- U.S. stocks fell after the close as investors awaited Nvidia’s first-quarter earnings report.

- Investors also accepted comments from Fed officials that suggested a rate cut was not imminent.

- The Fed will release the minutes of its last policy meeting on Wednesday afternoon.

U.S. stocks fell on Wednesday as traders looked ahead to Nvidia’s long-awaited first-quarter earnings report and took in the latest commentary from Federal Reserve speakers.

All three benchmark indexes fell and bond yields rose, with the 10-year Treasury yield rising 3 basis points to 4.451 percent.

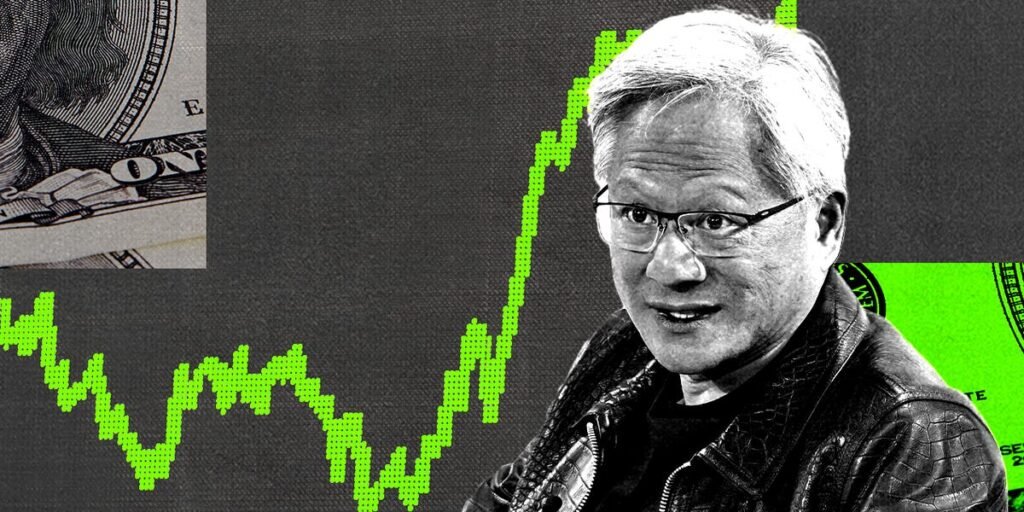

Nvidia is on deck to report financial results after the closing bell. Wall Street is expecting another blowout quarter from the chipmaker, with analysts expecting the company to have made $24.6 billion in revenue in the first three months of the year, according to Bloomberg data.

Wall Street was expecting earnings of $5.34 a share, and the report is expected to show demand for the company’s AI-enabled chips is growing. The stock price has increased more than 90% by 2024.

Investors also bought into comments this week from several Fed officials who reiterated that interest rate cuts probably won’t happen until there is more progress in inflation.

“I think the numbers have been very mixed” on inflation, Boston Fed President Susan Collins said Tuesday night, “and it looks like it’s going to take a lot longer than we previously thought.”

Cleveland Fed President Loretta Mester added that she would like to see inflation data calm down for “a few more months” before the Fed starts cutting rates.

Since the beginning of this year, the market has been dialing back expectations for a Fed rate cut. According to CME’s FedWatch tool, investors expect the Fed to keep interest rates on hold nearly 100% at its June policy meeting, while expecting one or two rate cuts by the end of the year.

Here are the U.S. indices immediately after the opening bell at 9:30 a.m. Wednesday:

Here’s what else happened today:

In Commodities, Fixed Income and Cryptocurrencies:

- West Texas Intermediate crude oil fell 1.14% to $77.76 a barrel. International benchmark Brent crude oil fell 1.13% to $81.94 a barrel.

- Gold fell 0.52% to $2,409.48 per ounce.

- The 10-year Treasury yield rose 3 basis points to 4.451%.

- Bitcoin fell 1.88% to $69,784.