Indian Stock Market: Domestic stock market indices Sensex and Nifty 50 are expected to open lower on Monday following weak readings from global peers.

Asian markets fell on key economic data from China and reports that US President Joe Biden plans to raise tariffs on some products from the world’s second-largest economy.

This week, investors will be looking at key stock market trends, including ongoing fourth-quarter results, Indian retail inflation data, domestic and international macroeconomic data, foreign capital flow trends, oil prices, and other global market indicators. We will look at the factors.

Read here: What’s in store this week: Inflation data, Q4 results, FII activity, and global clues to this week’s key market triggers

India’s stock market benchmark index ended higher on Friday, but each fell more than 2% for the week as broad markets saw heavy selling.

The Sensex rose 260.30 points or 0.36% to close at 72,664.47, while the Nifty 50 rose 97.70 points or 0.44% to close at 22,055.20.

“Heavy selling in FIIs and concerns over the outcome of the ongoing general elections have increased pressure across the market. Earnings season is gathering pace, with a number of important earnings leading to stock-specific moves. The fourth phase of the Lok Sabha elections, which is underway today, can and will lead to further instability. Overall, markets are more broadly consolidated and the fourth quarter results globally. We expect to take cues from the news flow surrounding the general elections,” said Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services.

Here are the key clues for Sensex domestic and global markets today.

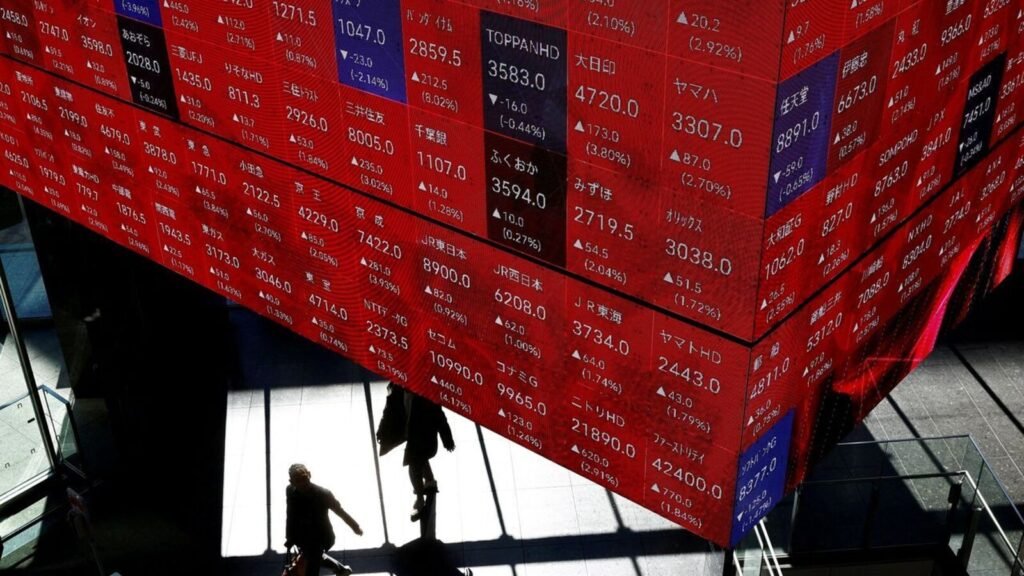

asian market

Asian markets fell on Monday as investors assessed China’s inflation statistics and focused on other key economic indicators in the region.

Japan’s Nikkei Stock Average fell 0.32%, and TOPIX fell 0.46%. South Korea’s Kospi rose 0.29%, while the Kosdaq fell slightly. Hong Kong’s Hang Seng Index futures showed a weak start.

Also read: “Markets are hoping for a positive conclusion to the election.”

Give a thoughtful gift today

Gift Nifty is trading around 22,095 levels, at a discount of nearly 45 points from the previous closing price of Nifty futures, indicating a negative start for the Indian stock market index.

wall street

U.S. stock markets ended mixed on Friday, with all three indexes posting weekly gains as investors took cues from comments from Federal Reserve officials.

The Dow Jones Industrial Average rose 125.08 points, or 0.32%, to 39,512.84, and the S&P 500 rose 8.6 points, or 0.16%, to 5,222.68. The Nasdaq Composite Index fell 5.40 points (0.03%) to 16,340.87.

Among stocks, Nvidia stock rose 1.3%, and SoundHound AI stock rose 7.2%. Novavax shares rose 98.7% after the deal with Sanofi was worth up to $1.2 billion.

Also read: The week ahead on Wall Street: Investors focus on inflation, retail sales data, Walmart earnings

US consumer sentiment

US consumer sentiment fell to a six-month low in May. The University of Michigan’s Consumer Sentiment Index for this month was 67.4, the lowest level since November of last year, compared to April’s final reading of 77.2. The preliminary forecast of economists compiled by Reuters was 76.0.

US Fed officials

Atlanta Fed President Rafael Bostic acknowledged recent signs that the economy is slowing, but added that the timing of any rate cuts remains uncertain. Dallas Fed President Laurie Logan said it was unclear whether monetary policy was tight enough to bring inflation down to the central bank’s 2% goal.

inflation in china

China’s consumer prices rose for the third consecutive month in April, but the decline in producer prices widened. Consumer prices were expected to rise 0.3% in April compared to the same month last year, 0.1% in March, and 0.2% in a Reuters poll. Overall, the consumer price index (CPI) rose 0.1% from the previous month, exceeding the survey’s forecast for a 0.1% decline and reversing the 1% decline seen in March.

The producer price index (PPI) in April fell 2.5% from the same month last year, slowing down from the 2.8% decline in the previous month, but the decline widened for the first time in a year and a half.

India IIP

India’s factory production slowed in March as Index of Industrial Production (IIP) growth fell to 4.9% in March from 5.7% in February, government data showed.

Read here: Slowdown in factory production in March won’t dampen momentum for the year

crude oil price

Oil prices fell after Iraq said it would not agree to further production cuts at the next OPEC meeting.

Brent crude oil fell 0.33% to $82.52 per barrel, while U.S. West Texas Intermediate (WTI) crude oil futures fell 0.31% to $78.02 per barrel.

Disclaimer: The views and recommendations expressed above are those of individual analysts or brokerages and not of Mint. We recommend checking with a certified professional before making any investment decisions.

Unlock a world of benefits! From insightful newsletters to real-time inventory tracking, breaking news and personalized newsfeeds, it’s all here, just a click away. Log in here!