Wpadington/iStock via Getty Images

Previously, DraftKings (Nasdaq:DKNG) reported strong third quarter 2023 results in November 2023 driven by strong growth in monthly unique payers. [MUP] The average revenue per MUP suggests the stickiness of the gaming platform. Loyal consumers with strong purchasing power.

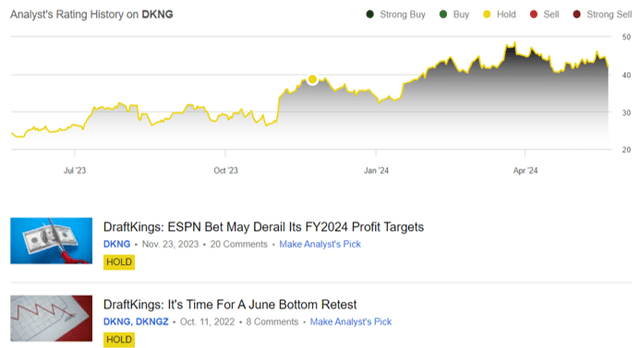

Still, we maintained our Hold rating as the company’s shares continue to trade at a premium to its peers and it remains to be seen how PENN Entertainment’s competition from ESPN Bet (PENN) will fare.

So far, DKNG has exceeded expectations by reporting stellar earnings results for FY23 and Q1FY24, with the stock posting a +8.5% return versus the broader market’s +16.4%.

While the company has raised its guidance for fiscal 2024, it still boasts the largest gaming market share in the U.S. As DKNG remains the market leader, we have been too bearish so far and have raised our rating to Buy.

Let’s discuss further.

DKNG’s investment thesis is inherently compelling, and market leaders aren’t cheap.

As things stand, DKNG beat expectations by 2x in its Q1 2024 earnings report, with revenue of $1.17B (-4.5% QoQ / +52.6% YoY) and Adjusted EBITDA of $22.39M (-85.1% QoQ / +110.1% YoY).

Much of the revenue tailwind came from sustained growth in MUPs to 3.4 million (-100,000 QoQ, +600,000 YoY), meaning the company was able to retain its existing user base while acquiring new customers in new jurisdictions such as Vermont and North Carolina.

At the same time, with average revenue per MUP rising to $114 in the most recent quarter (-1.7% QoQ, +23.9% YoY), it’s clear that DKNG is also increasing volume per user as it improves the overall customer experience and accelerates penetration into new jurisdictions.

Readers should also note that part of the revenue tailwind can be attributed to the acquisition of fully integrated Golden Nugget Online Gaming, which closed in May 2022 and is already “enhancing cross-selling opportunities and driving revenue growth.”

At the same time, DKNG’s bottom line was boosted by management’s relatively efficient adjusted operating expenses of $510.22 million after deducting non-cash stock-based compensation in the most recent quarter (+14.7% QoQ, -1.9% YoY).

Adjusted EBITDA margin expanded to 1.9% (-10.3 points quarter-on-quarter/+30.6 points year-on-year) driven by increased sales and efficient operations, demonstrating a “near-scale fixed cost structure” so far.

As a result, DKNG’s increased guidance for fiscal 2024 is not surprising, as it now expects revenue to increase to $4.9 billion (up 33.8% year-over-year) and adjusted EBITDA to $500 million (up 431% year-over-year) at the midpoint, compared to its initial guidance of $4.77 billion (up 30.2% year-over-year) and $460 million (up 404.5% year-over-year) provided in its fourth quarter 2023 earnings call.

Readers should also note that these figures do not yet take into account the recently completed Jackpocket acquisition, which is expected to increase revenue by up to $340 million and adjusted EBITDA by $100 million by fiscal year 2026, ultimately leading to increased sales and earnings for DKNG.

As a result, while the acquisition of Jackpocket is expected to result in moderate equity dilution, DKNG believes that the expansion into digital lottery services is indeed strategic, allowing it to diversify its offerings while gaining access to Jackpocket’s “database of 6 million customers (1.8 million active customers and 700,000 monthly unique users).”

At the same time, DKNG’s cash burn is also likely to ease from here, with the balance sheet likely to improve from 1Q24 reported cash and cash equivalents of $1.19 billion (-6.2% QoQ, +10.1% YoY) and debt of $1.25 billion (inline QoQ, inline YoY).

