FG Trade

Bitcoin (BTC-USD) Price fluctuations since inception have been mostly attributed to two factors: changes in liquidity in the monetary system and investors’ desire to own “decentralized” digital currencies as a hedge against fiat issuance. Honestly, without anyone willing to go red, Given government spending around the world, I don’t see a good reason for Bitcoin to exist.

Believe it or not, this makes Bitcoin (and other cryptocurrencies overall) a great indicator of future stock market movements and acts as a proxy for risk-on capital flows. Upon investigation, Bitcoin has tended to lead stock market movements (both up and down) to varying degrees in its short history since its invention in January 2009.

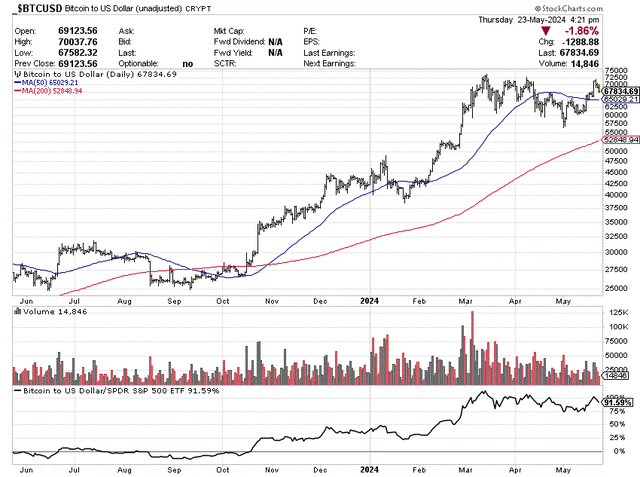

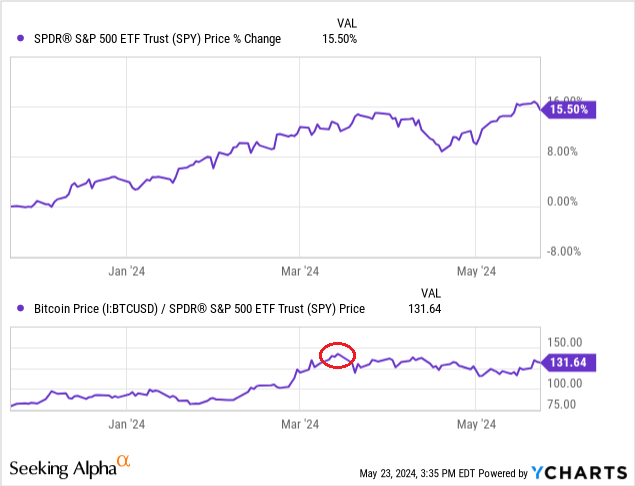

Problems are emerging to ensure that the US stock market S&P 500 will reach a new all-time high in May 2024. Bitcoin has indeed failed. It has been unable to keep up with the gains in stock trading since the 2021 highs, with percentage performance lagging far behind since March of this year. This may be telling investors that net liquidity is shifting from excess levels of funds circulating in financial markets (which helped drive the price above $73,000 in March) to something more akin to tightening credit terms.

This is because (1) consumers have spent all of the extra income they received from COVID-19 stimulus checks, (2) persistently high inflation of 4% is eroding wealth and confidence, and (3) overall bank lending is finally coming under pressure due to the negative impact of 18 months of inverted Treasury yields (measured since October 2022, 3-month vs. 30-year).

Another concern is that the Fed’s “promise” to cut interest rates in 2023-24 could prove illusory until a recession causes inflation to return to the central bank’s 2% target. With prices for many goods soaring since March and wage growth remaining high, inflation instead seems set to bottom out in the 3% to 3.5% year-over-year range in early 2024.

So if the logical trading conclusion is that Bitcoin will peak first when liquidity in the system is at its highest, then its failure to surpass the S&P 500’s all-time high in May should worry observers a bit. Looking ahead, we “should” see a sharp drop in Bitcoin price before the S&P 500 takes a big hit from the sell-off over the coming months. This trading assumption lines up well with evidence of an economic slowdown throughout April and May. Let’s look at historical Bitcoin and S&P 500 patterns:

StockCharts.com – Bitcoin in USD, daily price and volume change over 12 months

Evidence of Historical Transactions

The main point I want to highlight in this article is that Bitcoin has a history of peaking earlier than the S&P 500 index. SPDR S&P 500 ETF (NYSEARCA:SpyUnfortunately, there is not much of a track record of accurately predicting stock market bottoms.

