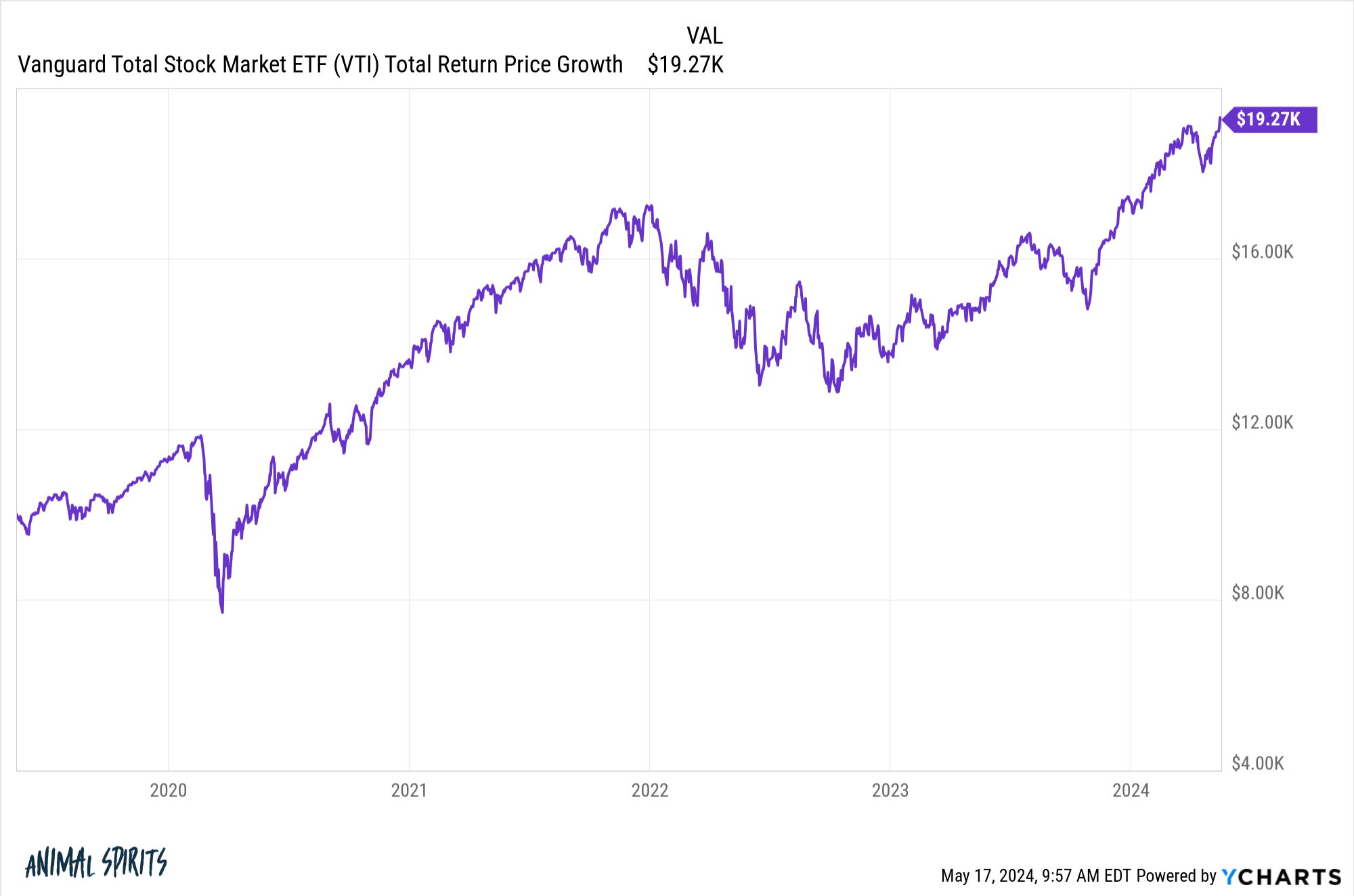

These are trends in the total return of the US stock market.1 Across different time frames:

Year-to-date: +11%

1 year: +30%

5 years: +94%

10 years: +223%

15 years: +679%

Not bad considering there have been two bear markets in the past four years.

If you invested $10,000 in the U.S. stock market five years ago, your money would essentially double.

