While some quantum computing stocks offer promising opportunities, others should be approached with caution by investors. Not all companies are in a position to take advantage of technology’s potential. Overhyped stocks either lack the necessary fundamentals or face serious challenges to their business models, making these quantum computing stocks one to avoid.

We uncover the promising potential of undervalued quantum computing stocks and shine a light on stocks that may not live up to the hype. It must be emphasized that the quantum computing industry is in an early speculative stage. Many quantum systems remain theoretical, and there is insufficient evidence to suggest that their solutions will lead to commercial products.

Righetti Computing (RGTI)

righetti computing (NASDAQ:RGTI) specializes in superconducting qubits and has secured strategic collaborations to advance the technology. However, this is a risky bet as the company continues to burn cash as its business expands.

Throughout 2023, Righetti’s financial position reflected significant cash burn. This is a common challenge for companies in high-tech industries focused on expanding their operations. For example, by the end of the first quarter of 2023, Righetti reported that he had $26.1 million in cash and cash equivalents, which is down from his $57.9 million at the end of 2022. Masu.

Despite these concerns, RGTI has a strong balance sheet, but leaves much of the financial risk on investors, with 29% of shares outstanding at the time of writing.

For investors, a one-third reduction in ownership is rarely exciting. It can be said that RGTI had little choice. However, this is not a symptom of large-cap quantum computing stocks such as: microsoft (NASDAQ:MSFT) and other blue-chip companies.

With continued stock dilution expected, there may be better options than RGIT.

IBM

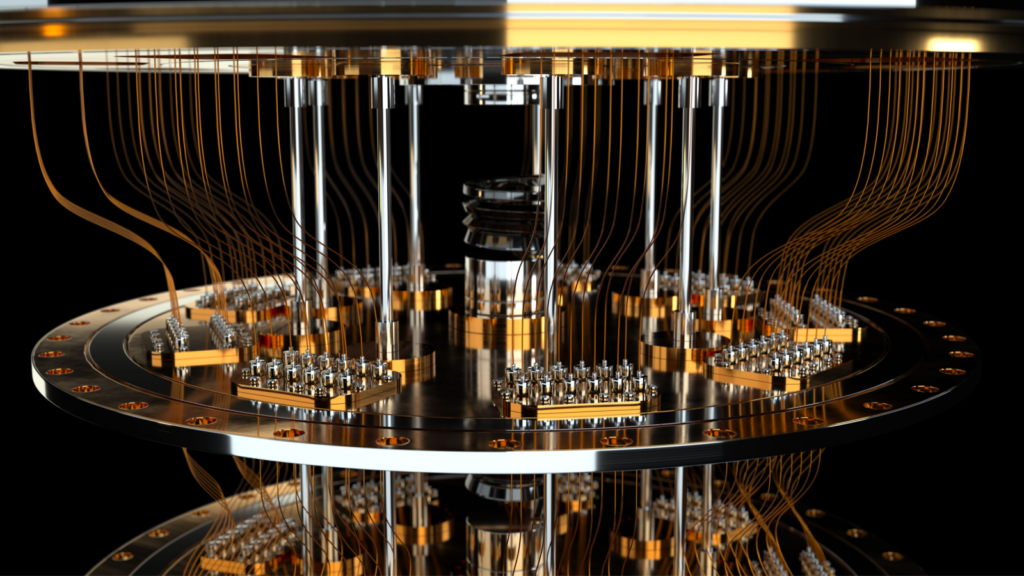

Source: shutterstock.com/LCV

IBM (New York Stock Exchange:IBM) has had a long-standing presence in the quantum computing space and has made significant investments in the technology. But the company’s overall growth has slowed, and its heavy investments in quantum computing have yet to yield commensurate financial returns.

I don’t like IBM for several reasons. Although the company is a tech stock, its share price growth rate over the past five years has been about 10% lower than that of some growth stocks such as MSFT. IBM is a Dividend Aristocrat, but its dividend growth rate has been declining since 2016. The dividend yield is 4%.

If income is your primary concern, there are alternative stocks that pay higher and lower valuations.

Aside from its weaknesses as a “jack of all trades,” its growth quest for quantum computing has been disappointing. The company has developed several high-capacity quantum processors, including the 127-qubit IBM Quantum Eagle and the 433-qubit IBM Osprey, making significant progress toward overcoming the limitations of classical computing. I am.

Although it’s still very early days for the industry, IBM’s investment has yet to show any promising returns, let alone actual returns.

In general, IBM is an odd stock in that it does not meet the needs common to most people’s portfolios and does not offer high immediate returns, dividend growth, or capital appreciation. However, its beta of 0.7 makes it a good choice if you’re looking for a low-volatility stock in the tech sector.

D-Wave System (QBTS)

Source: T. Schneider/Shutterstock

D-wave system (New York Stock Exchange:QBTS) focuses on a particular type of quantum computation: quantum annealing. While the company has secured high-profile partnerships and customers, its narrow focus on quantum annealing rather than more general quantum computing solutions may limit its market opportunities.

Focusing on this specific solution also carries concentration and execution risks. That’s because they can’t easily pivot to building general quantum computing systems without losing what differentiated them in the first place.

We have made great progress in this area. This is evident with the introduction of the Advantage2 system, which features a new qubit design aimed at reducing noise and improving performance.

Overall, the quantum computing industry is speculative and therefore poses risks for companies with a narrow focus or a pure focus on quantum computing. MSFT and alphabet (NASDAQ:googleNasdaq:Google) may be a better option as it gives you exposure to the quantum industry without putting all your eggs in the basket.

On the date of publication, Matthew Farley did not have (directly or indirectly) any positions in the securities mentioned in this article. Opinions expressed are those of the author and are subject to InvestorPlace.com Publishing Guidelines.