To justify the effort of picking individual stocks, it’s worth striving to beat returns from market index funds. But the main battle is finding enough winners to outweigh the losers. Therefore, there is no long-term liability. ENERGY RESOURCES OF AUSTRALIA LIMITED. (ASX:ERA) shareholders have questioned their ownership decisions and the share price has fallen 76% in 50 years. Furthermore, about a quarter of them have fallen by 17%. That’s not much fun for the holder.

So let’s take a look at whether the company’s long-term performance is in line with the progress of its underlying business.

See the latest analysis on Australia’s energy resources.

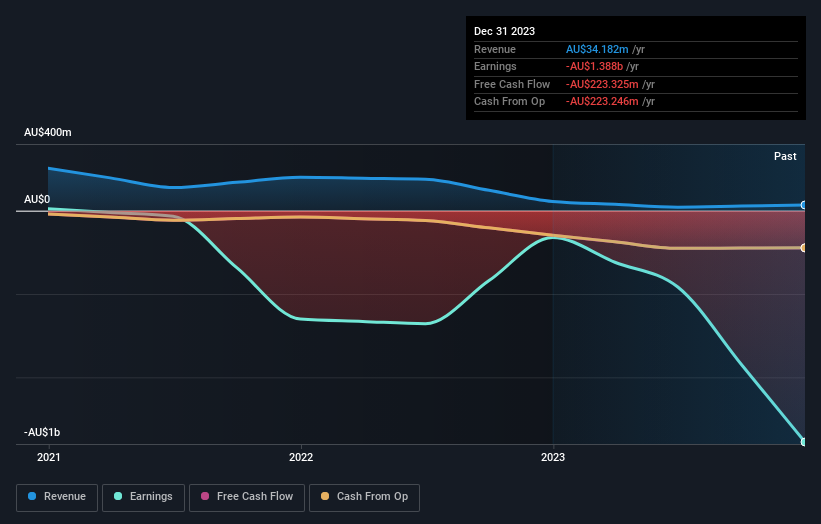

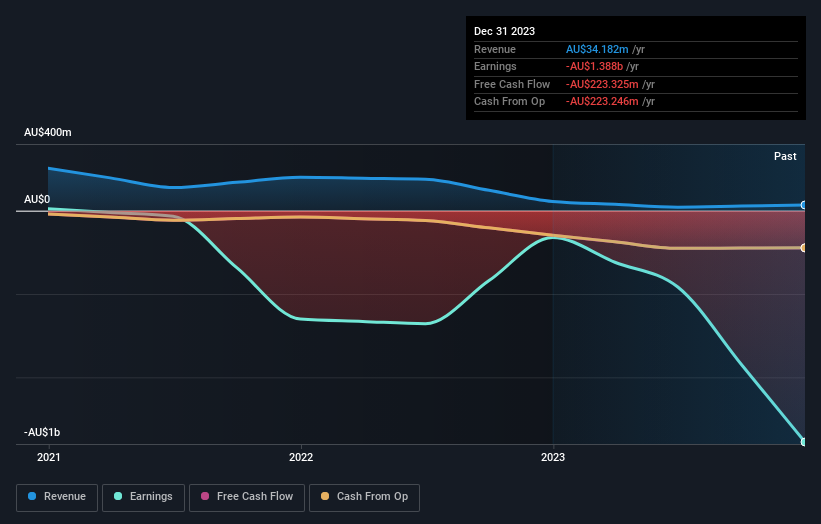

Considering that Energy Resources of Australia didn’t make a profit in the last twelve months, we’ll focus on its revenue growth to get a quick look at its business development. Shareholders of unprofitable companies typically want strong earnings growth. That’s because rapid growth in revenue can often be easily extrapolated to predict profits of considerable size.

Over the past five years, Energy Resources of Australia’s revenue has declined by 27% per year. It falls into the unappealing group, to say the least. So it’s not at all surprising to see the share price drop 12% per year over the same period. We do not believe this is a particularly promising situation. Ironically, that action could create opportunities for contrarian investors, but only if there is good reason to predict a brighter future.

You can see below how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We’re pleased to report that our CEO is paid more modestly than most CEOs at similarly capitalized companies. While it’s always worth keeping an eye on CEO pay, the more important question is whether the company will grow its earnings over the years.this free If you want to explore Australia’s Energy Resources further, our interactive report on Australia’s Energy Resources revenue, revenue and cash flow is a great place to start.

What about total shareholder return (TSR)?

We’ve already covered Energy Resources of Australia’s share price movement, but we should also mention its total shareholder return (TSR). The TSR seeks to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Energy Resources of Australia does not pay a dividend, but its TSR of 30% exceeds its share price return of -76%, suggesting it has either spun off a business or raised capital at a discount. thereby providing added value to shareholders.

different perspective

It’s good to see that Energy Resources of Australia returned a total shareholder return of 41% to shareholders over the last twelve months. This growth rate is better than the five-year annual TSR (5%). So sentiment around the company seems to be positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock to make sure you don’t miss out. It’s always interesting to track stock performance over the long term. However, many other factors need to be considered to better understand Australia’s energy resources.Case in point: we discovered 4 warning signs about Australia’s energy resources you should know.

of course Australian Energy Resources may not be the best stock to buy.So you might want to see this free A collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.