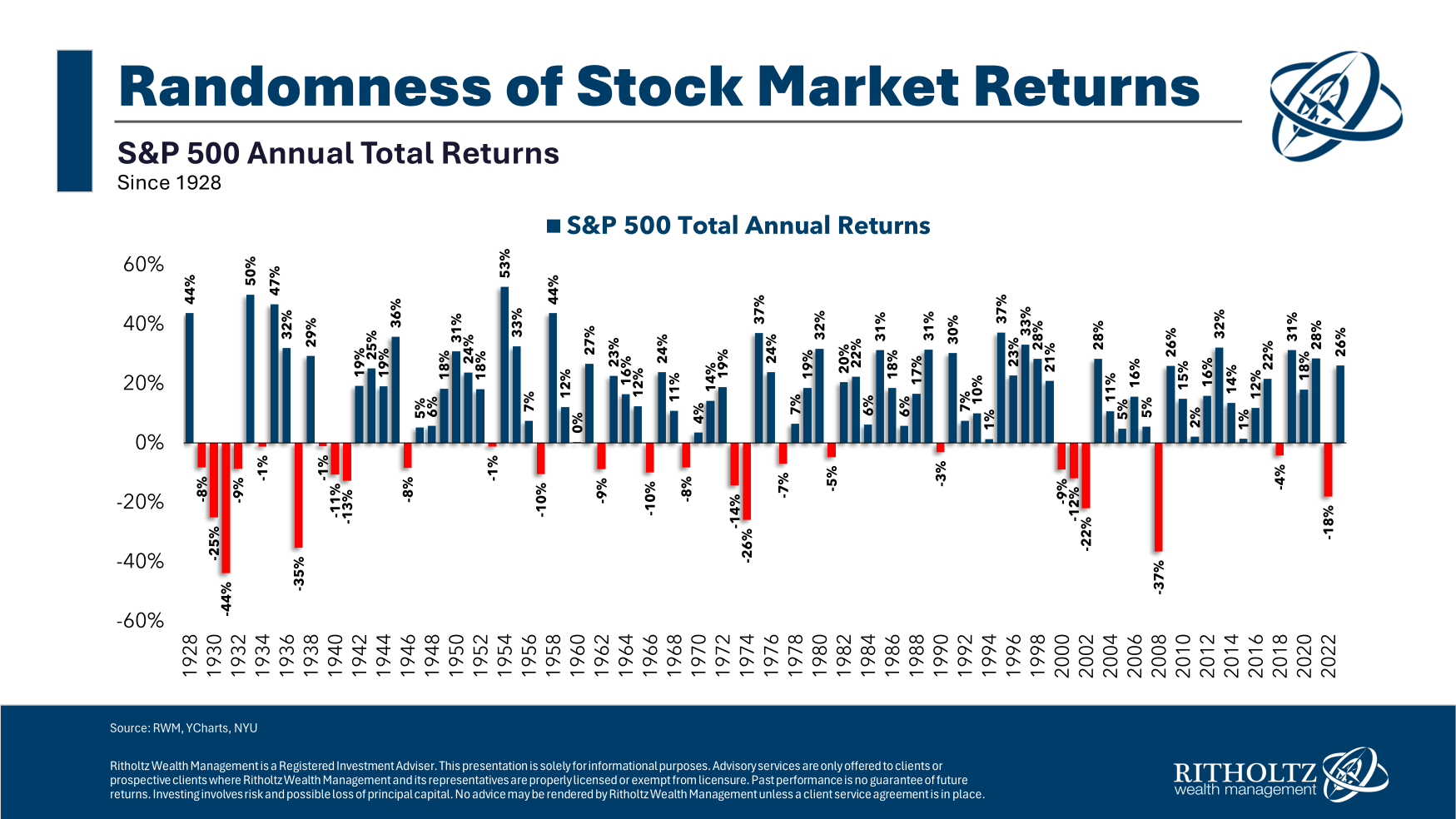

Next, let’s look at the revenue by year.

2019: +31%

2020: +21%

2021: +26%

2022: -20%

2023: +26%

2024: +11%

The 2022 bear market was painful, but given the strength of the market since then, it seems like a distant memory.

Since the beginning of 2019, the U.S. stock market is up more than 16% annually.

Looking at these numbers, it seems like it’s time for some bad profits or at least a pause in activity.

There are cycles in the market. The bad tends to follow the good and vice versa…eventually.