This makes Bitcoin a terrible investment to hold when rising interest rates have clearly tightened liquidity conditions, as they did in 2018-19 and in 2022. A caveat for Bitcoin bulls is that the only downturn Bitcoin has seen was a short one due to the pandemic in 2020, and there isn’t much trading history on what Bitcoin might do in the event of a severe and prolonged economic downturn.

YCharts – Bitcoin (USD), since 2015, recessionary part shaded

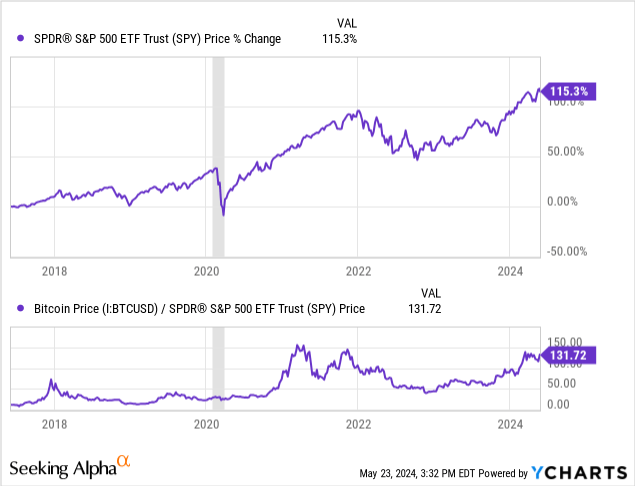

The statistical analysis in this article begins with a long-term chart comparing the trading behavior between the two asset classes going back to June 2017. At this point, Bitcoin was making waves in the mainstream media with its massive increase in price. The bottom section is my main focus and graphs Bitcoin’s price movement against the S&P 500 index.

YCharts – Bitcoin vs. S&P 500 ETF, Price Change Since June 2017

The biggest problem for Bitcoin forever bulls is that the U.S. stock market has outperformed the digital cryptocurrency three years ago since May 2021 (though most cryptocurrencies have risen even slower than Bitcoin). If you had sold your cryptocurrency position 36 months ago and swapped it for an S&P 500 ETF, you would have more money in your pocket by now.

I see this longer term situation as liquidity uncertainty for the US stock market to reach all-time highs in 2024. Sure, the S&P 500 is higher than it was in late 2021 (the rise is driven by a few big tech companies), but the underlying liquidity in the financial system is the same or lower. This is related to the rise in short term bank rates from zero to over 5% during this period.

2018

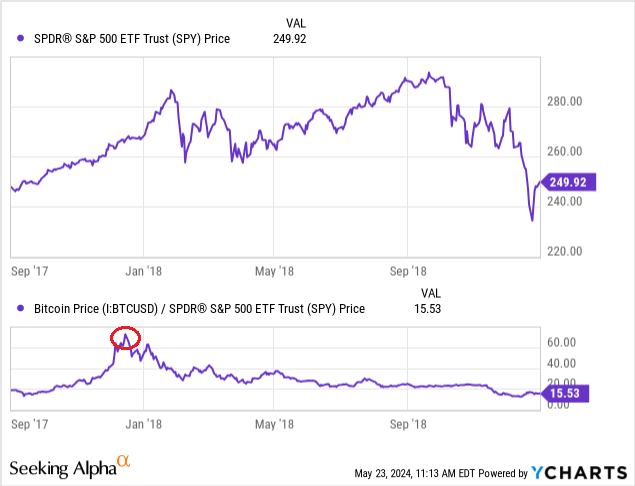

Perhaps more interesting and useful for today’s conversation is to look back at the month-over-month changes in Bitcoin and the S&P 500. Going back to late 2017, Bitcoin’s price skyrocketed and then plummeted throughout 2018. Marked in red is the point where cryptocurrency gave investors some “lead” time to be careful with their portfolio allocation to stocks. Two months later, the price of the S&P 500 fell -10% in one week.

September 2018 saw the stock market reach an all-time high again, something not seen by Bitcoin. A -20% bear market continued into late December, bringing Wall Street back to early 2017 market levels.

For reference, between December 2017 and December 2018, the price of Bitcoin fell by 85%.

YCharts – Bitcoin vs S&P 500 ETF, Price Change, September 2017 to December 2018, Author Reference Point

