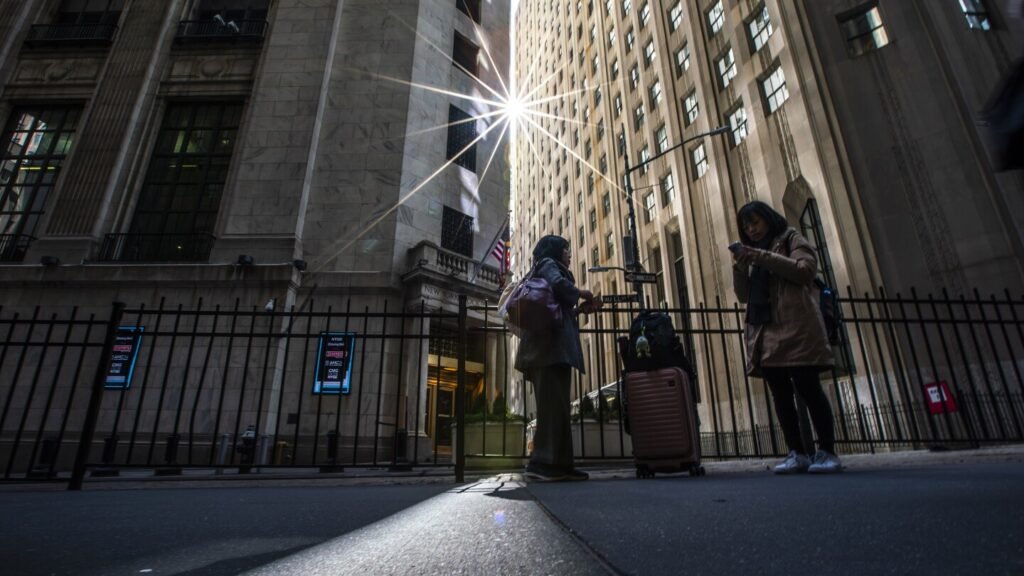

NEW YORK (AP) — U.S. stocks ended mixed Wednesday as momentum on Wall Street weakened after several sharp changes in direction.

The S&P 500 was nearly flat, rising 1.08 points, or less than 0.1%, to 5,071.63. It soared in the first two days of the week, regaining nearly two-thirds of its gain from last week. sudden loss.

The Dow Jones Industrial Average fell $42.77, or 0.1%, to $38,460.92, and the Nasdaq Composite Index fell $16.11, or 0.1%, to $15,712.75.

Tesla soared 12.1% after announcing overnight that it would accelerate car production. New, more affordable vehiclesInvestors have been hoping this will accelerate growth. The announcement helped investors avoid Tesla’s reported 55% profit decline.

Tesla is the first of a group of stocks known as the Magnificent Seven to report results for early 2024. With Tesla driving much of the U.S. stock market’s rise last year, the focus is on a group of smaller stocks. It will need performance to justify the high price.

Metaplatforms also reported updated financial results after the close of trading on Wednesday. Alphabet and Microsoft plan to follow suit a day later.

Earnings growth is expected to extend beyond the Magnificent Seven to more types of companies, largely because the U.S. economy is so strong. If you want the stock price to rise, it’s probably going to need to deliver higher returns. That’s because they’re unlikely to get much help from interest rates, another way to boost stock prices.

“A strong earnings season is likely to help restore market confidence,” said Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management.

In the bond market, U.S. Treasury yields rose after the latest report that the U.S. economy beat expectations, putting pressure on stock prices.a string of Recent like that report Hopes that the Fed might implement three policies are fading. lower interest rates That was shown early on this year.

A report on Wednesday said orders for machinery, aircraft and other long-lived industrial products were stronger than expected last month. Wall Street is in the awkward position of hoping the economy avoids a painful recession, but not one that would maintain upward pressure on inflation and persuade the Fed not to cut interest rates.

The yield on the 10-year U.S. Treasury rose to 4.64% from 4.60% late Tuesday.

On Wall Street, rail operator Norfolk Southern fell 3.6%. Report weak results The latest quarter beat expectations.

Boeing lost 2.9% despite reporting results like It wasn’t as bad as analysts feared.. The company, which is battling criticism over the safety of its planes, said it was taking steps to improve manufacturing quality, which has held up production.

Teledyne Technologies fell 10.9%, the market’s biggest loss, after the maker of digital image sensors, cameras and other equipment reported lower-than-expected profits and revenue. The company said demand from the industrial automation and test and measurement markets was weaker than expected.

Among the market winners, toy and game company Hasbro soared 11.9% after reporting its latest quarter’s profit and revenue were better than analysts expected. It benefited from growth from Baldur Gate 3 and Magic: The Gathering games, as well as Peppa Pig content.

Texas Instruments rose 5.6% after reporting better-than-expected profits and sales for the latest quarter. Boston Scientific was another powerful force pushing up the S&P 500 index, rising 5.7% after beating earnings and revenue expectations.

In overseas stock markets, Japan’s Nikkei Stock Average rose 2.4% as the value of the Japanese yen continued to decline against the US dollar. The yen is trading at a 34-year low, a boost for Japan’s exporters, but speculation is also mounting about whether Japanese authorities will strengthen the currency.

Stock indexes rose in most of the rest of Asia, but fell slightly in Europe.

___

Associated Press writers Matt Ott and Zimo Zhong contributed.