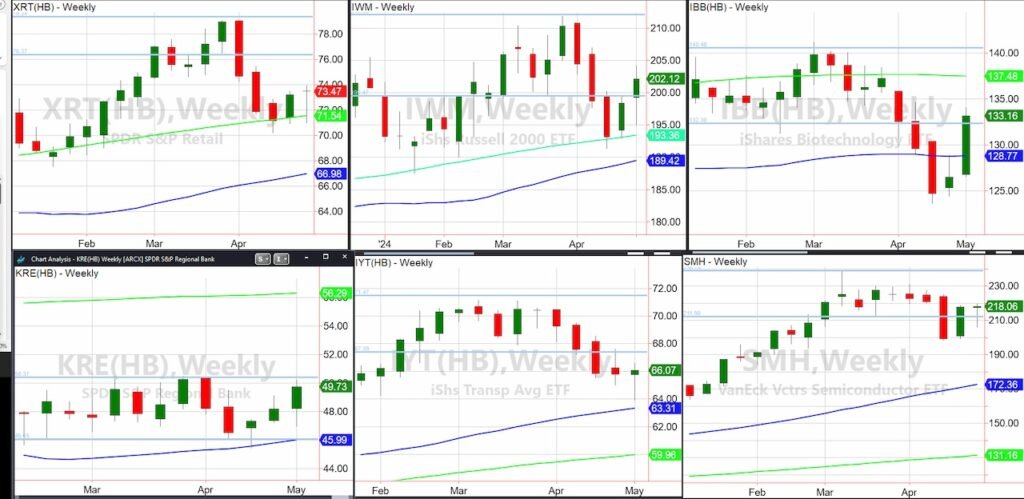

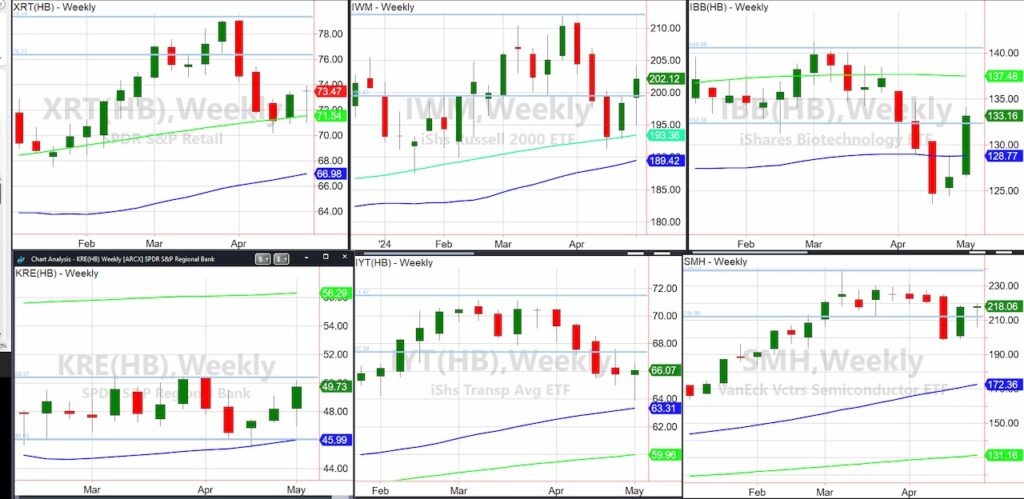

This is number 5th Back-to-back weekends, I covered the Economic Modern Family of important stock market ETFs in my weekend update.

Since five weeks ago, when the Retail Sector ETF (XRT) and Russell 2000 ETF (IWM) sold off heavily after failing to capture weekly channel highs.

to

Three weeks ago, when both were holding important weekly moving averages –

to

Two weeks ago, the Semiconductor Sector ETF (SMH) once again took the lead as the only member ETF to survive the weekly channel lows.

to

Last week, half of the ETFs rallied through weekly channel lows.

The ETF family has made us cautious and prepared for a correction, then a pullback, then a follow-through, and now??

How should I prepare this week?

Starting with the Retail Sector ETF (XRT), last weekend I wrote:

“This pop looking beyond the 200-week moving average is a great start. But will it be enough? Keep $75.00 in mind as XRT needs to clear that level to continue higher .”

Looking at the weekly chart, 73.50 is last week’s high. Last week, XRT closed below that level.

Yes, XRT held support, but Granny is the key to watch this week considering four indexes failed to clear their 50-day moving averages. She may be leading the charge, or she may be telling us that the rally is just a rally for mass resistance.

Which brings us to our family of indexes, the Russell 2000 ETF (IWM).

I wrote this last weekend,

“The Russell 2000 IWM also had an inside week, holding the 200-WMA and finding resistance at the bottom of the weekly channel.”

Last week, IWM was one of three family members that retraced the weekly channel lows.

So 200 is crucial and 205 is the next hurdle. Below 200, we maintain further vigilance and warning against market devaluation.

The Biotechnology Sector ETF (IBB) was a hot topic last week.

I wrote, “If IBB can clear 50-WMA (blue), it will be a positive. ”

It was, and it was.

I hope readers will follow this breakout. Next week, we’ll look at how 132 is key to sustainment.

The Regional Bank ETF (KRE) held major support three weeks ago. Currently, it has to contend with the lows in the weekly channel.

We will continue to pay attention to this project. Above 50.00, you will see an upside.

A red flag that came up last week was the Transportation Sector ETF (IYT).

I flagged this area as being of greatest concern.

All I can say this week is that IYT seems indecisive. IYT ended the week barely higher, so this and Retail XRT remain in question.

Finally, Semiconductors (SMH) was competing for a lot of revenue, from the misery of Advanced Micro Devices (AMD) to the jubilation of Taiwan Semiconductors (TSM).

This week, we expect SMH to hold the weekly channel low.

To remain bullish, SMH will also need to break out of last week’s high (around 220) and sustain higher.

If you want to know if we’re headed for further stagflation, keep the family on your screen because that could mean a further crash in stocks and another crash with further increases in commodities.

twitter: @Market Minute

The author may have positions in the securities mentioned at the time of publication. All opinions expressed here are those of the authors and do not represent the views or opinions of any other person or entity..