Despite already showing good performance, STIC Investments Co., Ltd. (KRX:026890) shares are gaining momentum, up 26% over the past 30 days, and the annualized gain over the past 30 days is a very steep 86%.

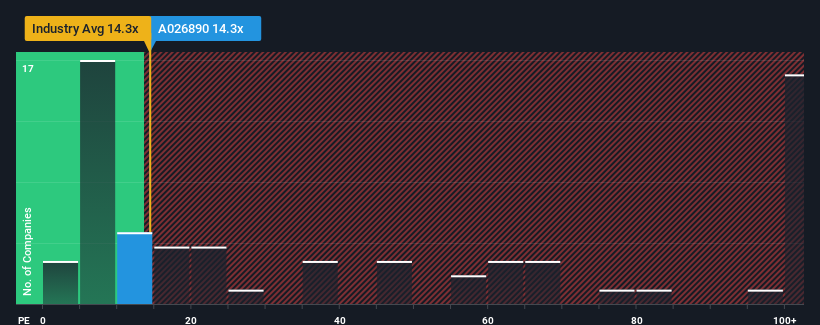

Despite the solid share price growth, STIC Investments’ price-to-earnings (P/E) ratio is currently 14.3x, which is fair to say is quite “moderate” when compared to the Korean market, where the median P/E is around 13x. This may not be a big deal, but without a justified P/E, investors could be missing out on potential opportunities or ignoring impending disappointments.

These have been very good times for STIC Investments and the company’s earnings have been growing rapidly. Many are expecting this upswing to fade, which may be why the price-to-earnings ratio hasn’t risen. If you’re interested in this company, you’ll hope that’s not the case, so you can buy shares while the going gets slower.

Check out our latest analysis for STIC Investments

There are no analyst forecasts for STIC Investments, but you can find them here. free Data-rich visualizations give you insight into a company’s revenue, income, and cash flow situation.

What do growth metrics tell us about the P/E ratio?

The only time you’d feel comfortable seeing a P/E like STIC Investments’ is if the company’s growth is closely linked to the market.

Looking back, last year the company’s bottom line grew an incredible 328%. Still, it’s incredibly disappointing that EPS was down a total of 48% compared to three years ago. So, unfortunately, we have to admit that the company hasn’t done very well in terms of growing profits over this period.

Comparing this medium-term earnings trajectory with the overall market’s projected one-year growth of 31% shows an unfavorable outlook.

This information gives us cause for concern that STIC Investments is trading at a P/E roughly in line with the market. It appears that many of the company’s investors are not as bearish as recent developments would suggest, and are not looking to exit the stock at this time. If the P/E were to fall to levels consistent with the recent negative growth rate, existing shareholders would likely be disappointed in the future.

Conclusion on STIC Investments’ P/E ratio

STIC Investments appears to be back in favor as its share price has risen steadily and its price-to-earnings ratio has returned to parity with most other companies. While price-to-earnings ratios are said to be poor gauges of value in certain industries, they can be a powerful indicator of business confidence.

We find that STIC Investments’ recent earnings decline over the medium term has caused the company to trade at a higher than expected price-to-earnings multiple. At this point, we are concerned about the price-to-earnings multiple as this earnings performance is unlikely to support long-term positive sentiment. If the recent medium-term earnings trend continues, it would put shareholders’ investment at risk and put potential investors at risk of paying an unnecessary premium.

That being said, be careful STIC Investments is showing 2 warning signs In our investment analysis, one of them should not be ignored.

If you are Concerns about the strength of STIC Investments’ businessTo see other companies you might have missed, be sure to check out our interactive list of stocks with solid fundamentals.

Valuation is complicated, but we can help make it simple.

investigate STIC Investments By checking our comprehensive analysis, you can see whether it may be overvalued or undervalued. Fair value estimates, risks and warnings, dividends, insider trading, financial strength.

View your free analysis

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.