June 5, 2024 13:38 (IST)

Live Stock Market Updates Today | Emkay Global on Election Results

“While power dynamics and political pressures may force the NDA to reassess policies amid a negative shock from the 2024 general elections, we do not see any major change in the overall macroeconomic backdrop. Factor market reforms (land, labour, agriculture, capital) and political reforms may take a back seat. Fiscal consolidation remains on track, but we rule out GFD/GDP falling below 5% and will slightly skew expenditure mix in favour of regular investment over capex (vs. FY25 interim budget) to rectify unfavourable rural terms of trade. The curve steepening theme should work well once fiscal expenditure outlook is recalibrated. Twin deficits will continue to improve and external shocks through monetary channels will be contained.” “Volatile FPI flows will likely see RBI continue aggressive tactical interventions, but the interplay between Fed rate cut repricing and China FX strategy will remain the key cyclical and structural FX movers going forward,” said MK Global Financial Services.

June 5, 2024 13:16 (IST)

Today’s Stock Market Updates | Experts’ Thoughts on Election Results

“In the near term, defensive sectors (FMCG, IT, healthcare) will outperform capex-heavy sectors. Further, some of the sectors with stronger stories (SOEs, defence, railways) will take a breather and may see some downgrades from the current near-all-time high valuations. In the medium to long term, we continue to believe that the structural story (earnings + capex + credit growth) remains intact and India has entered a phase where earnings growth > nominal GDP for the next few years. Hence, we remain constructive on the long-term potential of the Indian market and maintain an overweight stance on financials, auto, real estate and select industrial/manufacturing companies,” said Rupen Rajguru, head of equity investment and strategy at Julius Baer India.

June 5, 2024 13:01 (IST)

Today’s Stock Market Update | Market Participants on Election Results

“The ruling BJP is expected to win around 240 seats and will need support from allies such as the TDP, JDS etc to reach a majority of 272+ seats. The most likely scenario is that the NDA will form a government with Modi as prime minister (the BJP alone has won more seats than the entire Indian Union), but there is still a small chance of an adverse outcome. Markets will not like this uncertainty and we expect a further correction of around 5% before the market settles down.

Coalition governments and economic reforms: The perception that India needs a strong majority government to push through economic reforms is not entirely correct. Coalition governments have implemented difficult economic reforms in the past too. When the BJP came to power with a majority in 2014, the government announced land reforms bills but withdrew them in the face of opposition criticism with the quip, “suit-boots ki sarkar”. Similarly, the farm bills, which could have significantly boosted growth, were withdrawn due to pressure and protests despite the BJP having a majority. Other reforms like IBC, divestment of public enterprises, labour and PLI schemes have also made slow progress. In contrast, the government implemented the controversial demonetisation of high-value currency notes in November 2016 just before the Uttar Pradesh elections, which would have been very difficult to implement with a coalition government,” said Jitendra Gohil, chief investment strategist at Kotak Alternative Asset Managers.

June 5, 2024 12:35 (IST)

Today’s Stock Market Update | Gains and Losses

The top gainers on the Nifty 50 index on June 5 were Hero MotoCorp, Hindustan Unilever, M&M, Tata Consumer Products and IndusInd Bank. On the other hand, the top losers on the Nifty 50 index were L&T, BPCL, Power Grid, SBI and Grasim Industries.

June 5, 2024 12:17 (IST)

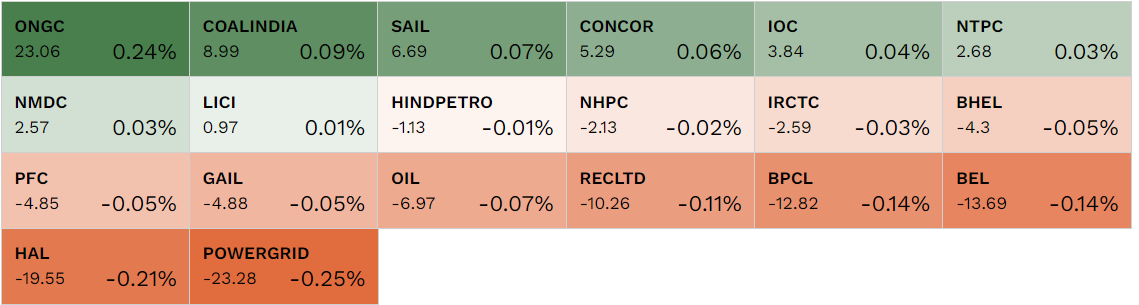

Live Stock Market Updates Today | Nifty PSE Index Movement

Provided by: NSE

June 5, 2024 12:02 (IST)

This afternoon’s market

The NSE Nifty 50 rose 393 points or 1.80 per cent to 22,277.85 and the BSE Sensex rose 1.75 per cent or 1,259 points to 73,338.

