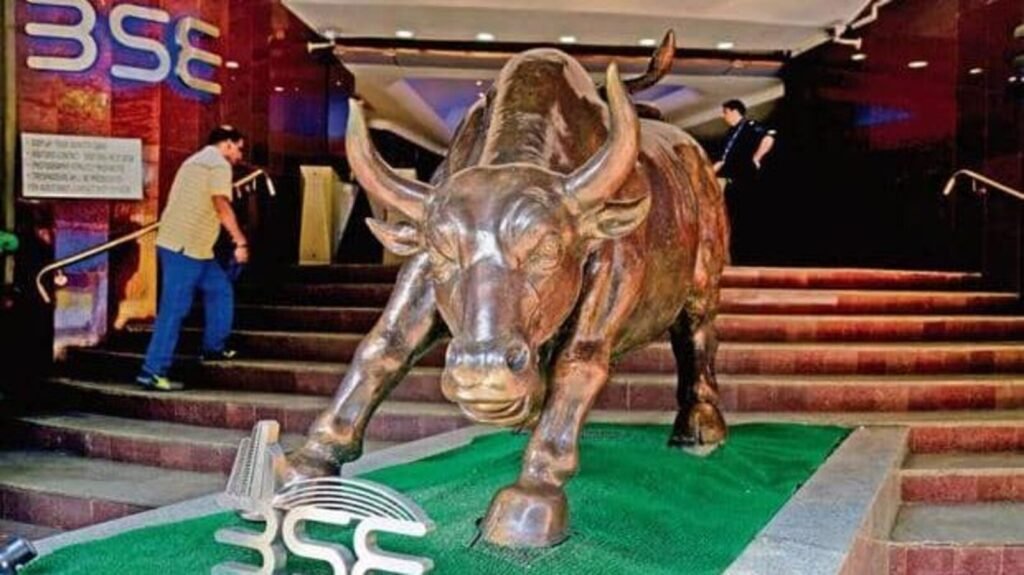

Mumbai With just two weeks to go for the announcement of results of the Indian Lok Sabha elections on June 4, foreign portfolio investors (FPIs) have significantly softened their bearish view on the Indian markets.

With just two weeks to go for the announcement of results of the Indian Lok Sabha elections on June 4, foreign portfolio investors (FPIs) have significantly softened their bearish view on the Indian markets.

On Thursday, they reduced their cumulative net short position in index futures contracts by 121,415 contracts to 98,351 contracts from 219,766 the previous day. ₹Short interest of 467.095 billion shares was the main reason for the market testing a fresh high of 22,993.60 on Thursday.

Hello! You’re reading a premium article! Subscribe now to continue reading.

Subscribe now

Premium Benefits

Premium for those aged 35 and over Daily Articles

Specially curated Newsletter every day

Access to 15+ Print Edition Daily Articles

Register-only webinar By expert journalists

E-Paper, Archives, Selection Wall Street Journal and Economist articles

Access to exclusive subscriber benefits: Infographic I Podcast

35+ Well-Researched Unlocks

Daily Premium Articles

Access to global insights

Over 100 exclusive articles

International Publications

Exclusive newsletter for 5+ subscribers

Specially curated by experts

Free access to e-paper and

WhatsApp updates

On Thursday, they reduced their cumulative net short position in index futures contracts by 121,415 contracts to 98,351 contracts from 219,766 the previous day. ₹Short interest of 467.095 billion shares was the main reason for the market testing a fresh high of 22,993.60 on Thursday.

“Markets don’t fall on pessimism,” said Deepak Shenoy, founder of Capitalmind, a portfolio manager registered with the Securities and Exchange Commission, commenting on short covering by FPIs. Markets usually fall when there are large amounts of long positions in the system, not too many short positions. Shenoy added that financial results for the March quarter were “very good” and he expects market momentum to continue. The combined net profit of 1,874 companies rose 26.4% year-on-year to US$12 million. ₹It will reach $3.74 trillion in the fourth quarter of fiscal 2024.

According to UR Bhat, co-founder of Alphanity Fintech, FPIs “may have thought it wise to moderate their negative stance ahead of the election results, with five phases of voting now over,” and expect the market to move sharply after June 1, when exit poll results will start coming in.

The momentum continues

Markets ended flat on Friday with Nifty down 0.05% to 22,957.10, however, Bank Nifty rose 0.42% to end at 48,971.65.

Gautam Dagad, head of institutional equity research at Motilal Oswal, believes the market momentum will continue “barring any negative surprises on June 4.”

Rohit Srivastava, founder, IndiaCharts, said the market momentum would depend on whether FPIs cover their remaining short positions and initiate fresh long positions in the market.

Positioning opposite to FPIs in index futures were retail and HNI investors, whose cumulative net long or bullish position stood at 124,742 contracts.

FPIs sold 100% of their shares in the first quarter. ₹It purchased shares worth Rs 30,718 crore in the financial year ended May 22. ₹2.8 trillion.