Just because a company isn’t making profits doesn’t mean its stock price will go down. For example, Amazon.com lost money for years after going public, but if you had bought and held the stock since 1999, you could have made a lot of money. But the harsh reality is that too many loss-making businesses run out of cash and go bankrupt.

So the obvious question is, RTG mining (TSE:RTG) shareholders are debating whether they should be worried about the company’s cash burn rate. In this article, we define cash burn as annual (negative) free cash flow. This is the amount of money a company spends each year to fund growth. First, compare its cash burn to its cash reserves to determine its cash runway.

Check out our latest analysis on RTG Mining.

When will RTG mining funds run out?

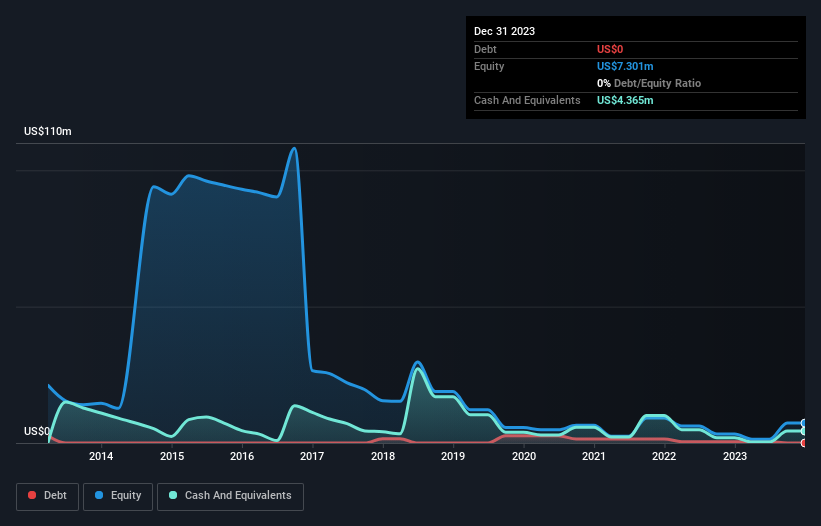

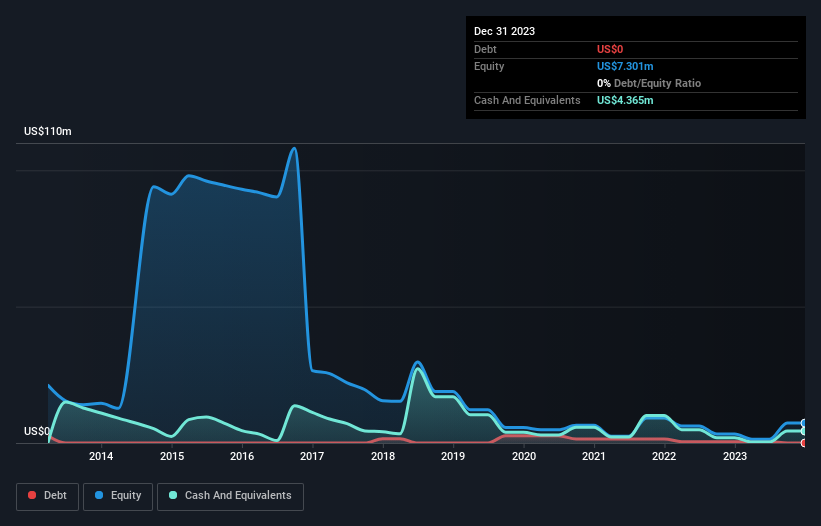

A company’s cash runway is calculated by dividing its cash holdings by its cash burn. As of December 2023, RTG Mining had cash of US$4.4m and no debt. Importantly, its cash burn was US$3.9m in the trailing twelve months. So it had a cash runway of about 14 months starting in December 2023. That’s not too bad, but it’s safe to say that the end of its cash runway is in sight unless its cash burn decreases significantly. The image below shows how its cash balance has changed over the past few years.

How has RTG Mining’s cash burn changed over time?

While RTG Mining is recording statutory Last year’s revenue was $19,000; operation. For us, that means it’s a pre-earnings company, so we look at its cash burn trajectory to assess its cash burn situation. Even though that doesn’t excite us, the 28% year-on-year reduction in cash burn suggests that the company can continue to operate for quite some time. Admittedly, we’re a little cautious about RTG Mining because it doesn’t have significant operating revenue. Therefore, we typically prioritize stocks on this list of stocks that analysts predict will grow.

How easy is RTG mining to raise cash?

RTG Mining has shown steadily decreasing cash burn, but it’s still worth considering how easily it can raise more cash, even if it’s to fuel faster growth. . Companies can raise capital through debt or equity. One of the main advantages of publicly traded companies is that they can sell stock to investors to raise cash and fund growth. By comparing a company’s annual cash burn to its total market capitalization, we can roughly estimate how many shares it would need to issue to run the company for another year (at the same burn rate).

RTG Mining’s market capitalization is USD 21 million, so RTG Mining’s cash burn of USD 3.9 million equates to approximately 19% of its market value. As a result, we’d venture that the company could raise more cash for growth without too much trouble, even at the cost of some dilution.

Are you worried about RTG Mining’s cash burn?

RTG Mining seems to be quite healthy when it comes to its cash burn situation. Not only was the cash burn very good relative to market capitalization, but the cash burn reduction was also very positive. While we don’t think cash burn is particularly problematic, shareholders should monitor how cash burn changes over time after considering the various factors in this article. That’s what I think.On a different note, RTG mining is 4 warning signs (and two concerns) that I think you should know about.

of course, You may find a great investment if you look elsewhere. So take a look at this free A list of companies that insiders are buying, as well as this list of growth stocks (as predicted by analysts).

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.