key insights

-

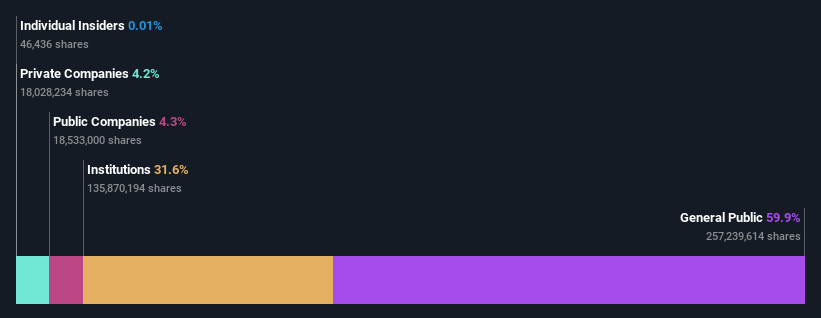

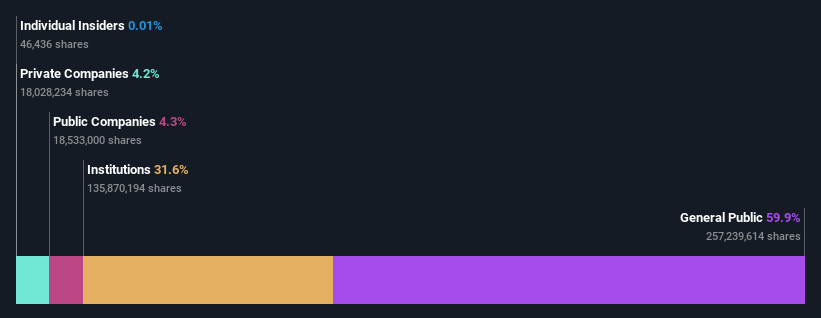

The significant ownership of Sandoz Group by retail investors indicates that they collectively have a greater say in management and business strategy.

-

A total of 25 investors hold a majority stake in the company, with an ownership of 37%.

-

32% of Sandoz Group is owned by institutional investors

Every investor in Sandoz Group AG (VTX:SDZ) should be aware of the most powerful shareholder groups. The group that owns the most shares in the company (about 60% to be exact) is individual investors. That is, if the stock price rises, the group will gain the most (or if the stock price falls, it will suffer the maximum loss).

Retail investors benefited the most from last week’s CHF666 million market capitalization rise, but institutional investors also accounted for 32% of the gains.

Let’s delve deeper into each type of owner at Sand Group, starting from the image below.

Check out our latest analysis for Sandoz Group.

What does institutional ownership tell us about Sandoz Group?

Institutions typically measure a stock against a benchmark when reporting to their own investors, so enthusiasm for a stock often increases once it’s included in a major index. We would expect most companies to have some institutions on their register, especially if they are growing.

Sandoz Group already has a share registry. In fact, they own a significant stake in the company. This suggests some credibility among professional investors. But we can’t rely on that fact alone because institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there’s always a risk that they are in a ‘crowded trade’. If such a trade goes wrong, multiple parties may compete to sell stock quickly. This risk is higher for companies without a history of growth. You can see Sandoz Group’s historic earnings and revenue below, but keep in mind there’s always more to the story.

Hedge funds don’t have many shares in Sandoz Group. UBS Asset Management AG is currently the company’s largest shareholder with 6.4% of outstanding shares. On the other hand, the second and third largest shareholders hold about 6.1% of the stock and his own 4.3%.

A closer look at our ownership data reveals that the top 25 shareholders collectively own less than half of the register, with a large number of smaller shareholders with no single shareholder in the majority. This suggests that it is a group of people.

Researching institutional ownership is a good way to assess and filter a stock’s expected performance. The same can be done by studying analyst sentiment. There are plenty of analysts covering the stock, so it might be worth seeing what they are predicting.

Sandoz Group Insider Ownership

The precise definition of an insider can be subjective, but almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be members of the board of directors. Especially if the manager is the founder or CEO.

I generally consider insider ownership to be a good thing. In some cases, however, it may be more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that Sandoz Group AG insiders own less than 1% of the company. However, they may have an indirect stake through a corporate structure that we do not address. It’s quite large, so we wouldn’t expect insiders to own a large percentage of the shares. They own a total of CHF 1.5 million in shares. Perhaps it’s important to consider recent buys and sells as well. You can click here to see if insiders have been buying or selling.

Open to the public

The general public, mostly retail investors, owns 60% of Sandoz Group’s shares. This level of ownership gives retail investors a degree of power to influence important policy decisions such as board composition, executive compensation, and dividend payout ratios.

Private company ownership

Our data shows that Private companies own 4.2% of the company’s shares. Private companies may qualify as related parties. Insiders may have an interest in a public company through ownership in a private company rather than in their individual capacity. Although it is difficult to draw broad conclusions, it is worth noting as an area with room for further research.

Public company ownership

Listed companies currently own 4.3% of Sandoz Group’s shares. We can’t be sure, but it’s very possible that this is a strategic interest. Businesses may be similar or aligned.

Next steps:

It’s always worth thinking about the different groups who own shares in a company. However, to understand Sand Group better, you need to consider many other factors. For example, consider the ever-present fear of investment risk. We’ve identified 1 warning sign If you are considering partnering with Sandoz Group, understanding them should be part of your investment process.

after all the future is most important.You can access this free A report on analyst forecasts for a company.

Note: The numbers in this article are calculated using data from the previous 12 months and refer to the 12-month period ending on the last day of the month in which the financial statements are dated. This may not match the full year annual report figures.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.