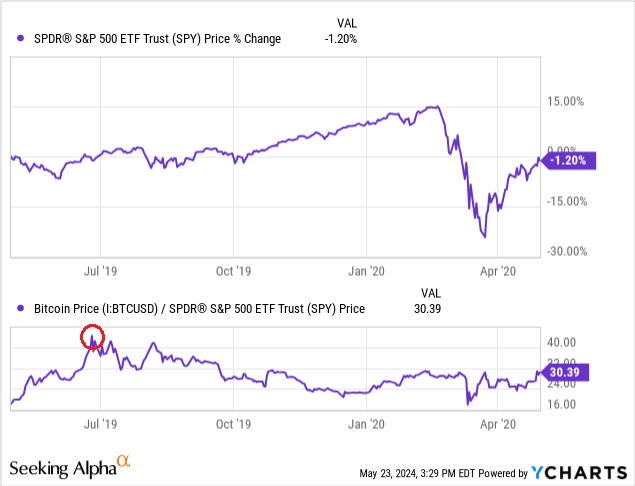

2019-20

Bitcoin peaked again against stocks in June 2019 (circled in red). Stocks continued to rise for another six months despite a massive tightening of credit in the financial system and an inversion of government bond yields. Then the COVID pandemic hit and the forced shutdown of the economy caused a recession. The S&P 500 wiped out several years of gains in two months, plummeting -30%.

The price of Bitcoin would fall by 70% between June 2019 and March 2020.

YCharts – Bitcoin vs S&P 500 ETF, Price Change, April 2019 to April 2020, Author Reference Point

2021-22

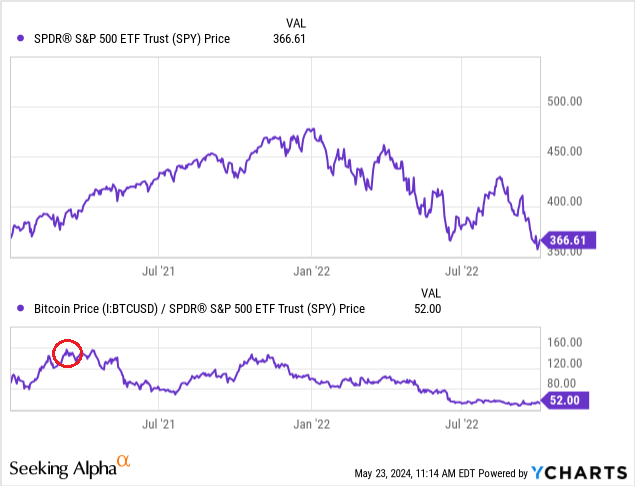

Pandemic-induced government money printing, debt relief, payroll loans, and direct check payments drove “liquidity” to new highs in the US in 2021. Both Bitcoin and the S&P 500 welcomed a massive relief-induced bull market that began in April 2020 and really accelerated in the first half of 2021. Bitcoin peaked in March of the same year (circled in red), signaling excess liquidity (stocks would rise faster from this point onwards), but the S&P 500 moved in a positive direction for another nine months until the end of the year.

What we learned… Bitcoin’s less-than-aggressive rally portends trouble ahead for the stock market, and the period from January to October 2022 was extremely tough for Wall Street, as the S&P 500 Index fell roughly -25% from top to bottom and Bitcoin suffered a massive -75% crash from its November 2021 nominal peak.

YCharts – Bitcoin vs S&P 500 ETF, Price Change, January 2021 to October 2022, Author Reference Point

2024 (present)

Therefore, investors should keep a close eye on Bitcoin prices going forward, even if they don’t own cryptocurrency. Bitcoin’s March surge due to the groundbreaking SEC ETF approval may have been a new all-time high for the cryptocurrency (circled in red).

If Bitcoin and digital crypto assets succumb to a massive sell-off in June and July, the stock market outlook would deteriorate dramatically in late 2024 and early 2025.Sell in May and leave“The calendar timing mantra may prove to be very prophetic this year. I guess we’ll find out soon.”

YCharts – Bitcoin vs S&P 500 ETF, Price Change, 6 Months – 2024, Author Reference Points

Final thoughts

If you are bullish on U.S. stocks, you should be rooting for Bitcoin. This much is clear. Given the weakness in the Bitcoin and cryptocurrency markets in the near future, liquidity in the financial system could reverse.

