Indian Equity Market: Domestic equity indices Sensex and Nifty 50 are expected to open lower on Friday following weakness in global markets.

Asian markets fell and U.S. stocks ended lower after data showed inflation remained a concern and could prompt the Federal Reserve to delay cutting interest rates.

India’s major stock indexes closed at record highs on Thursday, fuelled by broad buying.

The Sensex index rose 1,196.98 points or 1.61 percent to close at 22,967.65, while the Nifty 50 index rose 369.85 points or 1.64 percent to close at 75,418.04.

“We expect the positive momentum to continue on the back of an improving political environment, continued short covering by foreign institutional investors and favorable domestic macroeconomic performance. Sectors like defence, banking and railways are expected to remain in focus,” said Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services Ltd.

Key global market indications on Sensex today include:

Asian Market

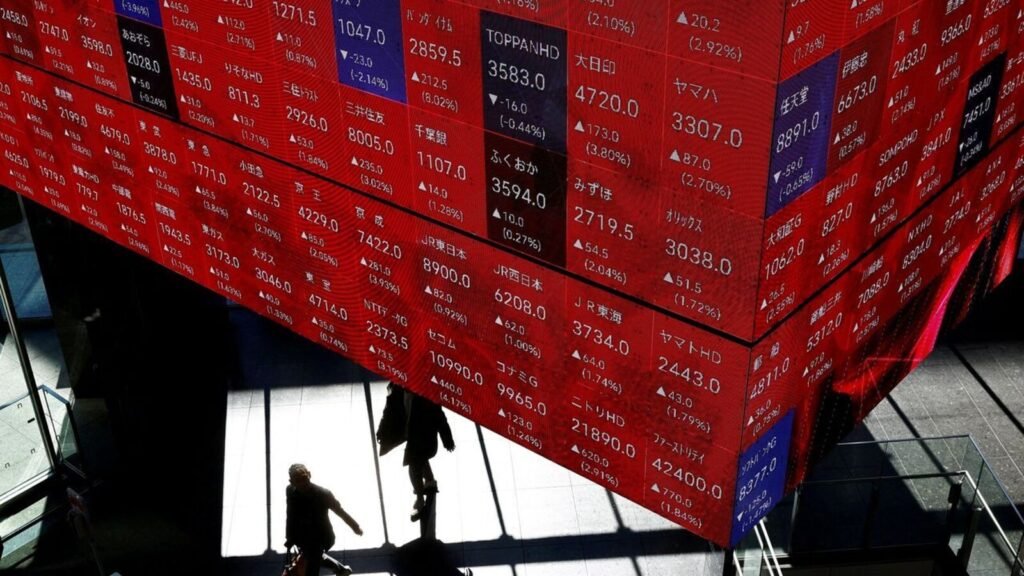

Asian markets fell on Friday following Wall Street’s overnight decline.

The Nikkei Stock Average fell 1.83% and the Topix plunged 1.22%. South Korea’s KOSPI dropped 1.34% and the Kosdaq lost 0.95%. Hong Kong’s Hang Seng Index futures got off to a weak start.

Read also: Buy or Sell: Vaishali Parekh recommends 3 stocks to buy today – May 24

Give the gift of Nifty today

GIFT Nifty was trading near the 22,950 level, down about 50 points from the previous day’s closing price of Nifty futures, indicating a negative start for Indian stock market indices.

Wall Street

U.S. stock markets ended lower on Thursday, with the Dow Jones Industrial Average posting its biggest one-day percentage drop since March 22, 2023.

The Dow Jones Industrial Average fell 605.78 points, or 1.53%, to 39,065.26, the S&P 500 lost 39.17 points, or 0.74%, to 5,267.84 and the Nasdaq Composite Index lost 65.51 points, or 0.39%, to close at 16,736.03.

On the stock market, Nvidia shares rose 9.32% to close above $1,000 per share for the first time. DuPont shares rose 0.48%, while Live Nation shares fell 7.81%.

Read also: Dividend Stocks: These stocks will trade ex-dividend on May 24th

Nvidia stock price

Nvidia shares surged more than 9% on Thursday after the company announced a strong earnings outlook and a stock split, adding roughly $218 billion to its market capitalization that day — the second-largest one-day increase in market capitalization in Wall Street history.

Nvidia announced a 10-for-1 stock split and increased its quarterly dividend by 150%.

Nvidia shares closed at $1,037.99, surpassing the $1,000 mark. The company’s shares have more than tripled in value last year and are up nearly 110% so far in 2024.

US unemployment claims

The number of Americans who filed new claims for unemployment benefits fell last week. Initial jobless claims fell by 8,000 to a seasonally adjusted 215,000 in the week ended May 18. Economists surveyed by Reuters had expected claims to be 220,000 in the latest week.

usa home sales

U.S. new single-family home sales fell more than expected, dropping 4.7 percent to a seasonally adjusted annualized rate of 634,000 in April. Economists polled by Reuters had expected new home sales to fall to 679,000.

Read also: Dollar headed for weekly gain as interest rate cut expectations fade

Dollar

The dollar is on track to post its biggest weekly gain in a month and a half on Friday.

The U.S. Dollar Index, which tracks the greenback’s relative value against six major currencies, rose nearly 0.6% from the previous week to 105.07, on track for its biggest weekly gain since mid-April.

Inflation in Japan

Japan’s core inflation rate slowed for a second straight month in April but remained well above the central bank’s 2% target. The national core consumer price index (CPI), which excludes fresh food, rose 2.2% year-on-year, following a 2.6% increase in March, in line with the median market forecast.

(Quoted from Reuters)

Disclaimer: The views and recommendations expressed above are those of the individual analysts or brokerage firms and not that of Mint. We recommend checking with a certified professional before making any investment decisions.

You are on Mint! India’s No.1 News Site (Source: Press Gazette). For more of our business coverage and market insights, click here!