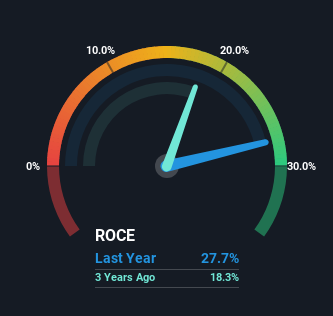

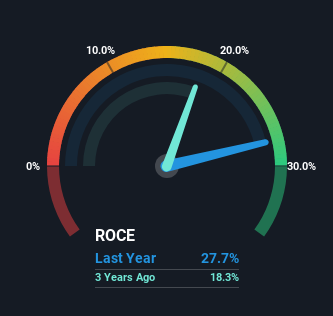

If you want to find stocks with long-term growth potential, what fundamental trends should you look at? First, you want to identify something that is growing. return In addition to capital employed (ROCE) continues to increase base of capital employed. This shows that it is a compounding machine and the earnings can be continuously reinvested into the business to generate higher profits. So when we looked through, Arista Networks (NYSE:ANET) ROCE Trends, we really liked what we saw.

Return on Capital Employed (ROCE): What is it?

For those who don’t know, ROCE is a measure of a company’s annual pre-tax profit (return) on the capital employed in the business. The formula for this calculation in Arista Networks is:

Return on Capital Employed = Earnings before interest and tax (EBIT) ÷ (Total assets – Current liabilities)

0.28 = $2.4 billion ÷ ($11 billion – $1.8 billion) (Based on the previous 12 months to March 2024).

So, Arista Networks has an ROCE of 28%. In absolute terms, this is a significant gain, even better than the telecom industry average of 8.4%.

Check out our latest analysis for Arista Networks.

Above you can see how Arista Networks’ current ROCE compares to its previous return on capital, but the past can only tell you so much. If you wish, check out forecasts made by the analysts covering Arista Networks. free.

ROCE trends

We’d be pretty happy with a return on capital like Arista Networks. Over the past five years, the ROCE has remained relatively flat at around 28%, with 214% more capital invested in operating the business. A return like this would be the envy of most companies, and it’s even better considering it has been repeatedly reinvested at such rates. If Arista Networks can keep this up, we’ll be very optimistic about its future.

Arista Networks ROCE Highlights

In summary, we’re happy to see Arista Networks is doubling its earnings by reinvesting at consistently high rates of return. Because these are common characteristics of multibaggers. And there’s no doubt long-term investors are overjoyed with the results, as the stock has performed incredibly well over the past five years, returning 399%. So while investors may be considering the underlying positive trends, we still think the stock is worth further consideration.

But before you jump to any conclusions, you need to know what value you’re getting from the current share price.Check out ours there Free estimate of ANET’s intrinsic value Compare stock prices and estimated values.

If you want to find more stocks with high returns, check this out. free This is a list of stocks with strong balance sheets and high return on equity.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology, and articles are not intended as financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.