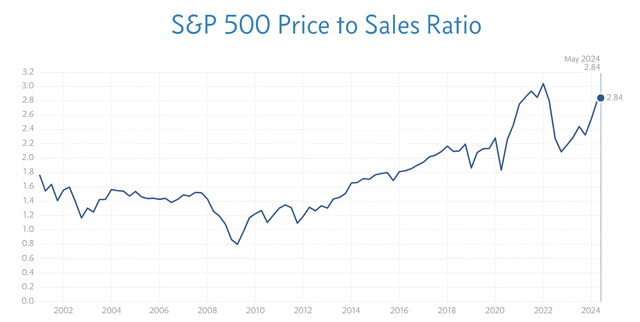

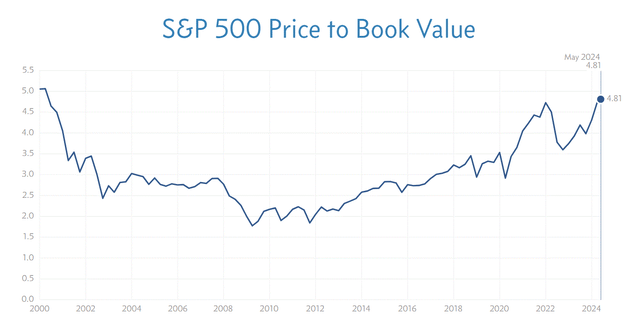

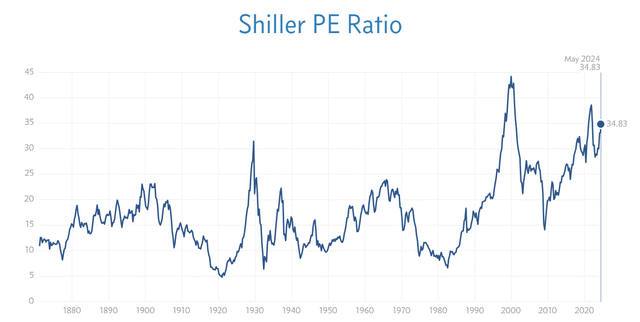

Assuming liquidity dries up, it will be extremely difficult to make profits in the stock market in my view. With S&P 500 stocks trading at 3x sales and 5x price-to-book, near recent records, and stock valuations fully inflated as a function of 10-year cycle adjusted earnings (Shiller CAPE ratios), the potential for a Wall Street downturn is huge for the remainder of 2024. Don’t fool yourself.

Multipl.com – S&P 500, Price vs. Sales, since 2001 Multipl.com – S&P 500, Price to Book Ratio, 2001 to Present Multipl.com – US Stock Market, CAPE Ratio, Since 1870

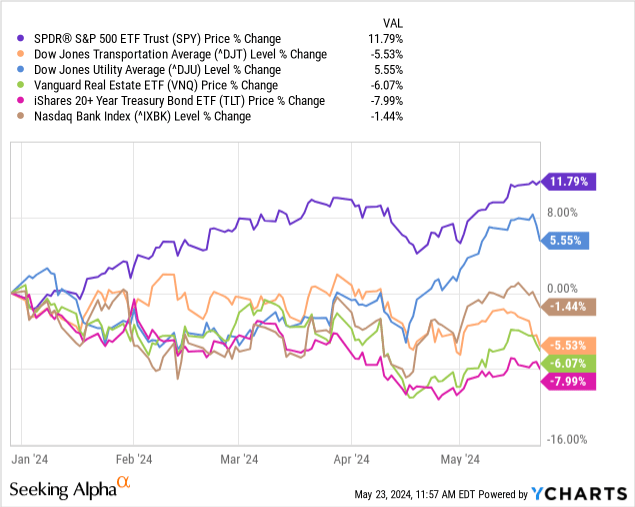

Various indicators of liquidity have been trending in the wrong direction this year. Dow Jones Transportation and Utility Average,plus Vanguard Real Estate ETF (VNQ), iShares 20+ Year Treasury ETF (TLT), and Nasdaq Bank IndexWhile a healthy stock market rally led by US blue chip stocks is a positive sign, the weak performance of these sectors suggests shrinking market liquidity and could signal a looming economic crisis.

YCharts – S&P 500 ETFs vs Liquid Sectors, Jan 1, 2024 onwards

Don’t assume that stocks won’t or won’t crash until 2025. If the next recession hits and liquidity in the financial system dwindles rapidly, the concept of investment “risk” should not be taken lightly. In this scenario, the S&P 500 and Bitcoin prices could retreat in lockstep for months. Tight liquidity is incompatible with rising valuations. Ask investors in 1929, 1987, 2000, and 2022 how things went. What’s interesting about the 2024 investment equation is that we experienced a similar macro trade setup in 2021.

Are both set to see a big price drop? No, but a further drop in Bitcoin from today’s $68,000 only strengthens the argument that real trouble is coming for Wall Street, and perhaps sooner than most people expect.

For peace of mind, I would recommend holding hedges such as rising gold and silver bullion prices, a larger than normal weighting in cash which currently produces a respectable yield of 5%+, index put options (currently available at the cheapest premiums as protection against downside risk), and even short positions to offset potential macroeconomic headwinds in your portfolio. ProShares Short QQQ ETF (PSQ) and ProShares Short S&P 500 ETF (SH) invests in tax-deferred accounts as a way to earn yield and protect against stock declines at the same time. We’ve discussed that dual benefit in the current market environment here for PSQ and here for SH.

Thank you for reading. Please consider this article as the first step in your due diligence process. We recommend consulting with a registered and experienced investment advisor before making any transactions.