June 5, 2024 11:09 (IST)

Today’s Stock Market Live Updates | Nifty 50 Index Movement

Provided by: NSE

June 5, 2024 10:48 IST

Sensex Today Live Updates | Sensex Index Movement

Provided by: BSE

June 5, 2024 10:25 (IST)

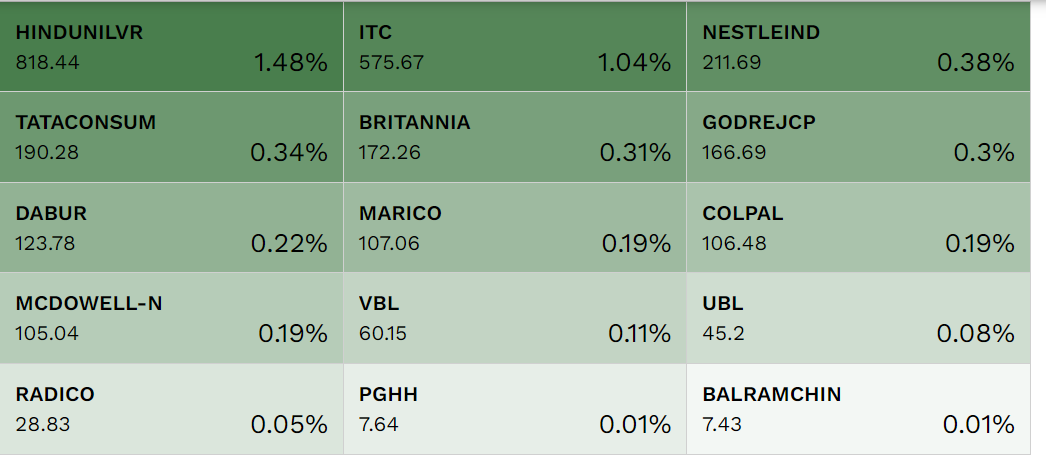

Live Stock Market Updates Today | Nifty FMCG Index Movement

FMCG stocks are rallying in a weak market as investors shift their focus to safer investments.

Provided by: NSE

June 5, 2024 10:07 (IST)

Today’s Stock Market Live Updates | Geojit Financial Services on Markets

“It will take some time for markets to absorb the unexpected election outcome. Markets will soon regain stability but volatility will continue till clarity on the cabinet and key portfolios comes. A sharp market recovery is unlikely in the near term but sector preferences may change. Sectors like FMCG, healthcare and IT will see an increase in preference and momentum trading will slow down. One positive side of a sharp market correction is that hype will ease a bit and clarity on cabinet composition and composition will encourage institutional buying. Investors can start investing in quality large cap stocks in IT, financials, auto and capital goods,” said VK Vijayakumar, chief investment strategist at Geojit Financial Services.

June 5, 2024 09:46 (IST)

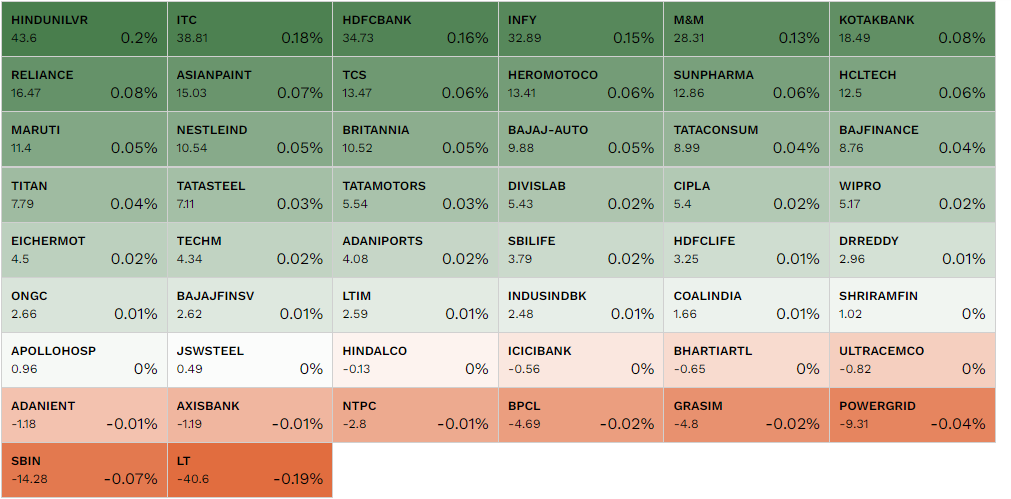

Today’s Stock Market Live Updates | NSE Top Movers

Hindustan Unilever, Hero MotoCorp, Nestle India, Britannia Industries and Asian Paints were the top gainers on the NSE Nifty 50 index, while the top losers included Hindalco Industries, L&T, Adani Enterprises, Power Grid Corp and Adani Ports and SEZ.

