John M Lund Photography Inc/DigitalVision (via Getty Images)

overview

When investing in business development companies, I tend to focus on how sustainable the high yields are. At the end of the day, I prioritize adding BDCs, so high yields are the main attraction. Added income to my portfolio. I came across SLR Investment Corporation (NASDAQ:SLRC) Last weekend I wanted to see if it met my criteria. To be considered for BDC, you must meet the following criteria:

- Diversified investment portfolio across various sectors.

- The creditworthiness of the portfolio is high.

- Net investment income must consistently exceed distributions by a sufficient margin.

- Increase in net asset value.

- Transparent reporting, both good and bad.

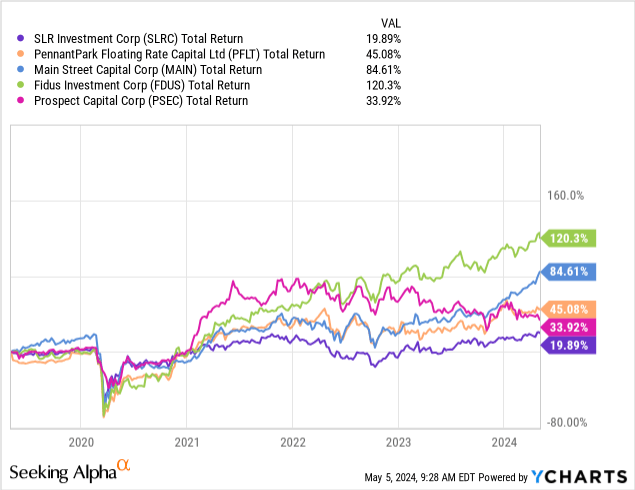

With these things in mind, let’s also take a look at SLRC’s total return performance when compared to some of its competitors.I understand that SLRC is a PennantPark Floating Rate Capital (PFLT), Main Street Capital (major), Fidus Investment Corporation (FDUS), and Prospect Capital (PSEC). I find it very strange that Prospect Capital has the worst price performance among these peers, yet still manages to outperform SLRC. This was the first thing that raised a red flag in my mind, but let’s look a little deeper and let him give SLRC a fair chance before we get into speculation.

For context, SLRC operates as a business development firm focused on investing in companies with EBITDA in the $15 million to $100 million range, making it a middle market focused BDC. SLRC is a little different in that although it is technically classified as an externally managed closed-end fund, it has chosen to be classified as a BDC.

Portfolio and strategy

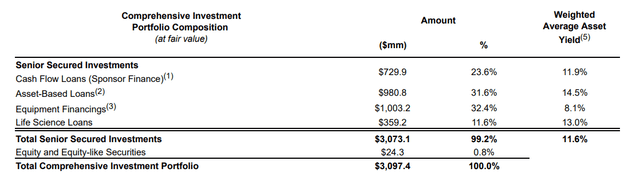

SLRC’s strategy is to invest in senior secured loans of these middle market companies. Their main objective is to generate profits from these investments and distribute them to shareholders. They accomplish this by investing in four different senior secured investment types: cash flow loans, asset-based loans, equipment loans, and life science loans. A look at the company’s latest portfolio composition shows that equipment financing is a large part of the portfolio. Asset-based loans make up his second largest portion of the portfolio at 31.6%, and his weighted average yield is the highest at 14.5%.

SLRC Q4 Report

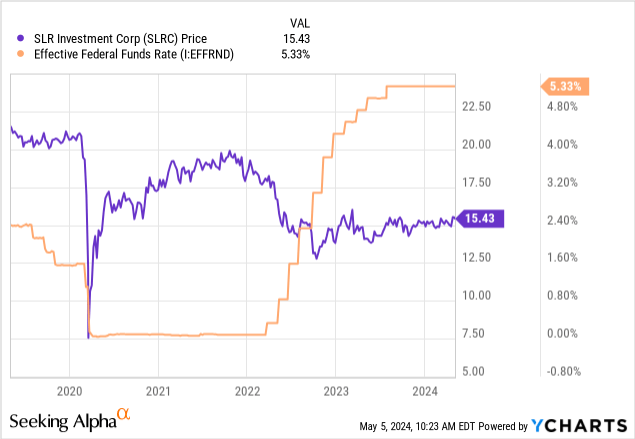

Additionally, the portfolio has exposure to over 110 different industries and holds approximately 790 unique issuers. This results in an average overall portfolio exposure of just 0.1%, or $3.9 million, per issuer. Therefore, SLRC is checked for portfolio diversity. Additionally, the portfolio consists mostly of variable rate loans, which stood at approximately 65.3% as of last quarter. This allowed SLRC to benefit from his rapidly rising interest rate environment starting in 2022. You can see how the price of SLRC rose when interest rates were reduced to near zero levels.

