Timewatch Investments Limited (HKG:2033) shares have had a really impressive month, rising 28% after a volatile period, and in the broader picture, while not as strong as last month, a 21% increase for the year is also quite reasonable.

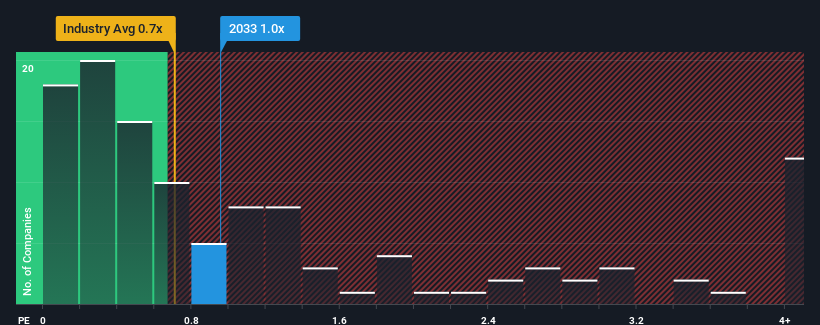

Despite robust price growth, the average price-to-sales multiple (“P/S”) for the luxury goods industry in Hong Kong is also close to 0.7x, so one might be forgiven for feeling indifferent about Time Watch Investments’ P/S ratio of 1x. However, it is unwise to ignore the P/S without an explanation, as it could be that an investor is ignoring a clear opportunity or a costly mistake.

Check out our latest analysis for TimeWatch Investments

Time Watch Investments Performance

For example, let’s say Time Watch Investments has had a poor recent performance, with earnings declining. Investors may believe that the recent earnings performance is in line with industry standards, preventing the P/S ratio from falling. If you’re interested in the company, you’ll at least hope that this is the case, so you can buy shares while things aren’t going so well.

Analyst forecasts for Time Watch Investments are not available, but you can find them here. free Data-rich visualizations give you insight into a company’s revenue, income, and cash flow situation.

What is the trend in earnings growth at Time Watch Investments?

Time Watch Investments’ P/S ratio is typical for a company that is only expected to have moderate growth and, importantly, perform in line with its industry.

Looking back, the company’s revenue growth last year was disappointing, down 14%, which is nothing to be excited about. Over the past three years, the company’s revenue has also declined by a combined 42%, which is not great either. Therefore, shareholders would be pessimistic about the company’s medium-term revenue growth.

In contrast to the company, the broader industry is expected to grow at 13% over the next 12 months, which nicely sums up the company’s recent medium-term revenue decline.

With this in mind, it is somewhat worrying that Time Watch Investments’ P/S is in line with the majority of other companies. It appears that most investors are willing to ignore the recent weak growth rate and hope for an improvement in the company’s business outlook. Only the boldest would consider these prices sustainable, as a continuation of the recent earnings trend will likely eventually weigh on the share price.

What does Time Watch Investments’s P/S mean for investors?

The company’s share price has risen significantly, and Time Watch Investments’ P/S is now back within the industry average range. While you should generally refrain from placing undue weight on the P/S when making investment decisions, it can reveal a lot about what other market participants think of the company.

Our research with Time Watch Investments reveals that declining earnings over the medium term, as the industry grows, are not impacting the P/S as much as expected. Seeing earnings receding against the backdrop of industry expected growth, it is reasonable to expect the share price to fall and the mid-range P/S to potentially decline further. A continuation of the recent mid-term earnings trend would put shareholders’ investments at risk and put potential investors at risk of paying an unnecessary premium.

Remember that there may be other risks. For example, we have identified the following risks: 2 warning signs for TimeWatch Investments (1 is a bit unpleasant) You should be careful.

If you are Concerns about the strength of Time Watch Investments’ businessTo see other companies you might have missed, be sure to check out our interactive list of stocks with solid fundamentals.

Valuation is complicated, but we can help make it simple.

investigate TimeWatch Investments By checking our comprehensive analysis, you can see whether it may be overvalued or undervalued. Fair value estimates, risks and warnings, dividends, insider trading, financial strength.

View your free analysis

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.