June 5, 2024 09:13 (IST)

Today’s Stock Market Update | Oil prices fall, here’s what experts say

“International and domestic crude oil futures continued to fall further on Tuesday with negative carryover from OPEC+’s announcement on Sunday of plans to restore part of crude oil production in the fourth quarter. Signs of weakness in the US economy are bearish for energy demand and oil prices after JOLTS job openings in April fell more than expected to a three-year low. Meanwhile, US crude oil inventories unexpectedly increased by 4.052 million barrels, the largest weekly crude oil stocks increase since the last week of April, according to API data after the US market close. International crude oil futures opened marginally lower in Asian markets early on Wednesday ahead of the release of US EIA inventory data. Consensus is for inventories to fall by 2.3 million barrels and gasoline supplies to increase by 1.7 million barrels,” said Sriram Iyer, Senior Research Analyst, Reliance Securities.

June 5, 2024 09:07 (IST)

Today’s Stock Market Update | Pre-opening comments by Mehta Equities

“In a dramatic fall, Nifty 50 recorded its biggest single-day fall in over four years, falling 6 per cent. This was as bears took control on Dalal Street after the BJP failed to secure a clear majority in the elections. Though Narendra Modi-led BJP is leading with 293 seats, concerns over whether the new government will be able to implement bold policies are weighing on the market. GIFT Nifty was weak despite Modi’s victory speech and technical indicators are pointing to a trading range of 21,000-22,500. Meanwhile, WTI crude oil futures fell to a four-month low, offering some relief. All eyes are now on RBI’s three-day MPC meeting,” said Prashant Tapus, senior vice-president, research, Mehta Equities.

June 5, 2024 09:03 (IST)

Today’s stock market updates | Market rises in pre-opening

The BSE Sensex rose 1.34 per cent or 984 points to 72,971 in morning trade while the NSE Nifty 50 rose 195 points or 0.89 per cent to 22,077 in morning trade.

June 5, 2024 08:38 (IST)

Today’s Stock Market Updates | Expert Views on Bank Nifty

“Bank Nifty has also fallen from the ascending channel, indicating a change in trend. We expect Bank Nifty to correct towards 46,150-44,000, which are the 200-day moving average and the 38.2% Fib retracement levels of the 32,300-51,100 upside. On the upside, 48,600-49,200 will be the immediate hurdles,” said Jatin Gedia, technical research analyst, Sharecan, BNP Paribas.

June 5, 2024 08:23 (IST)

Today’s Stock Market Live Updates | Expert Opinion on Nifty

On Tuesday, Nifty opened with a gap down and then crashed to close down 6%. Nifty clearly fell below the previous swing low of 21820, breaking the high and low formation, suggesting a change in short-term trend. “Our key outlook is that Nifty will retrace the rally witnessed from 18840 to 23340 between October 2024 and May 2024. The key support levels to remember are 200-day moving average and 21100, which is the 50% Fib retracement level of the entire rally. A close below this support zone could see a further fall towards 20560, which is the 61.82% Fib retracement level. On the upside, 22310-22550 would act as an immediate hurdle from a near-term perspective. “The consolidation range is likely to be 21000-22500,” said Jatin Ghedia, Technical Research Analyst, Sharekhan, BNP Paribas.

June 5, 2024 08:14 (IST)

Today’s Stock Market Live Updates | FII and DII Data

Foreign institutional investors (FIIs) sold shares worth Rs 12,436.22 crore. Similarly, domestic institutional investors (DIIs) sold shares worth Rs 3,318.98 crore on June 4, 2024, as per provisional data available on the NSE.

June 5, 2024 08:09 (IST)

Stock Market Live Updates Today | Crude Oil

On Wednesday morning, WTI crude oil prices were trading at $73.10, up 0.24%, while Brent crude oil prices were trading at $77.38, up 0.22%.

June 5, 2024 08:05 (IST)

Stock Market Live Updates Today | Dollar Index

The US Dollar Index (DXY), which measures the greenback’s value against six foreign currencies, was flat at 104.16.

June 5, 2024 07:53 (IST)

Stock Market Live Updates Today | US Markets

Wall Street, or the US market, ended slightly higher after weaker than expected US labour market data confirmed the interest rate cut. The Dow Jones Industrial Average rose 140.26 points, or 0.36%, to 38,711.29. The S&P 500 fell 0.15% to 5,291.34. Similarly, the tech-heavy Nasdaq Composite Index closed down 0.17% to 16,857.05.

June 5, 2024 07:36 (IST)

Today’s Stock Market Update | India 2024 General Election Results

The BJP-led NDA won 292 seats, beating the INDI alliance which got 232. However, the BJP’s dominance in Uttar Pradesh faced a stiff challenge with the Samajwadi Party winning 37 seats compared to the BJP’s 33 seats.