Amid a backdrop of global economic uncertainty and market volatility, Hong Kong’s Hang Seng Index has fallen recently, down 2.84% according to recent data. At times like these, dividend stocks like Tianan China Investment can offer investors potential stability and a regular source of income, making them worth considering for those looking to reduce risk while maintaining exposure to market opportunities.

Top 10 Hong Kong Dividend Stocks

|

name |

Dividend Yield |

Dividend evaluation |

|

China Construction Bank (SEHK:939) |

7.68% |

★★★★★★ |

|

Chongqing Rural Commercial Bank (SEHK:3618) |

8.72% |

★★★★★★ |

|

CITIC Telecom International Holdings (SEHK:1883) |

9.81% |

★★★★★★ |

|

Kongsan Pharmaceutical Group (SEHK:1681) |

8.96% |

★★★★★☆ |

|

SAS Dragon Holdings (SEHK:1184) |

9.02% |

★★★★★☆ |

|

Playmates Toys (SEHK:869) |

8.57% |

★★★★★☆ |

|

Bank of China (SEHK:3988) |

6.84% |

★★★★★☆ |

|

China Mobile (SEHK:941) |

6.30% |

★★★★★☆ |

|

Sinopharm Group (SEHK:1099) |

4.18% |

★★★★★☆ |

|

International Housewares Retail (SEHK:1373) |

8.62% |

★★★★★☆ |

To see the complete list of 92 stocks from our Top Dividend Stock Screener, click here.

Let’s look at some noteworthy options from the screener results.

Simply Wall St Dividend Rating: ★★★★★☆

overview: Tianan China Investment Limited operates as an investment holding company focused on real estate investment, development and management in the People’s Republic of China, Hong Kong, the United Kingdom and Australia, with a market capitalization of approximately HK$5.78 billion.

operation: Tianan China Investment Limited generated revenue of HK$1.53 billion, mainly from property development, followed by property investment at HK$591.38 million and healthcare services at HK$394.15 million.