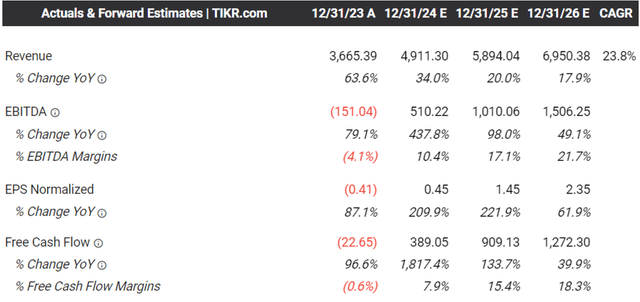

Consensus Forecast

Tickle Terminal

It’s no surprise, therefore, that the consensus is raising future estimates, with DKNG expected to generate revenue/earnings growth at +23%/+156% CAGR through FY2026.

This compares with initial estimates of +21%/+148% and historical revenue growth of +63% from FY2016-FY2023.

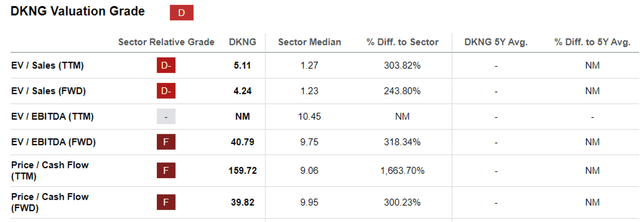

DKNG Rating

Find Alpha

It is therefore understandable why DKNG commands a FWD EV/EBITDA valuation of 40.79x and a FWD price/cash flow valuation of 39.82x, compared to the sector medians of 9.75x and 9.95x, respectively.

When compared to direct peers such as FanDuel owner Flutter Entertainment plc (FLUT) at 17.26x/23.26x and PENN at 9.72x/9.51x, there is no denying that DKNG’s premium is justified and notwithstanding previous concerns about ESPN Bet (interested readers can read our recent coverage of PENN here).

When comparing DKNG’s consensus future forecasts with FLUT’s revenue/profit CAGR of +13.4%/ +26.1% and PENN’s +5.7%/ +10.3% through FY2026, it’s clear that the former’s profitable accelerated growth justifies a premium valuation.

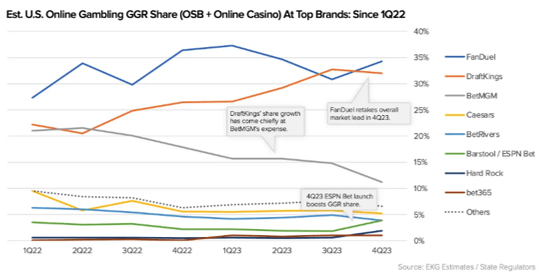

Online gaming market share

Next

This is especially so as DKNG boasts a 32% gaming market share in the U.S. by Q4 2023, second only to FanDuel’s 35%, though Q1 2024 data is still available.

At the same time, the U.S. OSB market size is projected to reach $40 billion by 2030, suggesting that DKNG has the potential to continue profitable growth, maintain its leading market share, and expand user engagement over the next few years.

Is DKNG Stock a Buy?sell or hold?

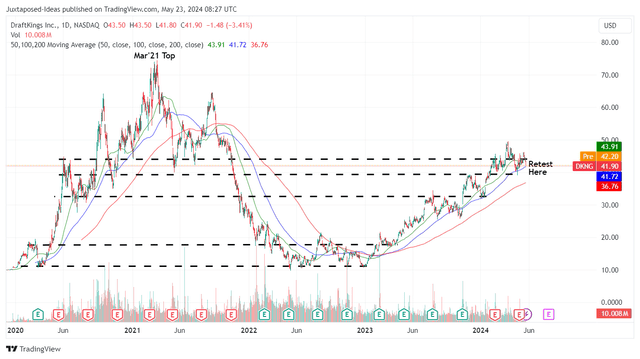

DKNG 4Y Stock Price

Trading View

Similar bullish support is being seen in DKNG stock, whose +265% recovery since the start of 2023 has well outpaced the broader market’s +38.3%.

Based on management’s increased 2024 adjusted EBITDA guidance midpoint of $500 million (231% increase year over year) and the current outstanding shares of 474.22 million, the company expects adjusted EBITDA per share to be $1.05.

Combined with a FWD EV/EBITDA valuation of 40.79x, the stock appears to be trading around our fair value estimate of $42.80.

Based on a similar methodology, and using the consensus 2025 Adjusted EBITDA forecast of $1.01 billion, this would result in Adjusted EBITDA per share of $2.10, resulting in an excellent potential to be twice our mid-term price target of $85.60.

Author’s rating

Find Alpha

Does this mean we’re finally retracting our statement and upgrading DKNG shares to a Buy after two Hold ratings?

Yes, indeed, but there is no specific recommended entry point as it depends on each individual investor’s dollar cost averaging and risk tolerance.

In this case, we believe that better late than never, especially since market leaders are not exactly cheap.