You can’t expect good times to last forever, but you can’t set your clock on these things. The stock market is random, especially in the short term. Let’s take a look at the S&P 500’s calendar year returns since 1928.

They are all over the map.

You can’t predict what will happen next based on what just happened. Investing would be easier if that were the case, but it isn’t.

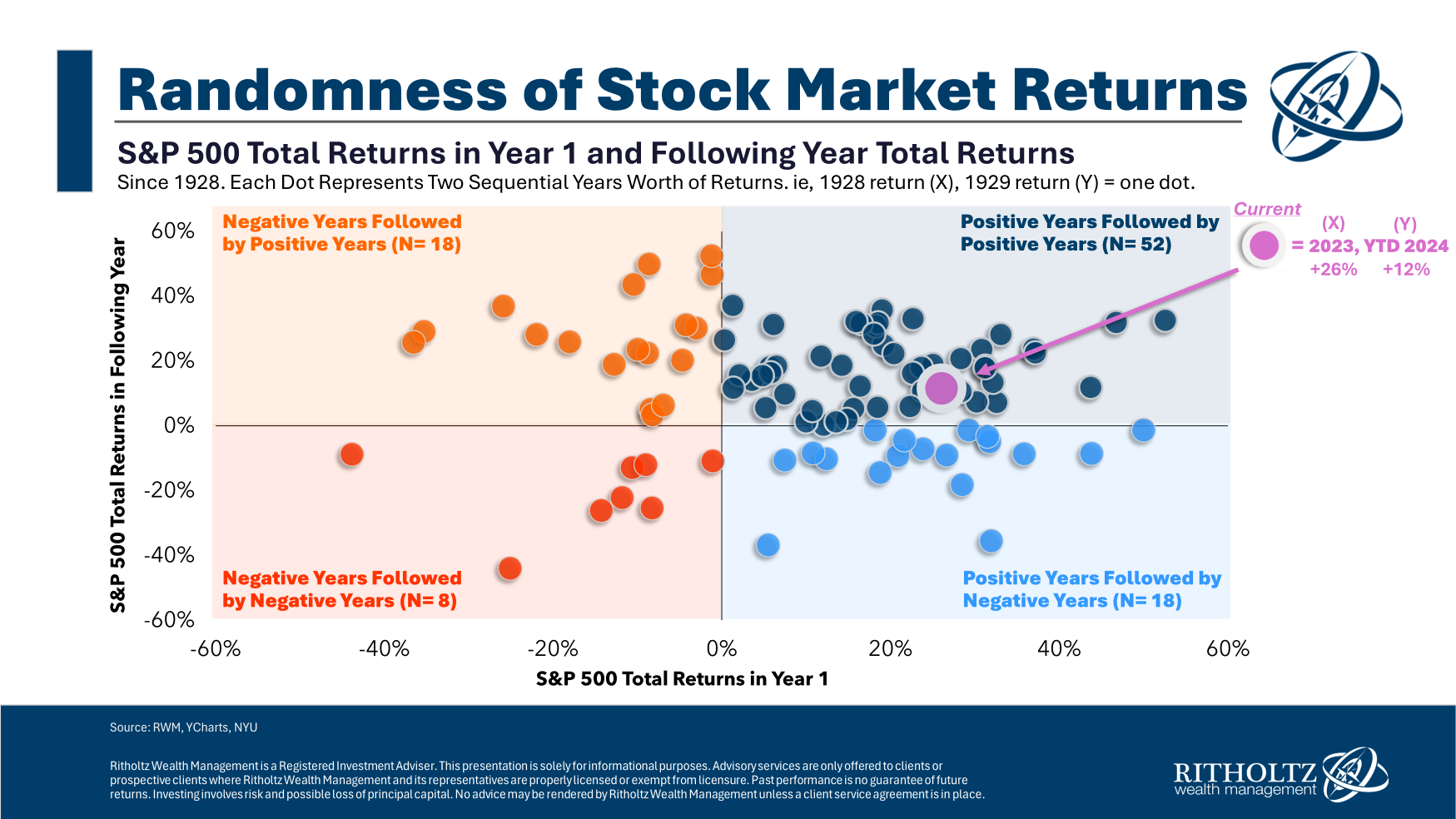

Just because you get five tails in a row, there is no longer a chance that the coin will turn up heads. Even if the roulette wheel is red 10 times in a row for him, it doesn’t make the next black more likely than usual.

