Indian equity markets will be driven by both global and domestic factors over the next week, including the US Federal Reserve’s interest rate decision, Indian inflation data and policy decisions of the BJP-led coalition government.

The Federal Reserve will release U.S. core inflation and the Consumer Price Index on June 12, along with its interest rate decision and the Federal Open Market Committee’s (FOMC) economic forecasts.

The Bank of Japan is also due to announce its interest rate decision next week.

See also: Dharmesh Shah recommended buying these two stocks on June 10.

Investors will be closely watching domestic industrial production and inflation data due for release on June 12.

India’s retail price inflation eased slightly to 4.83% in April from 4.85% in March.

However, consumer food price inflation jumped from 8.52% to 8.70%.

The market will also be paying close attention to asset allocation under the new government, news agency ANI reported, citing experts.

“We believe volatility is likely to subside now that the major events are over. The focus for further signals has shifted to domestic macroeconomic data like IIP, CPI, WPI etc. Further, global signals will be closely watched by participants, especially the upcoming US Fed meeting. The recovery after the post-election dip shows the resilience of participants and we expect this trend to continue,” Ajit Mishra, SVP – Research, Religare Broking Ltd. told ANI.

See also: To buy or sell: Sumeet Bagadia recommends these 3 stocks for Monday, June 10

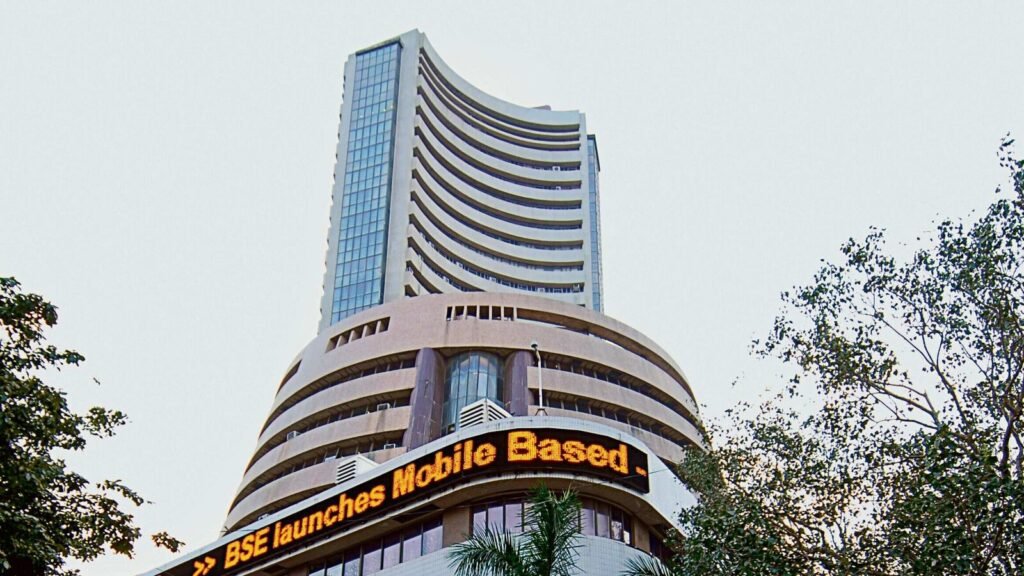

After major stock indexes soared after exit polls on June 3 predicted a BJP majority, Indian stock markets crashed on the day the results were counted as the incumbent BJP failed to secure a majority on its own.

On June 4, the Sensex index had fallen by 4,389.73 points and the Nifty index had fallen by 1,379.40 points.

Investors are about ₹Following the results, the stock market lost 31 trillion rupees. The total market capitalisation of BSE listed companies also fell. ₹3.94 million crores on that day, ₹425 lacclore.

However, in the last week, the BSE index rose 2,732.05 points or 3.69 percent while the Nifty rose 759.45 points or 3.37 percent.

3.6 Million Indians visited us in a single day and chose us as their platform for Indian General Election Results. Check out the latest updates here!