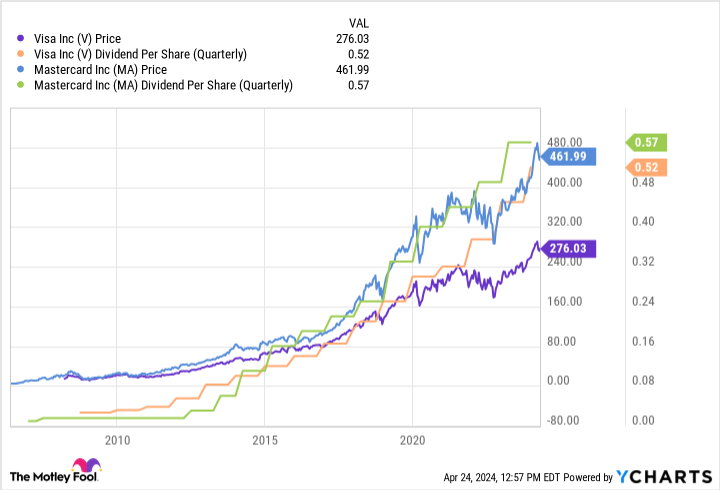

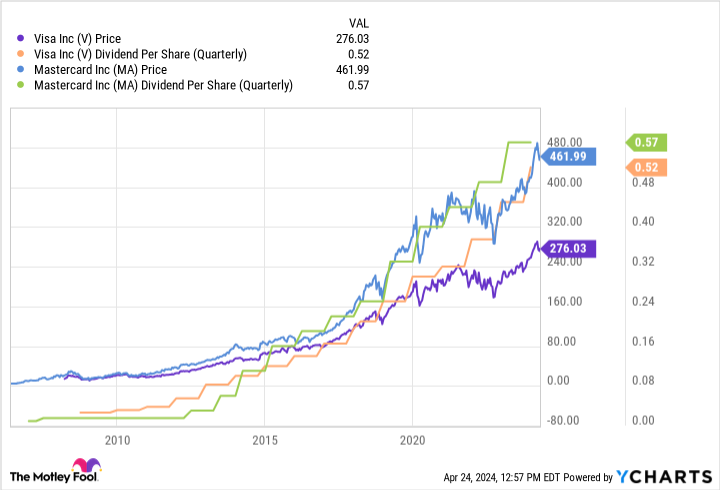

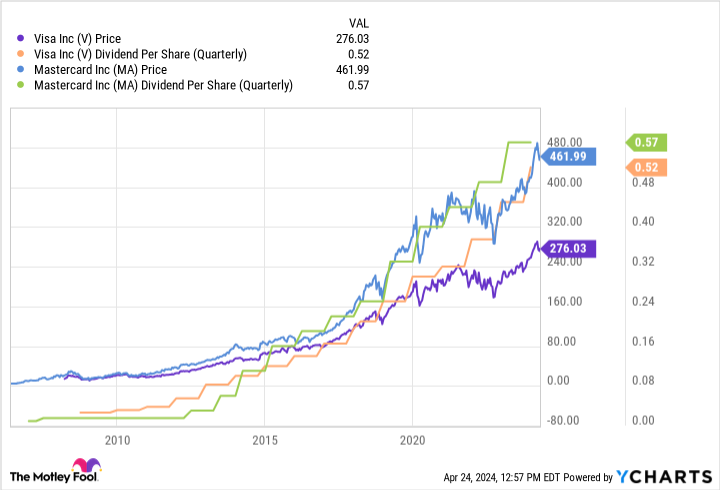

master Card (New York Stock Exchange: Massachusetts) The current dividend yield is approximately 0.6%. visa (New York Stock Exchange: V) The yield is only slightly higher at around 0.8%. These numbers probably aren’t appealing to many dividend investors, but the numbers are attractive. Both of these payment processors have had dividend growth rates of mid-teens per year over the past decade. In other words, these are dividend growth stocks with an impressive dividend history. Here’s why you’ll want to have them on your wishlist for your next big market sale.

The role of Visa and Mastercard

Visa and Mastercard are the number one and number two payment processors, respectively. This basically means that consumers use their cards (you’re probably familiar with the logo) to buy things. Visa and Mastercard work with merchants and banks to use their own computer networks to ensure transactions are processed and everyone is properly credited and debited. Sounds easy, but it’s actually not. This is because fraud and reliability issues are on the rise.

Both companies provide services, and they charge a fee for those services. They essentially collect a small percentage of every transaction they process. However, given the number of transactions that use cards with logos on them, these small fees add up to a huge amount of revenue. More and more transactions are taking place across networks as customers move away from cash or make purchases in places where cash is not available at all (such as online shopping).

This has led to many years of strong growth. The downside is that both Visa and Mastercard hold dominant positions in the industry and frequently battle with regulators and retailers over fees. That may pose a serious risk someday, but for now the pair’s growth has not slowed down. Both companies reward dividend growth investors with 10-year annual dividend growth rates of 23% and 18%, respectively. Recent growth rates for both companies are solidly in the mid-teens.

