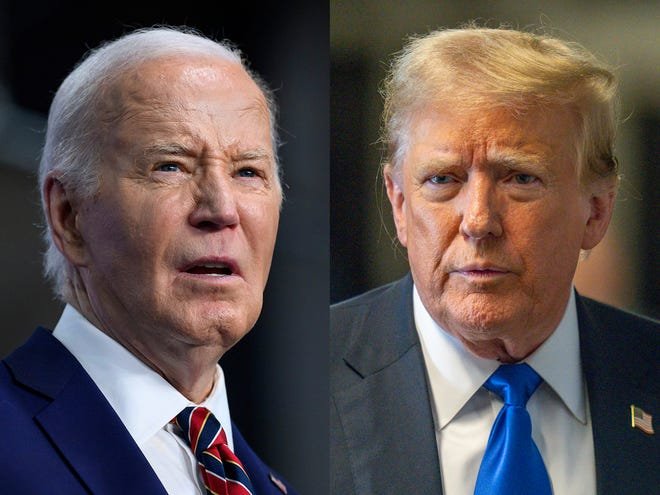

The upcoming presidential election between the front-runners Donald Trump and Joe Biden has generated a lot of excitement and anxiety, with some Americans vowing to leave the country if their candidate does not win.

But does this mean you should pack up your investment portfolio and send it overseas? Probably not. In fact, recent analysis of past election cycles shows that presidential elections are not all that important in influencing stock market outcomes, and are certainly less important than economic and inflation trends, corporate earnings, and other traditional factors. That means elections don’t typically move the markets that much.

“We expected to see more volatility in an election year, but that hasn’t necessarily been the case,” said Dan Lefkowitz, a stock market strategist at research firm Morningstar who recently discussed market movements around the past four presidential elections.

How has the stock market responded to past presidential elections?

Investment strategists at U.S. Bank recently looked at market data from the past 75 years and identified several patterns that tend to repeat during election cycles. One takeaway is that presidential elections don’t have much of a medium- or long-term impact on the stock market, with investment outcomes driven by economic and inflation trends.

That said, there were three election outcome scenarios that U.S. Bank noted were important:

One is for Democrats to win the White House and Republicans to gain or retain control of both the House and the Senate, which would tend to be positive for stocks.

This is also true in the current situation where Democrats control the White House and both houses of Congress are divided between the parties. Conversely, if Republicans controlled the White House and Democrats controlled both houses of Congress, stock market returns would lag slightly, the analysis found.

In a range of other election scenarios, U.S. Bank found no clear investment trends.

Fidelity Investments, in its own analysis, found that stocks have historically generated positive returns in “almost every party combination,” but also that divided governments are associated with better market returns. That may be because “government gridlock means less policy uncertainty” compared to a scenario in which one party can easily push through policies without significant opposition or compromise.

What about economic trends? What’s the sweet spot there?

According to U.S. Bank, higher economic growth and lower inflation are associated with above-average long-term returns, while slower economic growth and higher inflation typically indicate below-average market outcomes.

“Investors will likely find it more useful to keep an eye on these patterns in anticipating market movements than the likely election outcome,” U.S. Bank said in a comment.

Fidelity’s report similarly urged investors to focus on economic fundamentals rather than political hype, and at times rejected “common myths” that suggest “one political party is ‘better’ for market returns. … Historical data does not support these theories.”

What about industries and sectors that may be affected?

Some industries would clearly benefit from a Republican or Democrat in power, but again, there are some caveats to consider. For example, the energy sector, meaning traditional oil and gas companies, is actually the top-performing sector under Biden, “which is surprising given his emphasis on renewable energy,” Lefkowitz said. “Tech has also done very well under Biden.”

One lesson, he said, is that it’s hard to predict the outcome of an election, what policies will be enacted and how investors will react. In the long term, other factors, such as corporate profits and cash flow, are likely to have a bigger impact, he said.

But don’t investors already have track records to track under both the Biden and Trump administrations?

It is true that this election is likely to pit the incumbent against the former president, but that does not mean stock prices will reflect previous results.

“Markets are constantly learning and adapting, so we can’t simply assume that if Trump wins, the market will react the same way it did in 2016, and we can’t simply assume that if Biden wins, the market will react the same way it did in 2020,” Lefkowitz said.

That comment was largely echoed by Rob Howarth, senior director of investment strategy at U.S. Bank Wealth Management, who wrote in the firm’s election report that from an investment perspective, the differences between the candidates “are not as large as many would expect.”

For example, he noted that President Trump imposed tariffs on China, while Biden has maintained most of those tariffs and added more. He predicted that both Trump and Biden are likely to pursue economic stimulus packages, though with different combinations of tax breaks and spending priorities.

Moreover, White House policies don’t necessarily translate into investment outcomes, he added, noting that renewable energy stocks fared relatively well under the Trump administration, while traditional oil companies have fared better under the Biden administration.

What about the midterm elections? Are they that important?

They seem more important than the presidential election.

U.S. Bank found that leading stocks in the Standard & Poor’s 500 Index consistently perform better in the years following midterm elections compared to years without them. Historically, stocks in the index have gained about 8.1% annually, but have generated an average return of 16.3% in the 12 months following a midterm election.

It didn’t really matter which party controlled Congress after the midterm elections. When it came to stock market outcomes, U.S. Bank concluded it wouldn’t make much difference.

All of this doesn’t mean that the upcoming presidential election won’t affect your finances. It can obviously affect things like tax rates and deductions, incentives for buying things like electric cars, etc. And the fact that the election results may not be accepted this time adds another layer of uncertainty.

But in terms of the impact on the stock market, staying focused on the economy, inflation and other traditional factors “will probably be more useful than the likely election outcome,” the U.S. bank’s report said.

Contact the author at russ.wiles@arizonarepublic.com.