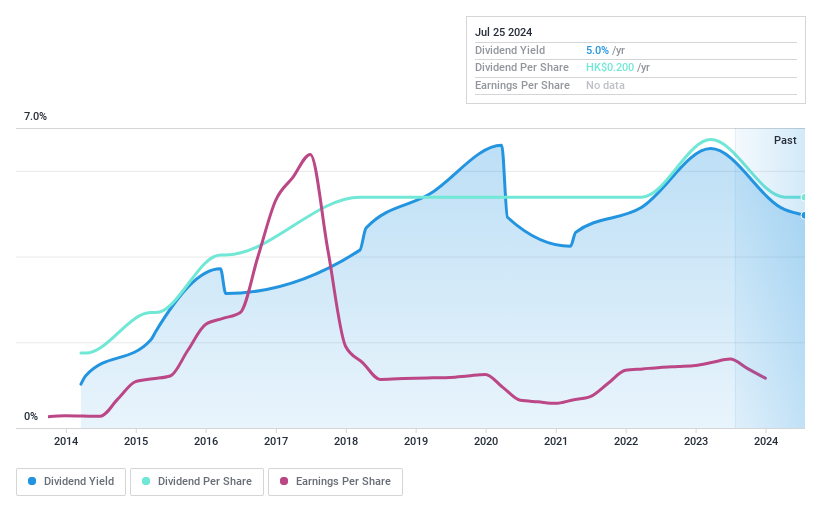

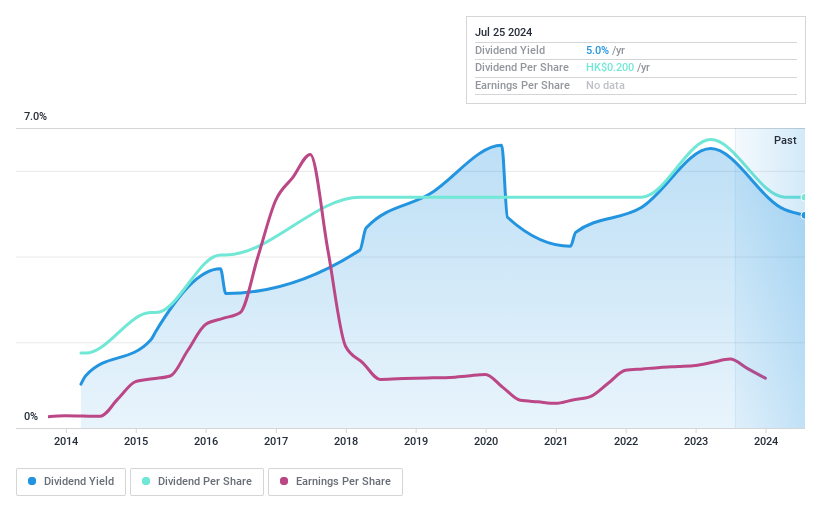

Dividend Yield: 5.1%

Tianan China Investment has maintained a stable dividend over the past decade, and recent increases reflect a commitment to shareholder returns. Although its dividend yield of 5.08% is low compared to major dividend payers in Hong Kong, the company’s dividend is well supported by both profits and cash flow, with payout ratios of 24.1% and 16.9%, respectively. The company’s P/E ratio is an attractive 4.7x, below the market average of 9.7x, suggesting it may be undervalued relative to its peers. Recent board changes may signal a strategic shift, but have not directly impacted dividend policy so far.

Simply Wall St Dividend Rating: ★★★★☆☆

overview: China Overseas Oceania Holding Company Limited operates as an investment holding company focused on investing in, developing and leasing real estate in the People’s Republic of China and Hong Kong, with a market capitalization of approximately HK$7.94 billion.

operation: China Overseas Ocean Group Limited derives its revenue mainly from real estate investment and development (RMB 56.08 billion) and real estate leasing (RMB 240 million).

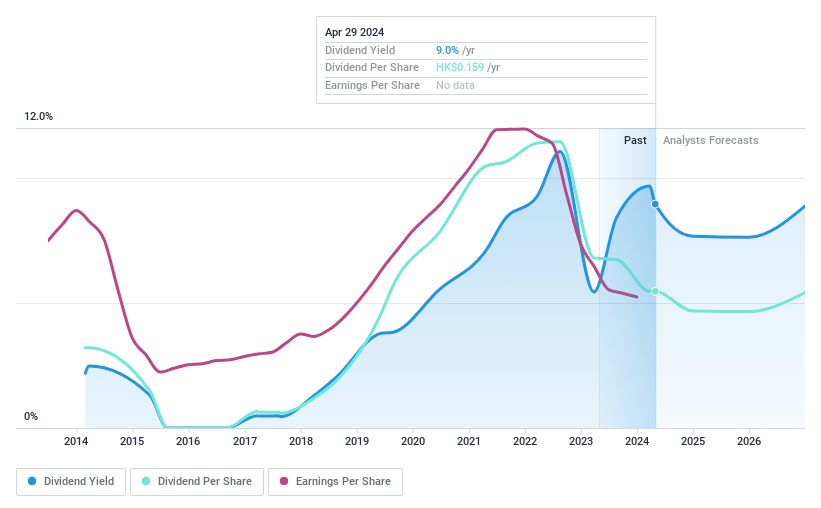

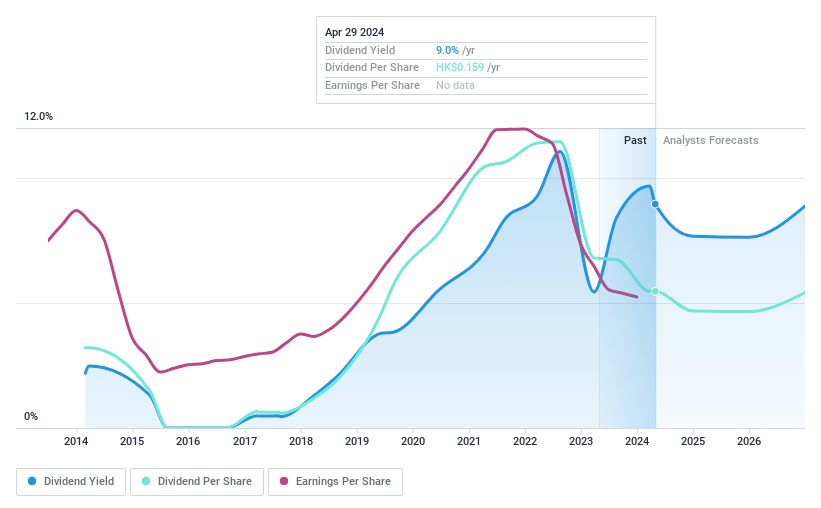

Dividend Yield: 7.1%

China Overseas Grand Oceans Group faces challenges from declining property sales and profits, as evidenced by the significant year-on-year declines in contracted sales and GFA in early 2024. Despite these pressures, the company maintains a low P/E ratio of 3.2x, suggesting a valuation below Hong Kong market standards. Dividend reliability has been called into question due to fluctuations over the past decade and recent cuts, but the dividend is well covered by a 22.5% payout ratio and cash flow (cash payout ratio of 5.8%). Recent board changes and auditor changes may impact future strategic direction, but have not yet had a direct impact on dividend policy.

