Indian Equity Market: Domestic equity market benchmark indices Sensex and Nifty 50 are expected to open flat on Friday ahead of the Reserve Bank of India’s (RBI) monetary policy decision.

Asian markets traded mixed, while US markets also ended mixed following declines in technology and industrial stocks.

Investors will be keeping an eye on the outcome of the Reserve Bank of India’s monetary policy announcement later today. The RBI’s Monetary Policy Committee (MPC), led by Governor Shaktikanta Das, is expected to keep the repo rate unchanged at 6.5% for the eighth consecutive session and also maintain its status quo stance of “withdrawing stimulus”.

However, analysts believe that the Reserve Bank of India governor’s comments on the trajectory of inflation and future interest rate cuts will be key to watch for the market.

Please read this: Reserve Bank of India Policy Committee Verdict Today: Repo Rates and Inflation Rates – Here are the key indicators to watch

Indian stock indexes closed higher on Thursday on hopes of political stability and policy continuity following the outcome of India’s 2024 Lok Sabha elections.

The Sensex index rose 692.27 points or 0.93 percent to close at 75,074.51, while the Nifty 50 index rose 201.05 points or 0.89 percent to close at 22,821.40.

“With the return of vitality in the market, the fear volatility index also declined sharply, dropping 11 per cent. Attention will be on the Union Budget next month and the Reserve Bank of India’s comment on interest rates to be announced in the credit policy,” said Prashant Tapse, senior vice president, research at Mehta Equities.

Key global market indications on Sensex today include:

Asian Market

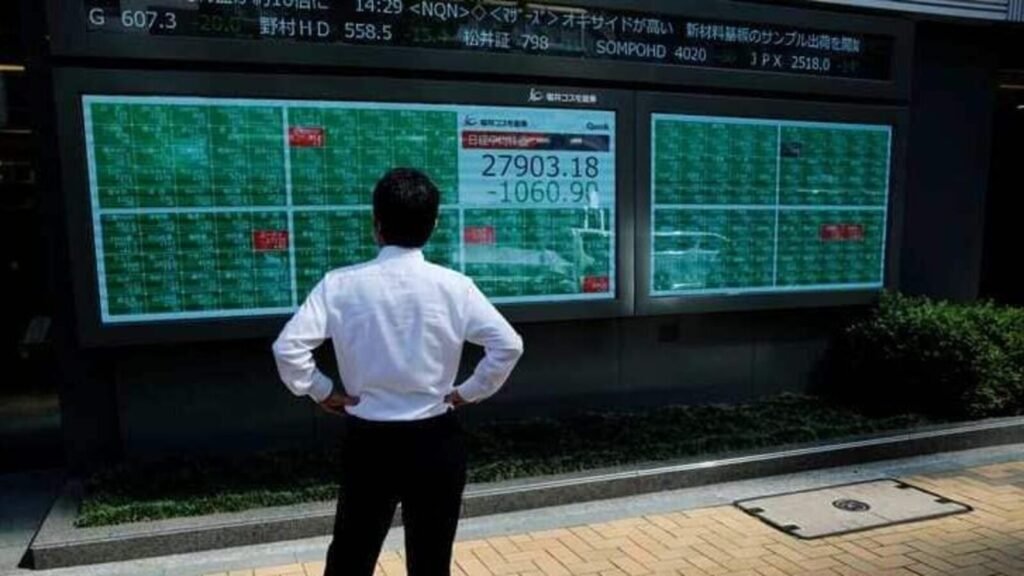

Asian markets were mixed on Friday following mixed signs from Wall Street overnight and ahead of key economic data from China and Japan.

Japan’s Nikkei and Topix were flat, while South Korea’s KOSPI rose 1.45% and the KOSDAQ added 0.6%. Hong Kong’s Hang Seng Index futures got off to a solid start.

Read also: Buy or Sell: Vaishali Parekh Recommends 3 Stocks to Buy Today — June 7

Give the gift of Nifty today

Indian equity market indices saw a flat start with Gift Nifty trading around the 22,910 level.

Wall Street

US stocks ended mixed on Thursday as technology and utility stocks sold off and investors await the key US non-farm payrolls report due later today.

The Dow Jones Industrial Average rose 78.84 points, or 0.20%, to 38,886.17, the S&P 500 fell 1.07 points, or 0.02%, to 5,352.96 and the Nasdaq Composite index fell 14.78 points, or 0.09%, to 17,173.12.

Nvidia shares fell 1.1%, while GameStop shares rose 47%. Lululemon Athletica shares rose 4.8% and Five Below shares fell 10.6%.

Read also: Stocks and bonds fall ahead of US jobs report: Market roundup

European Central Bank

The European Central Bank on Thursday cut interest rates for the first time since 2019, citing progress in fighting inflation, but acknowledged the fight is not over yet. ECB officials led by President Christine Lagarde cut the key deposit rate by 25 basis points (bps) to 3.75% from a record high of 4.0%.

Please read this: ECB cuts key interest rate by 25 basis points to 3.75% in response to growing deflation, first rate cut in five years

Unemployment claims

The number of people applying for new unemployment benefits rose last week. The Labor Department said new claims for state unemployment benefits rose by 8,000 to a seasonally adjusted 229,000 in the week ended June 1. Economists polled by Reuters had expected claims to be 220,000 for the latest week.

Japanese Consumer Spending

Japanese household spending rose year-on-year for the first time in 14 months in April. Consumer spending rose 0.5% year-on-year in April, slightly below the median market forecast of a 0.6% increase. On a seasonally adjusted month-on-month basis, spending was down 1.2% compared to the forecast of a 0.2% increase.

Oil prices

Oil prices have risen, with Brent crude, the global benchmark, surpassing $80 a barrel.

Brent crude oil rose 0.26% to $80.08 a barrel, while U.S. West Texas Intermediate (WTI) crude futures rose 0.25% to $75.74.

Check out the latest updates on RBI’s monetary policy here

(Quoted from Reuters)

Disclaimer: The views and recommendations expressed above are those of the individual analysts or brokerage firms and not that of Mint. We recommend checking with a certified professional before making any investment decisions.

You are on Mint! India’s No.1 News Site (Source: Press Gazette). For more of our business coverage and market insights, click here!