This week has seen a lot of headline earnings reports from some of our companies like Fiverr and travel companies like Airbnb (non-investment), while Starbucks and Dutch Bros (big!) There were also disagreements between the two.

I also applied for unemployment insurance. Although this is a single date and a historically volatile period, we believe this may be an early sign of a cooling job market. This supports our view that as economic activity moderates, the Fed could be cleared to cut rates completely by the third quarter. Now let’s move on to the data!

summary:

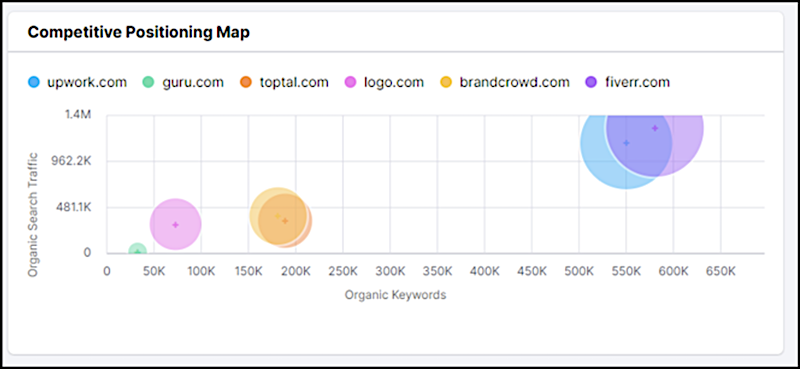

Fiverr takes the lead in organic traffic / Increases and increases revenue

Shopify suggests consumers balance strong/growth and profits

Airbnb prices are down, profits are up/good sign for inflation

Fiverr continues to run. Beat and Raise featured with best-in-class traffic

Fiverr reported earnings this week, beating plans for both revenue and bottom line, while also raising its full-year outlook. The amount spent per buyer increased by 8%, indicating that efforts are being made to move towards higher value buyers. They were very focused on AI and how their platform is well suited to capture some of the opportunities within AI.

One of the data points they shared was that there are now over 10,000 professionals on the platform and that AI transactions on the platform have increased by 95% year over year. He’s also built AI into his product with his search product Fiverr Neo, which has led to 3x more conversions for him live. We will know more about this after speaking with management on Monday.

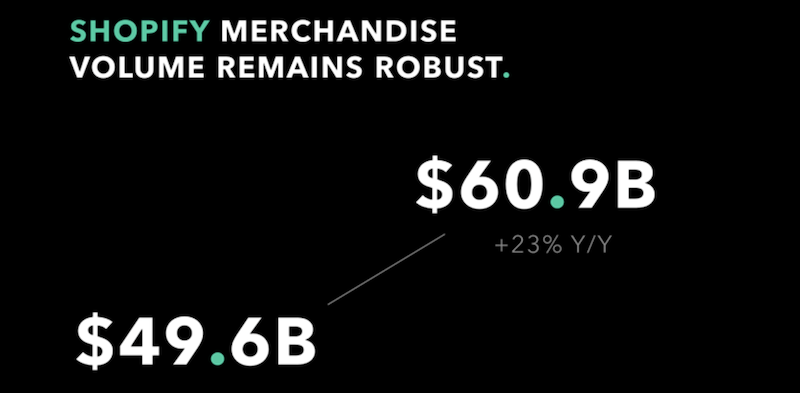

Shopify a Bellwether for Consumer continues to grow +20%.

Shopify also reports revenue, and with hundreds of billions of dollars in product value flowing through its platform each year, it’s a measure of spending habits. Management on the call signaled that consumers remain resilient. This is reflected in his total circulation reaching $60.9 billion from his $49.6 billion, a growth of 23%.

The company continues to expand internationally, expanding into brick-and-mortar stores. So, while it does not provide a complete picture of online and offline consumers, it is clear that online commerce continues to take place.

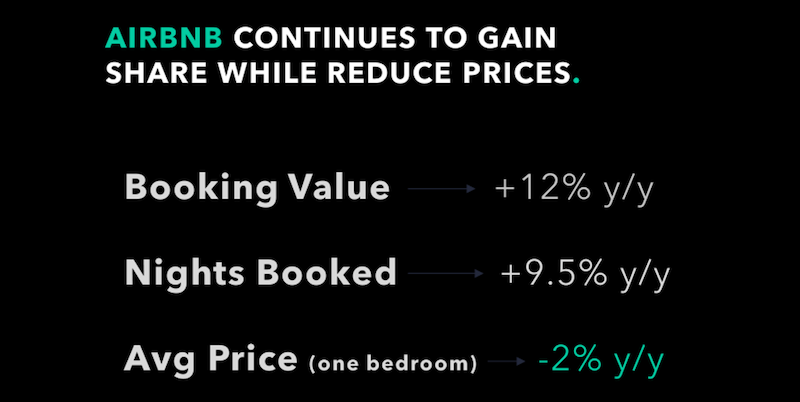

Airbnb’s strong report, falling average prices are a good sign for inflation

Last but not least is Airbnb, which announced its earnings this week. Although the company continues to do well, the data extracted here is actually closer to the price per stay. Bookings increased by more than 10%, and the number of nights booked also increased by 10%, but the average price for a one-bedroom stay fell by 2% (as noted in the earnings call).

So while this shows that consumers remain resilient and continue to spend, it also shows that inflationary pressures within the service economy are easing.

twitter: @_SeanDavid

The author and/or his company has positions in the companies and underlying securities mentioned at the time of publication. All opinions expressed here are those of the author and do not in any way represent the views or opinions of any other person or entity.