If you hold stocks for the long term, you naturally want them to have positive returns, but more than anything, you want to see them perform better than the market average. Shake Shack Inc. (NYSE:SHAK) fell just short of the second target, with the share price only up 59% in five years, below the market return.On a bright side, more new shareholders are likely pretty happy with the share price’s 49% increase over twelve months.

It’s also worth looking at the company’s fundamentals here, because it can help determine whether long-term shareholder interests are aligned with the performance of the underlying business.

View our latest analysis for Shake Shack

Shake Shack made a small profit last year, but the market is probably more focused on sales growth at this point. Typically, these types of companies are considered to be comparable to loss-making stocks because their actual profits are so low. Revenue growth is needed for shareholders to be confident that the company’s profits will grow substantially.

Over the past five years, Shake Shack has boasted 17% annual revenue growth. This compares favorably to other revenue-driven companies. Long-term shareholders have benefited, but five years of 10% annual growth falls short of market returns. Given the revenue growth, it’s fair to say the market is still fairly skeptical. This is likely a potential sweet spot. The stock is priced at a modest clip, but with strong revenue growth over the long term, it’s worth investigating.

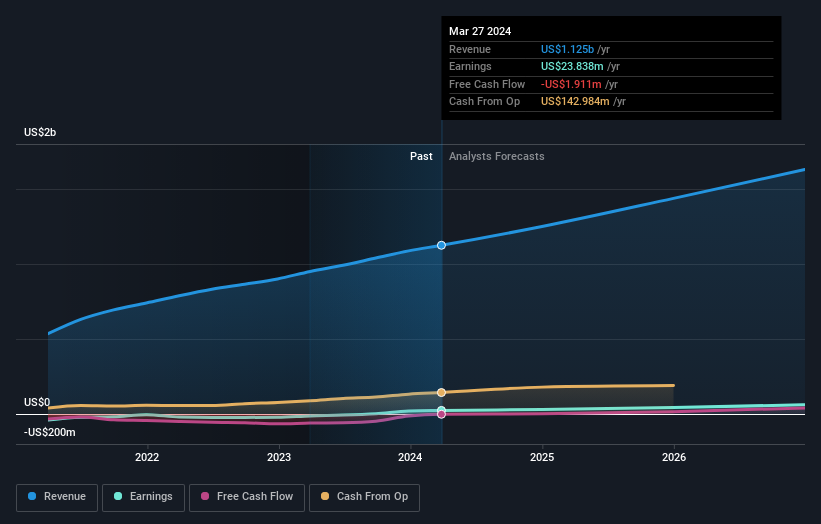

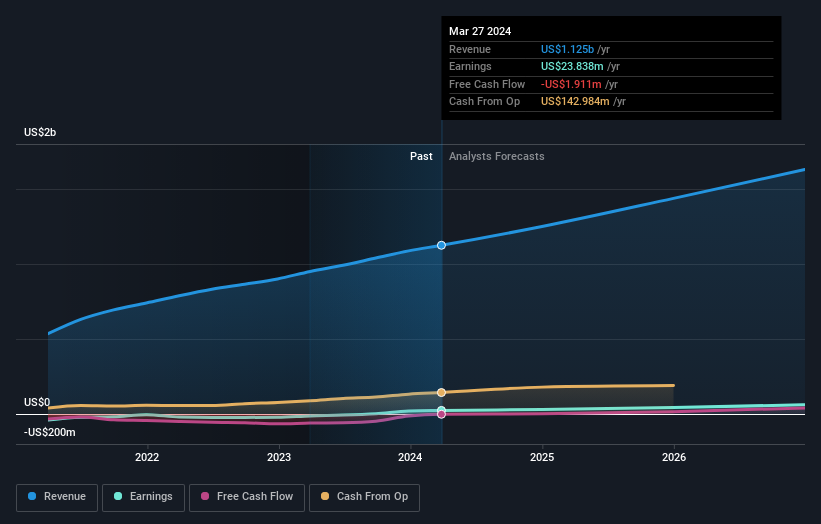

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Shake Shack is a well-known stock, with plenty of analyst coverage and good prospects for future growth, so it makes sense to check out what analysts are forecasting for Shake Shack’s future earnings ( analyst consensus forecasts are free

A different perspective

It’s good to see that Shake Shack has delivered a total shareholder return of 49% to shareholders in the last twelve months. The share price performance looks to be improving recently, with the one-year TSR being better than the five-year TSR (the latter of which was 10% per year). An optimistic viewer might view the recent improvement in TSR as an indication that the business itself is improving over time. While it is well worth considering the different impacts that market conditions can have on share prices, there are other factors that are even more important. Consider, for example, the ever-present threat of investment risk. We’ve identified 1 warning sign Shake Shack has many advantages, and understanding them should be part of your investment process.

of course Shake Shack may not be the best stock to buySo you might want to take a look at this free A collection of growing stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback about this article? Concerns about the content? contact Please contact us directly. Or email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We use only unbiased methodologies to provide commentary based on historical data and analyst forecasts, and our articles are not intended as financial advice. It is not a recommendation to buy or sell stocks, and does not take into account your objectives, or your financial situation. We seek to provide long-term focused analysis driven by fundamental data. Note that our analysis may not take into account the latest price sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.