Conversely, the price of SLRC fell and stabilized from 2022 when interest rates rose. This may have slowed price growth, but NII (net investment income) rose. This is because floating rate portfolios were able to effectively draw down higher levels of funds. Interest income earned from an investment.

Finally, more than 97% of the company’s portfolio is in first lien senior secured loans, which is excellent from a risk management perspective. Senior secured loans sit at the top of a company’s capital structure, meaning they have the highest priority in terms of repayment. This means that if a portfolio company defaults or goes into liquidation, SLRC’s debt is at the top of the list for repayment, providing additional security.

Financials – Revenue Forecast

SLRC is scheduled to announce its first quarter results after the market closes on May 8th. Looking at the last Q4 earnings reported in February, we thought it would be another strong quarter for SLRC, so we wanted to provide some earnings forecasts. NII’s stock price was reported at $0.44 per share, with total investment income increasing 0.3% year over year. NII also increased by 7.3% year-on-year due to higher interest rates.

As previously mentioned, the rising interest rate environment increased SLRC’s net investment income. Interest rates started rising around his second quarter of 2022, and you can see in the history below that this is impacting SLRC’s earnings. The last Fed meeting confirmed that interest rates will remain at 20-year highs for an extended period of time due to high inflation and a strong job market. To make the most of this environment, it would be an ideal time to join a BDC, which consists mostly of variable rate loans.

In search of alpha

We fully expect SLRC to continue to draw high NII, at least above $0.42, with interest rates rising over time. With the highest level of loan originations ever recorded by SLRC, I expect NII to report soon-to-be-reported first quarter earnings in the range of $0.43 to $0.45 per share.

Originations in 2023 reached record levels and contributed to a modest increase in NAV, up to $18.09 per share. During the fourth quarter, the company invested approximately $450 million to continue expanding its portfolio in this favorable environment. I fully expect 2024 guidance to be even higher due to the higher investment levels last year.

This is encouraging to see management taking advantage of the high interest rate environment and continuing to grow the portfolio. Additionally, the company’s current net debt-equity ratio is 1.19x, which falls within the company’s target range of 0.9x to 1.25x. SLRC’s liquidity profile is strong, with $613 million raised against total commitments of $860 million.

Dividend and valuation

Based on the recently announced quarterly dividend of $0.41 per share, the current dividend yield is 10.6%. As mentioned earlier, his NII for the quarter was reported at $0.44 per share. This equates to a dividend coverage of around 107%, which in my opinion is not a large enough margin to give confidence in long-term coverage. The result is a significant lack of dividend increases or additional dividend increases, which is strange given this favorable environment.

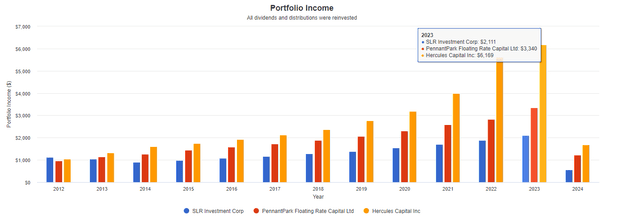

While there is nothing inherently wrong with not increasing distributions or providing supplemental compensation to shareholders, this makes SLRC more income-focused compared to other peer BDCs that offer these. It is true that the attractiveness as an investment has decreased a little. Portfolio Visualizer allows you to see how SLRC’s revenue growth compares to his BDC peers, Hercules Capital (HTGC) and PennantPark Floating Rate Capital (PFLT).

portfolio visualizer

This comparison assumes an initial investment of $10,000 in 2012 and no additional capital introduced. However, during this time the dividends were reinvested. In 2012, we see that SLRC’s dividend income was higher than its peers, amounting to $1,131 per year, compared to $1,040 for HTGC and $956 for PFLT. Fast forward to 2023 and we see SLRC’s dividend income being siphoned off by these peers.

