Global stocks were mixed on Thursday as Wall Street fell again on a decline in technology stocks.

Germany’s DAX fell 0.1% to 17,756.81, while Paris’ CAC40 rose 0.4% to 8,010.04. In London, the FTSE 100 index rose 0.1% to 7,857.46.

The S&P 500 futures index rose 0.3% and the Dow Jones Industrial Average futures index rose 0.1%.

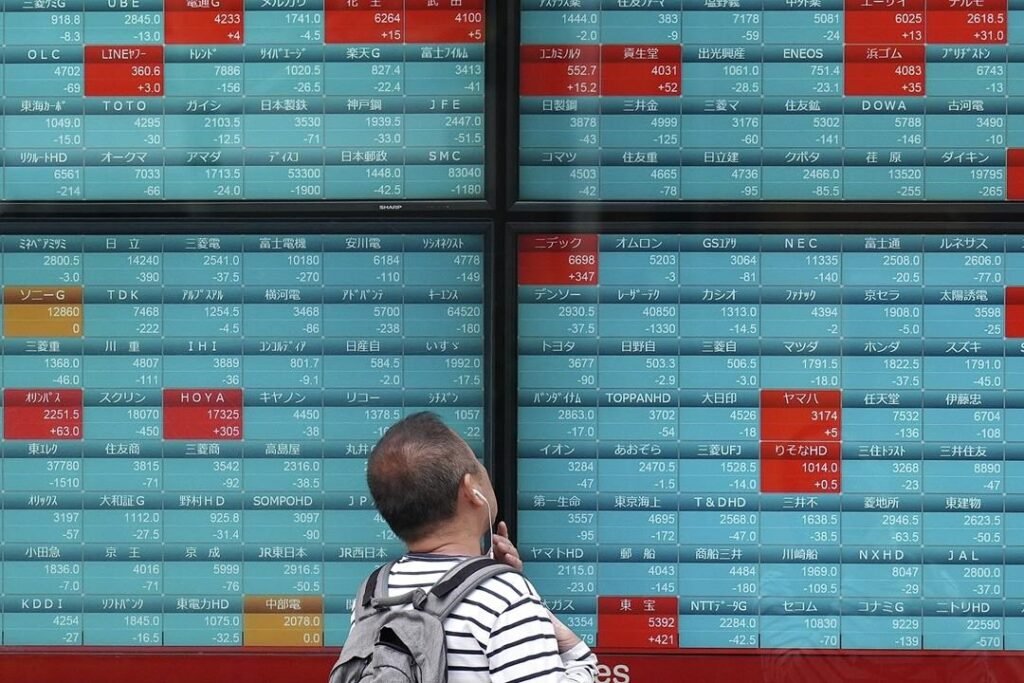

Stock prices rose across the board in Asian trading.

Tokyo’s Nikkei Stock Average rose 0.3% to 38,079.70 yen, while Hong Kong’s Hang Seng rose 0.8% to 16,468.07 yen.

The Shanghai Composite Index rose 0.1% to 3,074.22.

South Korea’s Kospi led the region’s gains, rising 2% to 2,634.70, while in Australia the S&P/ASX 500 rose 0.5% to 7,642.10.

On Wednesday, the S&P 500 fell 0.6%. It has fallen 4.4% since setting a record late last month.

The Dow Jones Industrial Average fell 0.1%, and the Nasdaq Composite Stock Price Index fell 1.1%.

Tech stocks fell after Dutch company ASML, a major supplier to the semiconductor industry, reported lower orders for early 2024 than analysts expected. The company’s shares fell 7.1% in U.S. trading.

Nvidia fell 3.9% and Broadcom fell 3.5%, making it the two heaviest weights in the S&P 500.

Weakness in tech stocks overshadowed better-than-expected profit reports from some major companies, including United Airlines. The stock soared 17.4%, boosted by strong demand from business flyers, after reporting better-than-expected year-to-date results than analysts expected.

Most traders now expect the U.S. Federal Reserve to cut interest rates only once or twice this year, according to data from CME Group. This was lower than the forecast of six or more cases at the beginning of the year.

With little short-term support expected from interest rate easing, companies will need to achieve higher profits to justify the strong rise in stock prices since the fall.

Travelers fell 7.4% after the insurance company’s quarterly results fell short of expectations. They had to contend with further losses from the catastrophe.

JB Hunt Transport Services fell 8.1% after reporting weaker-than-expected earnings and results. Competition in the country’s east and rising worker wages and other costs hurt in part.

The winner on Wall Street was Omnicom Group. The company rose 1.6% after the company said its latest quarterly profit beat analysts’ expectations. The marketing and communications company highlighted growth trends in most markets around the world except the Middle East and Africa.

Shares of Donald Trump’s social media company also continued to soar, this time up 15.6%. After that, it was a two-game losing streak of over 14%. Experts say the stock has been caught in a frenzy of trading driven more by public opinion about the former president than by the company’s earnings outlook.

In oil trading, benchmark U.S. crude fell 61 cents to $82.08 a barrel. It was down $2.67 on Wednesday.

Brent crude oil, the international standard, rose 58 cents to $86.71 a barrel.

The dollar rose by 154.39 yen from 154.38 yen. The euro rose to $1.0677 from $1.0673.

Elaine Kurtenbach, Associated Press