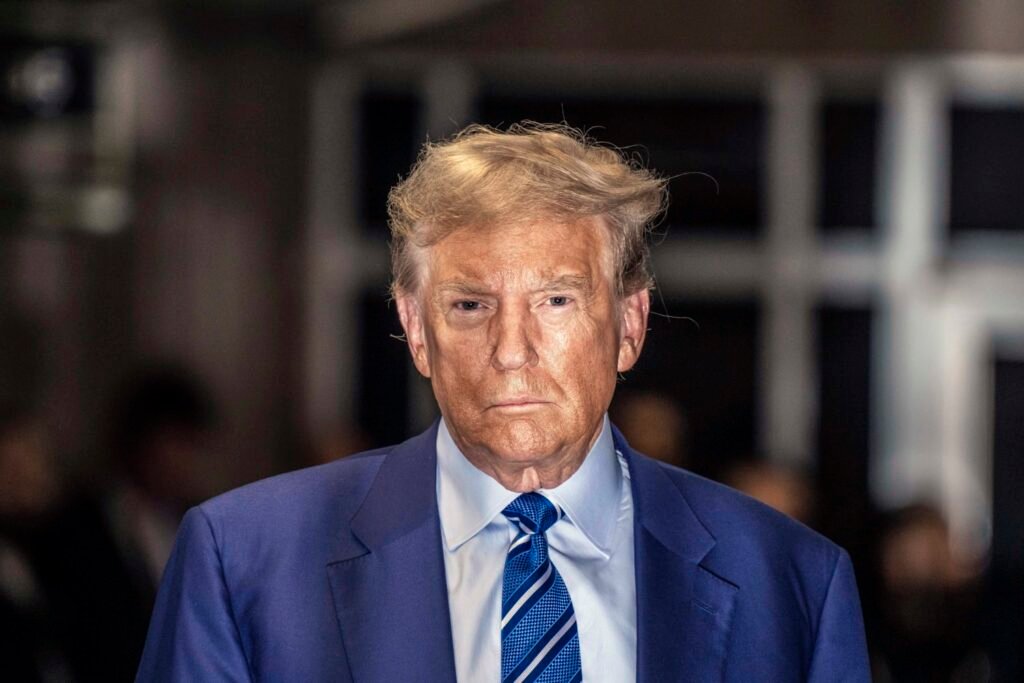

This week is sure to get off to a tough start for Donald Trump.

A flurry of Hail Marys failed to delay District Attorney Alvin Bragg’s case, but the former president is now on trial for hush money and election interference in a New York City courtroom. To make matters worse, his beloved social media company, Trump Media & Technology Group (DJT), has taken a hit in the stock market.

Three weeks ago, DJT began trading, allowing anyone from MAGA supporters to foreign sovereign wealth funds to buy its shares.

Anyone from MAGA supporters to foreign sovereign wealth funds could buy shares in the company. And they did.

And they did. The stock soared to an all-time high of $79.38 on its second day of trading, partly because Barry Diller called the whole thing a “scam” and because the company made only $4 million last year and lost $58 million. Please don’t worry about what I posted). For many, buying stocks seemed to be a way to show support for the former president.

The Washington Post spoke to some of these true believers earlier this week, some of whom lost hundreds or even thousands of dollars in the stock market crash. “This is more than just a stock to me,” Jerry Dean McClain, an Oklahoma logger and DTJ investor, told the Post. “I feel like God Almighty put it in my lap.”

Well, financial fundamentals are a bit like gravity. It will catch up eventually. And on Monday, DJT was down 66% from its record just a few weeks ago.

In fact, Monday was a particularly bad day after the company announced that millions of shares could be sold, including the former president’s shares, which account for almost 58% of the total stock. Although he and other insiders won’t be able to sell until September, the stock price fell on the prospect of millions of additional shares, closing at $26.61.

And on Tuesday, the company announced plans to launch a live TV streaming platform that combines news, religious programming, and even “canceled content” (“Arrested Development” is back!).

What’s your reaction? The stock fell further, closing at $22.84.

It may not have been taught at President Trump’s Wharton School, but this latest move is known as “grasping at straws” or (as per the Biz 101 memo) “throwing spaghetti at the wall.” Sometimes. please think about it. Disney is a highly profitable media company with thousands of hours of content available for everyone to watch, yet it loses money on streaming. want Not to mention the cable and TV networks you can watch.

Trump TV? Will Trump’s rallies be livestreamed? What will it be like when he is in court?

His stock was worth about $5.2 billion on paper when the stock reached its all-time high. Currently, the amount is about 1.8 billion dollars, but he did not spend a single dollar.

But remember this. People may see DJT falling like a stone and imply that Trump has lost his shirt or is “troubled,” but he’s not. His stock was worth about $5.2 billion on paper when the stock reached its all-time high. Now, it’s about $1.8 billion, but he never spent a single dollar or moved his finger to acquire these stocks, except maybe to type something into Truth Social. . It costs $1.8 billion to do almost nothing.

In fact, we learned on Monday that Trump is set to receive an additional 36 million shares, worth more than $800 million today.

The goal for Mr. Trump is to acquire as many stocks as possible and turn them into cash or loans as quickly as possible before people lose interest in stocks even more and the party ends.

Trump’s stock may be down, but he still has the potential to profit.