Total dividend income in 2023

- SLRC: $2,111

- PFLT: $3,340

- HTC: $6,169

Final position balance – 2024

- SLRC: $21,540

- PFLT: $34,497

- HTGC: $68,723

Although both of these BDCs offer similar dividend yield profiles, we find that HTGC and PFLT utilize capital better and reward shareholders with higher levels of dividend income and better total returns . These totals calculate all raises and supplements distributed. Some may argue, “Why worry about dividend growth when the yield is already high?” But at the same time, why settle for declining dividend income in what should be a very favorable environment for SLRC? As a result of this data, SLRC is my personal choice to consider as part of my portfolio. does not meet the standards.

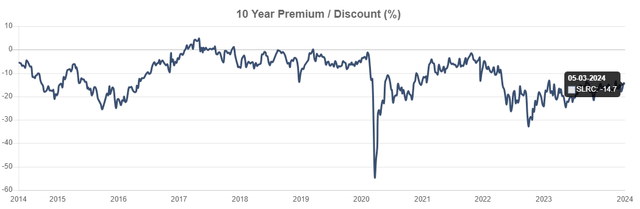

From a valuation perspective, SLRC has consistently traded at a discount to its NAV (net asset value) over the past decade. At the moment, the price is trading at a higher discount to his NAV than it was before the 2020 pandemic. The current discount rate is -14.7%. For reference, the price has traded at an average discount to NAV of -15.09% over the past three years.

CEF data

Although the current discount to NAV is higher than the 3-year average, I think this is a good entry point if you want to hold SLRC. As mentioned above, judging by the latest Fed meeting, it doesn’t seem like a rate cut will happen in the near future. This means that conditions are likely to continue to become more favorable for SLRC, and its net investment income should continue to grow.

As a result of this, we will eventually see the discount narrow as NAV rises and prices rise. For reference, before the initial decline due to the pandemic, SLRC’s price range was between $18 and $20 per share. As market conditions remain favorable, SLRC’s new investments could contribute to future growth to bring prices back to that level.

risk profile

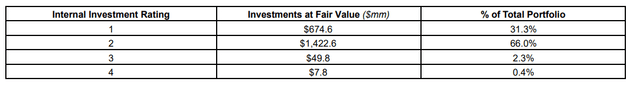

In terms of reporting transparency, in my opinion the SLRC provides a clear rating system for investments, which is why it is checked here as well. The company evaluates the creditworthiness of its portfolio companies using a numbered rating system from 1 to 4. A rating of 1 is the highest quality, assuming the portfolio company is exceeding expectations and repaying its debt successfully. A rating of 4 is the worst, meaning that the portfolio company is probably underperforming significantly and cannot expect full repayment.

SLRC Q4 Report

We can see that the majority of their portfolio, approximately 97% in total, is rated 1 and 2. This not only means that the company has a low backlog rate, but also provides peace of mind from a quality perspective. Accounts receivable are portfolio companies that are unable to service their debts and are no longer contributing to SLRC’s net investment income. As of our last earnings call, we received the following confirmation:

There were no new receivables during the quarter, and we remain satisfied with the credit quality of our portfolio. Non-accrual basis stop on December 31st [ph] were 0.6% and 0.4% based on fair value, still significantly below the BDC industry average. – Michael Gross, Chairman and Co-CEO

For reference, some of the unearned interest rates of the aforementioned companies in the same industry are shown below.

- PFLT: 0.1% of investment cost.

- HTGC: 1.2% of investment cost.

- PSEC: 0.2%

remove

SLR Investment Corp (SLRC) is taking advantage of an attractive interest rate environment to grow NII, but the lack of supplementation or dividend increases stands out to me. NII covers the distribution by a small margin of 107%, so it probably can’t provide much of an increase. We also expect the portfolio to continue to grow given our focus on new investments that are likely to contribute to rising NII levels as interest rates remain high. Portfolio quality is also diverse and accruals are still low, but ultimately I do not intend to initiate a position in SLRC as there are more attractive colleagues in my portfolio who are already public. That said, if you’ve already held for a long time, I don’t see any red flags that would advise you to sell. Therefore, I rate his SLRC a Hold for now.