The gambler’s fallacy is the belief that random events are more or less likely to occur due to the outcome of previous events.

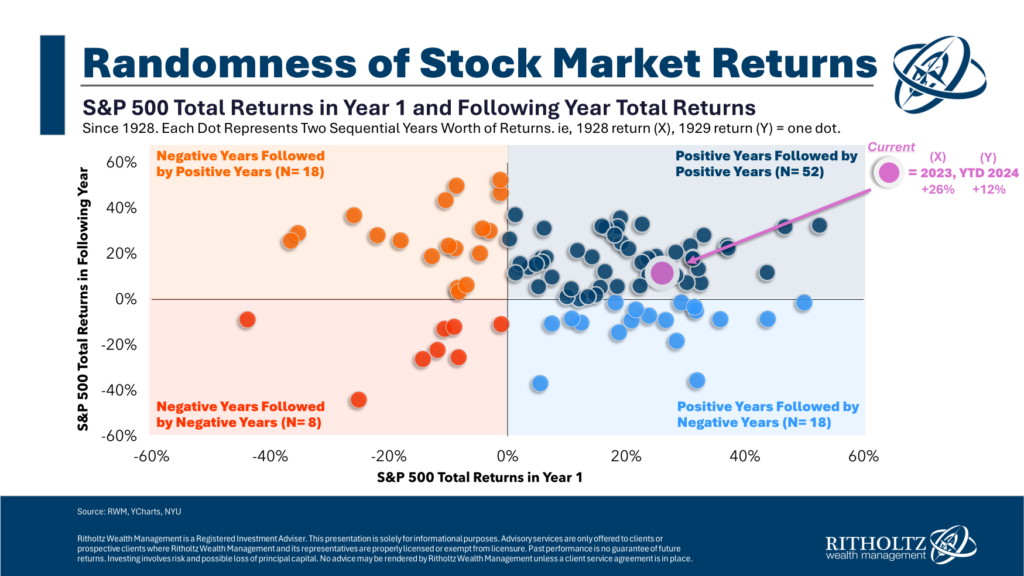

Let’s see how this plays out in the stock market.

There is no real predictive power based on what has happened before.

A good year can lead to a bad year. A bad year can lead to a good year. Sometimes a good year leads to a better year. A bad year can lead to a bad year.

Mean reversion can be a powerful force in the stock market.

However, in the short term, market returns are still fairly random.

Michael and I talked about stock market performance in recent years and more in this week’s Animal Spirits video.

Subscribe to The Compound and never miss an episode.

References:

30 years of financial market returns

Well, here’s what I’ve read recently:

Books:

1I’m using the Vanguard Total U.S. Equity Mallet ETF (VTI).

This content, including security-related opinions and information, is provided for informational purposes only and should not be relied upon in any way as professional advice or as a recommendation of practices, products, or services. There are no guarantees or warranties that the views expressed herein will apply to any particular facts or circumstances, and they should not be relied upon in any way. You should consult your own advisor regarding legal, business, tax, and other related matters regarding investments.

Comments in this Post (including associated blogs, podcasts, videos, and social media) reflect the personal opinions, perspectives, and analysis of the Ritholtz Wealth Management employee who provided the comments; They should not be interpreted as the views of Ritholtz Wealth. As a description of the performance returns of clients of Management LLC or its affiliates or of advisory services provided by Ritholtz Wealth Management or Ritholtz Wealth Management Investments.

References to securities, digital assets, or performance data are for illustrative purposes only and do not constitute an investment recommendation or the provision of investment advisory services. Charts and graphs provided herein are for informational purposes only and should not be relied upon when making investment decisions. Past performance is not indicative of future results. Content speaks only as of the date indicated. The forecasts, estimates, forecasts, objectives, prospects and/or opinions expressed in these materials are subject to change without notice and may differ from or be contrary to opinions expressed by others. .

Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payments from various entities for associated podcast, blog, and email advertising. The inclusion of such advertisements does not constitute or imply endorsement, sponsorship, or recommendation of such advertisements by, or any affiliation with, the content creator, Ritholtz Wealth Management, or their employees. Investing in securities involves risk of loss. For additional advertising disclaimers, see: https://www.ritholtzwealth.com/advertising-disclaimers

Please see our disclosure here.