Top 10 things to watch on Thursday, June 6th

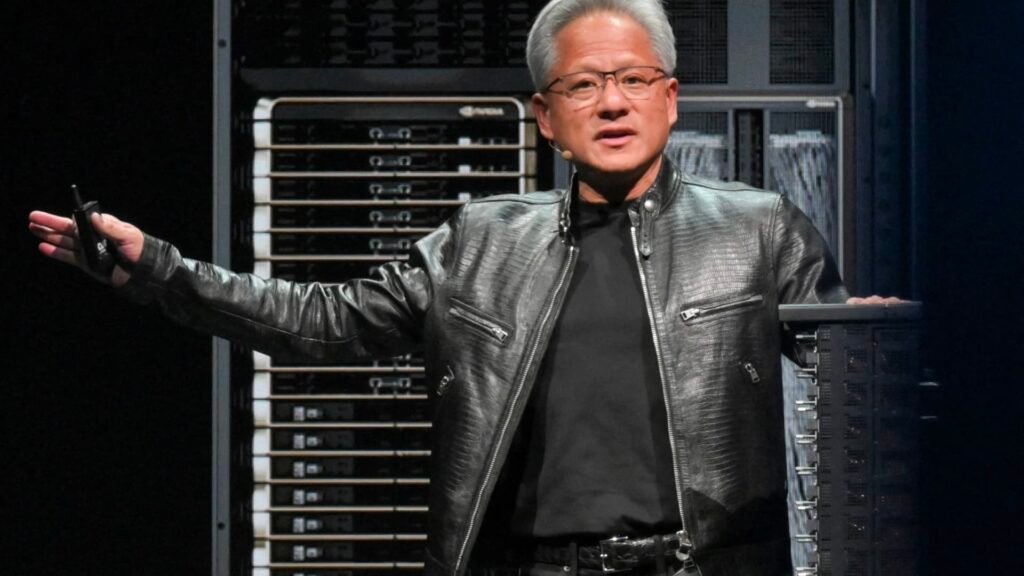

- Wall Street was quiet heading into trading on Thursday. NVIDIA The stock continued to trend upward after rising 5% the previous day and hitting a new all-time high. S&P 500 and Nasdaq That’s a record. Nvidia also joined the $3 trillion market cap club on Wednesday, surpassing the club’s name. apple It is now the second most valuable U.S. company, trailing only Microsoft as of Wednesday’s closing price.

- Bond yields rose ahead of Friday’s government jobs report. 10-Year Government Bond Yield The unemployment rate fell below 4.3% for the first time in months on Wednesday after a second straight day of data suggested a softening job market and raised the prospect of the Federal Reserve cutting interest rates this year.

- The Department of Justice and the Federal Trade Commission are investigating Nvidia’s dominance. Microsoftand Microsoft-backed OpenAI in the artificial intelligence field. This is according to media reports. Nvidia and Microsoft are both club names. The Department of Justice is leading the investigation into Nvidia, while the FTC is investigating Microsoft and OpenAI.

- Lululemon Lululemon’s US sales flop due to limited product selection, but its mainland China sales boom. Skepticism was widespread during the earnings conference call. Lululemon beat expectations on quarterly profit and sales but gave weak guidance. Still, its shares rose 9% after the earnings report. The CEO touted international growth and suggested more work needs to be done in the Americas.

- of stocks Five Below The discount chain’s shares fell 17% early Thursday after quarterly profits and revenue fell short of expectations. Five Below also issued guidance that was worse than expected. It’s a complete disaster. Business didn’t worsen until the Easter weekend, but then there was a big drop. The post-earnings conference call was demoralizing. Losses, including shoplifting, remain an issue.

- Matt Voss, a retail analyst at JPMorgan Dollar Tree The price target was raised to $135 per share from $152, but the analysts maintained an overweight rating equivalent to a buy following news that Dollar Tree was considering selling its Family Dollar brand. There were numerous other price target cuts by analysts.

- Goldman Sachs starts covering Charles River Laboratories With a buy recommendation and a $290 per share price target, this represents an upside of 34%. Goldman analysts believe the contract research industry is undervalued. If you agree, buy the club name. Danahergained footing in the second half of 2023 and continued to rise this year.

- Serious call: MoffettNathanson worries about short- to medium-term downside ShopifyAnalysts expect acquisition costs to rise. MoffettNathanson downgraded Shopify to Neutral from Buy and lowered its price target to $65 from $74 a share. The e-commerce platform, which helps businesses sell online, needs to show “lean, better-than-expected results” to justify its valuation, the analysts said.

- GTA VI mayhem: JP Morgan buys Grand Theft Auto video game maker Take-Two Interactive The price target was raised to $200 per share from $180. The outlook is mostly on GTV potential, but Take-Two has about 40 titles planned through fiscal 2027. The analysts maintained their Overweight rating.

- The next wave Disney Its US theme park expansion will take place in California, not Florida, as it becomes a tale of both coasts as the entertainment giant aims to invest $60 billion over the next decade in its flagship theme parks and cruises to create more value for shareholders.

Sign up for my top 10 morning thoughts on the markets Free Email Newsletter

(look here You can see a complete list of Jim Cramer Charitable Trust’s holdings here.

Subscribers to Jim Cramer’s CNBC Investment Club receive trade alerts before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling shares in his charitable trust’s portfolio. If Jim talks about a stock on CNBC television, he waits 72 hours after issuing the trade alert before executing the trade.

The above Investment Club information is subject to our Terms of Use and Privacy Policy, as well as our Disclaimer. Receipt of any information provided in connection with the Investment Club does not create any fiduciary duty or obligation, and no particular results or benefits can be guaranteed.