When buying stocks in a company, you need to keep in mind that there is a chance that the company could go bankrupt and you could lose your money. On the bright side, if the stock is really good, you could make more than 100% profit. For example: Masstec Co., Ltd. (NYSE:MTZ) shares have risen 126% over the past five years, which most people would be happy with, and on top of that, the stock has risen 28% in about a quarter.

It’s also worth looking at the company’s fundamentals here, since it can help determine whether long term shareholder interests are aligned with the performance of the underlying business.

View our latest analysis for MasTec

To paraphrase Benjamin Graham, “In the short run, the market is a voting machine, but in the long run it’s a weighing machine.” One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

We know that MasTec has been profitable in the past. However, the company posted a loss in the last twelve months, suggesting it isn’t reliably profitable, so it may be better to look at other metrics to understand the stock.

Meanwhile, MasTec’s revenue has been growing at a healthy 13% compound rate over the past five years, in which case the company may be sacrificing current earnings per share to drive growth.

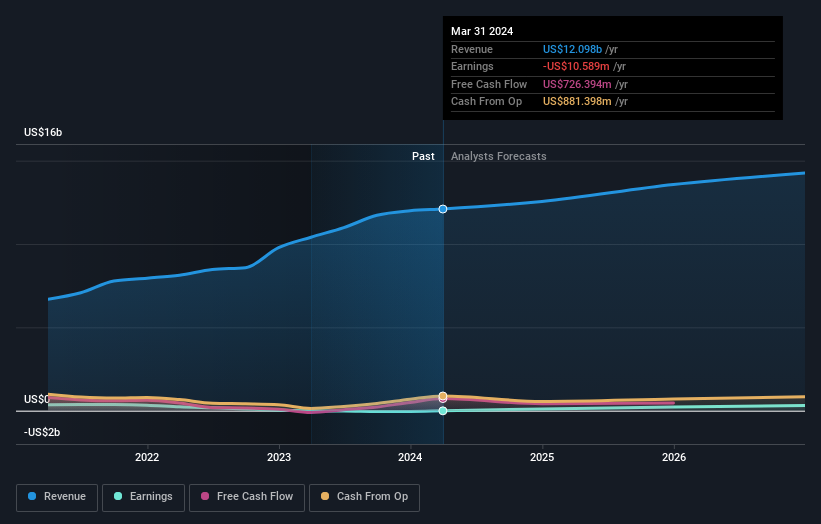

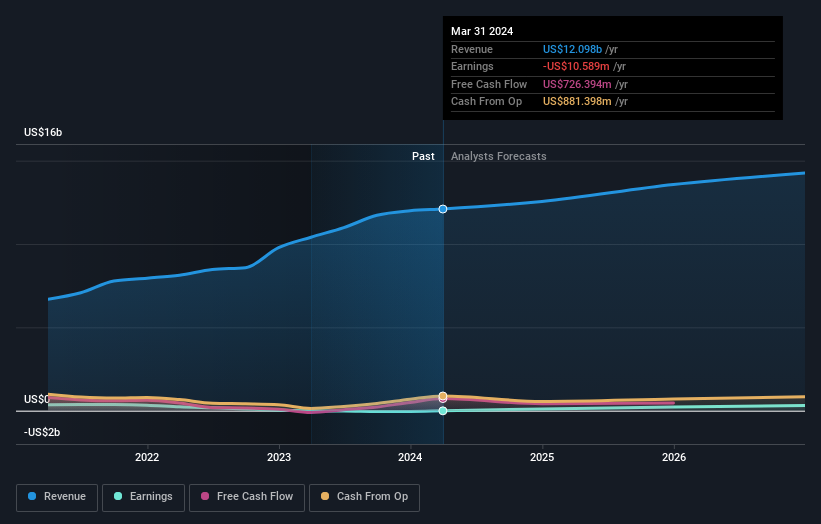

The company’s revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

MasTech is well known by investors, and plenty of smart analysts have attempted to predict its future profit levels, and there are quite a few analyst forecasts out there, so it might be worth checking this out. free Graph showing consensus estimates.

A different perspective

Mastec shareholders have gained 6.3% this year. However, this is below the market average. Looking back over five years, the return is even better, at 18% per year over that period. Given the long string of favourable reviews from the market, this may be a business worth keeping an eye on. I find it very interesting to look at share price over the long term as a proxy for business performance. However, to gain real insight, other information needs to be considered. Still, Mastec is Two Warning Signs in Investment Analysis one of which is not very convincing to us…

For those who love to find A winning investment this free This list of undervalued companies with recent insider buying could be just the thing.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.