Simply Wall St Dividend Rating: ★★★★★☆

overview: China Mobile Limited operates as a telecommunications and information services provider in mainland China and Hong Kong, with a market capitalization of approximately HK$1.66 trillion.

operation: China Mobile generates revenue of approximately 1.02 billion yuan (approximately 102 billion yen) from its communications and information-related businesses.

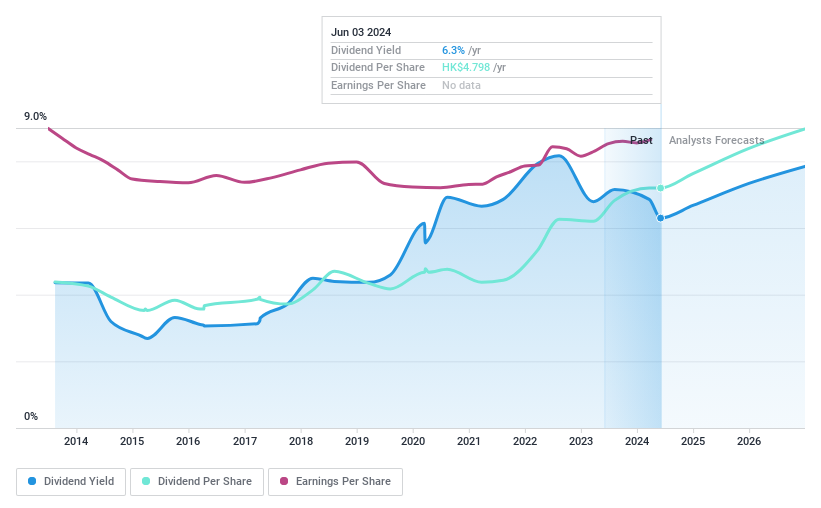

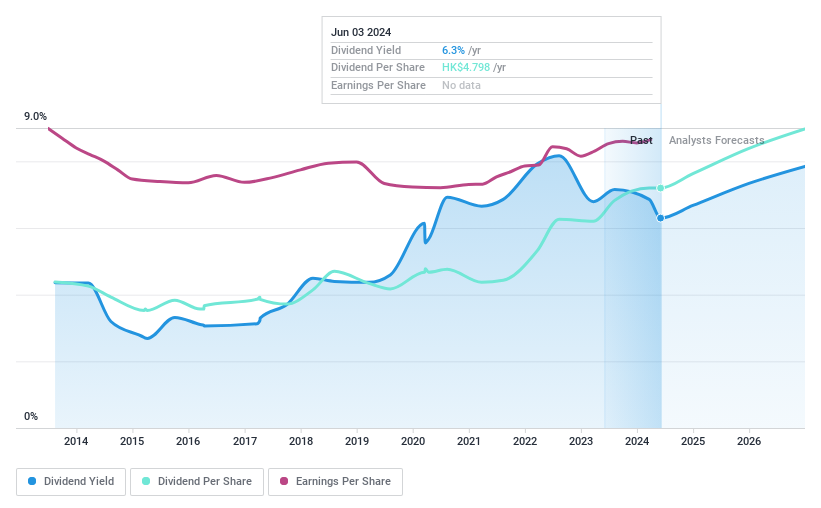

Dividend Yield: 6.3%

China Mobile has consistently offered a stable dividend yield of 6.3% over the past decade, with dividend payments increasing during this period. While the dividend yield is low compared to the top quartile of Hong Kong dividend stocks at 7.64%, the dividend is well supported by earnings and cash flow, with dividend payout ratios of 70.3% and 89%, respectively. The recent leadership change, with Ho Biao taking over as CEO, may signal a strategic shift, but has not yet impacted the company’s solid dividend distribution framework, as evidenced by recent financial performance showing stable revenue and net profit growth through Q1 2024.

Turning ideas into action

-

Click here to learn more about the universe of the top 92 dividend stocks.

-

Do you already own these companies? Link your portfolio to Simply Wall St to get alerted to emerging warning signs for stocks.

-

Unleash the power of informed investing with Simply Wall St, your free guide to navigating stock markets around the world.

Looking for other investments?

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Companies featured in this article include SEHK:28SEHK:81SEHK:941 and

Have feedback about this article? Concerns about the content? Contact us directly. Or email us at editorial-team@simplywallst.com