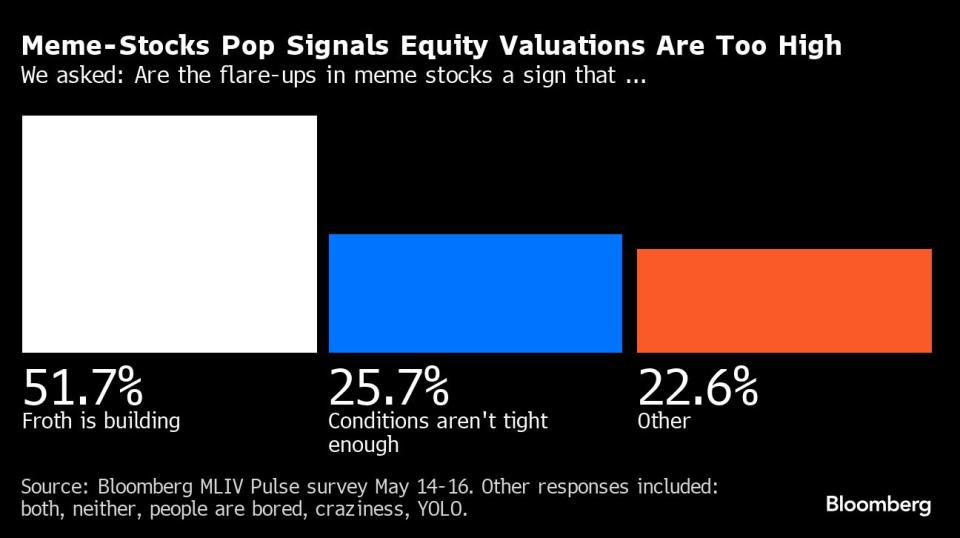

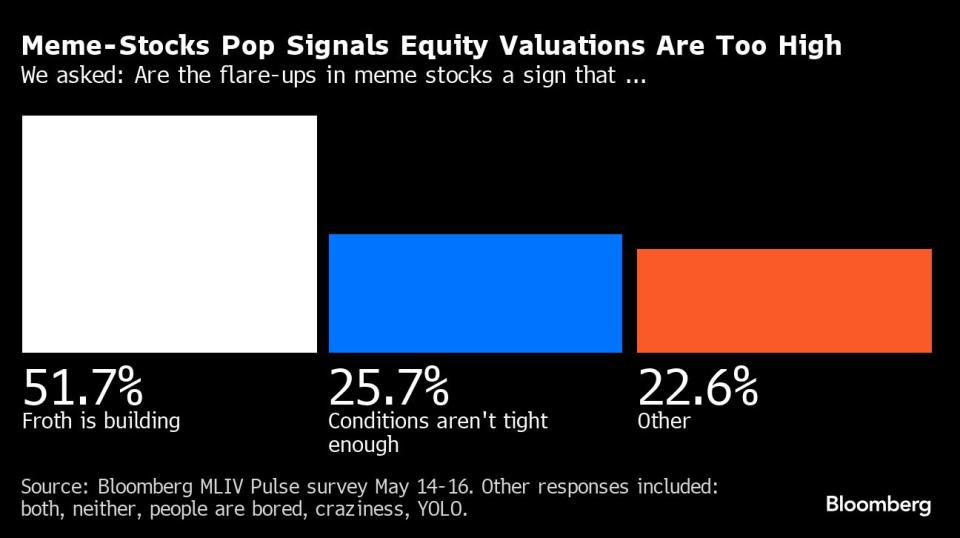

(Bloomberg) — The popularity of meme stocks this week suggests the U.S. stock market is frothy and could potentially peak, according to the latest Bloomberg Markets Live Pulse survey.

Most Read Articles on Bloomberg

GameStop Inc. and AMC Entertainment Holdings Inc., two darlings of meme stock mania in 2021, saw their stock prices soar after comments from retail icon Keith Gill, nicknamed “Roaring Kitty.” , and then plummeted. GameStop soared nearly 180% on Monday and Tuesday, and AMC soared 135%, but both companies sold off on Wednesday and Thursday, cutting their gains by more than half.

