservations at higher prices.

First-quarter adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) more than doubled from the same period a year ago to $871 million, and Carnival reported its third consecutive quarter of positive operating income. Free cash flow was $1.4 billion, near a record high.

Why Carnival shares are soaring

If you look at Carnival’s stock price before the pandemic, you’ll notice that it was closely tied to the company’s growth.

But even as sales hit record highs and net income improved, the stock remains sluggish. Net income has been negative for all but one quarter of last year since the pandemic began. But Wall Street expects it to turn positive as soon as this summer, and analysts on average are expecting full-year adjusted earnings per share of $1. At that point, Carnival’s stock price will likely surge and start to catch up with its performance.

Extremely low prices

Carnival shares are trading at less than 1 times sales, suggesting investors aren’t confident about the company’s opportunity right now, and the valuation is well below historical levels.

The main cause is Carnival’s extremely high debt load, which exceeds $30 billion but is down significantly from its peak of about $35 billion last year.

Management has taken steps to improve its financial position, including paying down some of its highest interest rate debt obligations and expanding its credit facilities. As operating cash flow and free cash flow continue to grow, management plans to effectively reduce debt without disrupting operations.

If Carnival is unprofitable and heavily in debt, the market won’t give it a high valuation, but if those conditions start to change, prices will rise and valuations will likely follow.

Long-term opportunities

Carnival was a market-beating stock before the pandemic. The company has great brands and assets and is a dominant player in its sector. As you can see from the chart, the company certainly does well when there isn’t a global pandemic, but pandemics don’t happen all that often.

Last week, the company’s shares soared following the news that the P&O Cruises Australia brand and operations would be absorbed into Carnival Cruise Line. Demand is unabated and the move will expand inventory and improve efficiencies across the company. This is a major boost of confidence in Carnival’s brand, operations and future opportunities.

Carnival is undergoing a measured restructuring and could bounce back completely in the short term, and the stock price will reflect that, and you may never get a chance to buy at this price again.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy Carnival Corporation shares, consider the following:

of Motley Fool Stock Advisor The analyst team Top 10 Stocks Here are the stocks investors should buy right now: Carnival Corp. isn’t one of them. The 10 stocks selected have the potential to generate huge profits over the next few years.

Things to consider NVIDIA This list was created on April 15, 2005…If you invested $1,000 at the time of recommendation, That comes to $740,688.!*

Stock Advisor With portfolio construction guidance, regular updates from our analysts, and two new stock picks every month, we provide investors with an easy-to-follow blueprint for success. Stock Advisor The service is More than 4 times First S&P 500 recovery since 2002*.

View 10 stocks »

*Stock Advisor returns as of June 3, 2024

Jennifer Cybill has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corporation. The Motley Fool has a disclosure policy.

The post Once-in-a-Lifetime Investment Opportunity: Why You Should Buy Carnival Stock Now was originally published by The Motley Fool.