Valuation issues for investors

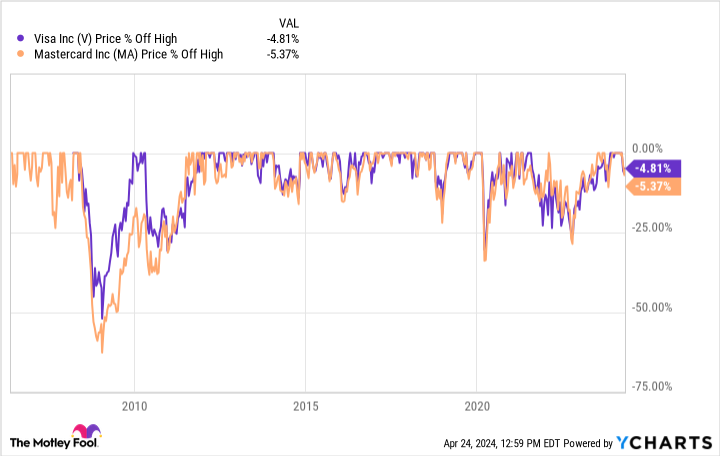

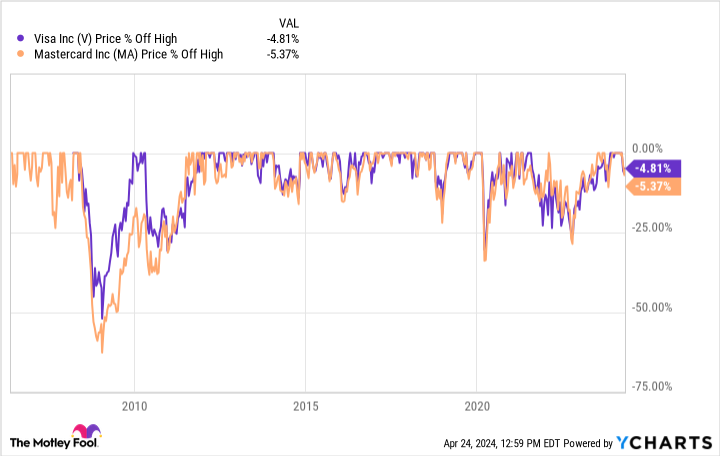

Of course, investors are well aware of the success these two companies have achieved. The stock is priced accordingly and the yield is modest. What’s noteworthy is that both are trading near all-time highs. There are things to discuss from a valuation perspective, but with key metrics such as price-to-earnings ratio and sales-to-sales ratio both below their long-term averages, it’s hard to suggest that either is a real buy. It would be difficult. Dividend growth investors are looking for slightly higher yields.

That doesn’t mean you should simply ignore this pair. You should keep them on your wishlist with the ambitious goal of adding them during market downturns. Markets can become irrational during difficult times and throw out the baby with the bathwater. If Visa and Mastercard get caught up in the selloff, there could be an even more attractive buying opportunity. Of course, this might only yield a dividend of around 1%, but on a percentage basis it would be significantly higher than the current yield. Notably, both stocks have experienced share price declines of 25% in recent years, so it’s not far-fetched to think that similar declines could occur in the future.

The problem with this logic is that you have to do your homework now. Before the market takes a turn for the worse, you want to take comfort in the fact that it offers solid long-term appeal. Otherwise, there will not be the fortitude to counter the widespread sell-off that is likely to occur. In other words, if you decide now, you’ll be able to act later when fear makes it difficult to pull the trigger.

A pair worth watching

Visa and Mastercard are well-run, industry-leading companies. One could argue that based on more traditional valuation metrics, it looks relatively attractive at the moment, but the yield is still pretty dire and the stock is near all-time highs. Even for dividend growth investors looking for a healthy combination of yield and dividend growth, now is probably not the best time to buy. But if a severe bear market puts these excess dividend growth stocks in the deep discount box, you’ll want to jump at the chance to own them. Make your decision now so you don’t let fear deter you from making a purchase when the opportunity finally arises.

Where to invest $1,000 right now

When our analyst team has a stock tip, it’s worth listening. After all, the newsletter they’ve been running for 20 years is Motley Fool Stock Advisorhas more than tripled its market. *

they just made it clear what they believe Best 10 stocks Visa made the list of stocks investors should buy right now — but there are nine others you may have overlooked.

See 10 stocks

*Stock Advisor will return as of April 22, 2024

Reuben Greg Brewer has no position in any stocks mentioned. The Motley Fool has a position in and recommends his Mastercard and Visa. The Motley Fool recommends long January 2025 $370 calls on Mastercard and options on his short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

2 Super Dividend Growth Stocks to Buy When There’s a Stock Market Selloff was originally published by The Motley Fool