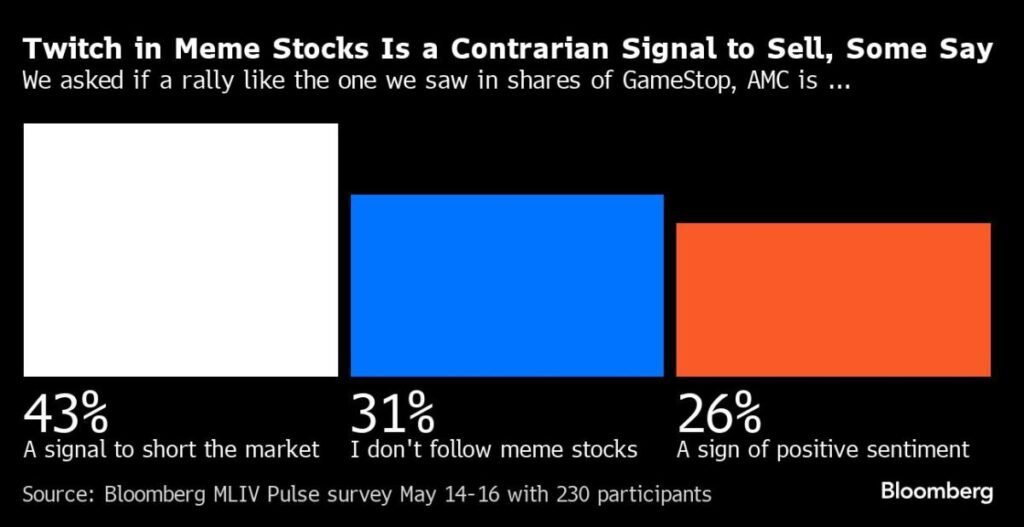

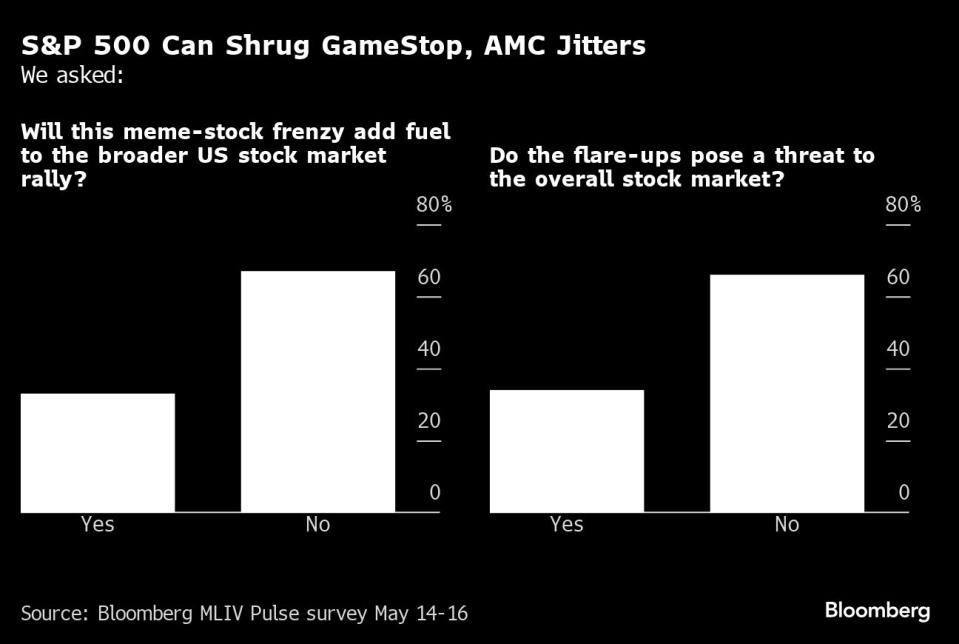

The wild price action reignited memories of the meme stock frenzy just a few years ago, but many of the 230 respondents to the MLIV Pulse poll were skeptical that this was a positive sign for the overall stock market. As the S&P 500 and Nasdaq 100 hit record highs this week, more than 40% of those surveyed said they saw the GameStop and AMC trades as a sign of unwarranted euphoria and a potential reason for a selloff. There is. GameStop fell about 25% in early Friday trading.

“We wouldn’t have seen this kind of rally in meme stocks if stocks weren’t already somewhat buoyant,” Steve Sosnick, chief strategist at Interactive Brokers LLC, said by phone.

The MLIV Pulse survey found that 43% of participants believe the surge in meme stocks is a contrarian warning for the future of the market. About a quarter see this as a positive sign for the stock. Meanwhile, 66% of respondents said there was no real threat to the overall stock market.

The recent surge in meme stocks is a fraction of the boom in 2021. At the time, retail traders banded together to fuel massive stock price increases by inflating the prices of the companies Wall Street was betting on. The behavior, born out of lockdown boredom, commission-free brokers and social media chat rooms, took weeks for investors and Wall Street professionals to catch on. One similarity is that multiple poll respondents cited bored investors as the reason for the recent moves.

The main reason stocks are rising now is that a resilient U.S. economy with strong consumer spending and falling inflation is driving growth and strengthening the outlook for U.S. businesses.

Federal Reserve policymakers have said they plan to keep borrowing costs high for an extended period of time to keep prices in check. And this strength of the economy gives policymakers little reason to rush to cut interest rates.

“If the Fed waits too long to cut rates, it could lead to a weak economy and pressure on stock prices,” said Stephanie Lang, chief investment officer at Omrich Berg. “That said, meme stocks are correcting quickly, which is a healthy sign for the market. Valuations are high, but they could remain that way for a very long time while stocks continue to rise.”

Investor confidence is rising, but certain sectors of the market suggest confidence is not yet overextended. Leveraged long ETFs (which use derivatives to amplify daily index returns) aren’t seeing the same enthusiasm they had during the meme stock craze of 2021, according to Bloomberg Intelligence ETF analyst Athanasios Psarofagis. That’s what it means.

Another big difference between this latest move in meme stocks and the 2021 mania is that this time it was driven by sophisticated traders rather than retail investors. At Interactive Brokers, GameStop was the stock with the most active customer orders over the five trading sessions through Wednesday, while AMC was No. 17, Sosnick said.

Additionally, while buying interest in GameStop turned into net buying, selling interest in the options market also turned into net buying, which goes beyond mere speculation and suggests covered call writing or other risk management strategies by investors. Sosnick added.

That’s why hedge fund Telemetry founder Thomas Thornton is shorting the SPDR S&P Retail ETF (XRT). GameStop is the fund’s biggest rated target, and debt-ridden online auto retailer Carvana Inc. (another meme favorite) is its second largest.

“It’s too risky to try to short some of these meme stocks,” Thornton said. “God knows if Roaring Kitty will keep tweeting. I don’t need that kind of stress in my life.”

The MLIV Pulse survey is conducted for Bloomberg readers on their devices and online by Bloomberg’s Market Live team. Sign up here to receive future surveys.

(Adds graph of impact on S&P 500, link to full results)

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP