- Andreessen Horowitz has raised $7.2 billion across funds, most of which will go toward late-stage, or growth, investing.

- The company is raking in huge amounts of cash even as the broader startup and IPO markets remain depressed.

- Andreessen Horowitz did not announce further funding for its cryptocurrency division.

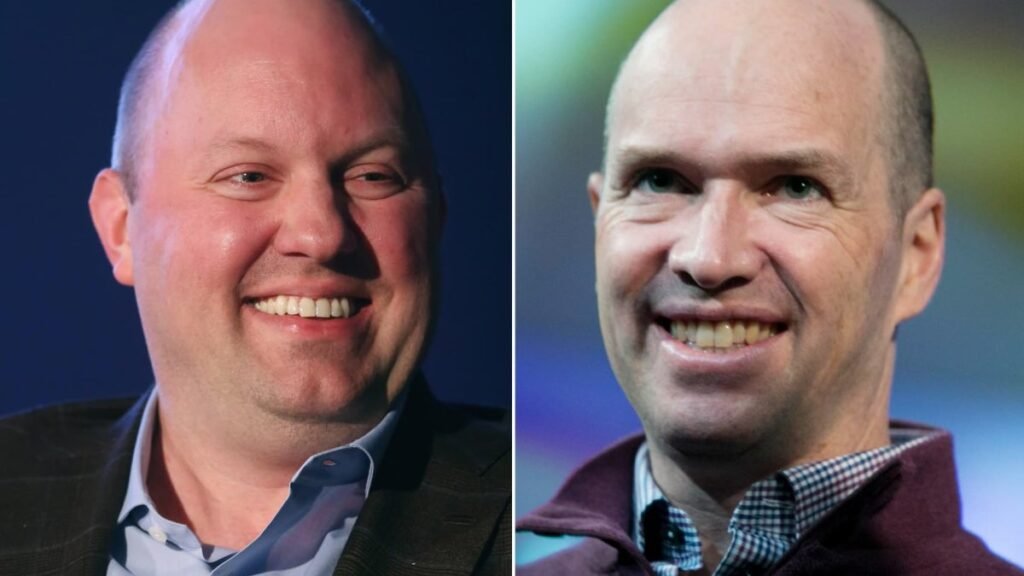

Andreessen Horowitz announced Tuesday that it has raised $7.2 billion from five different funds, a sign of optimism in a world of tech startups that hasn’t seen any major withdrawals in the past two years.

“This is an important milestone for our company,” Ben Horowitz, who co-founded the company with Marc Andreessen in 2009, said in a blog post.

The biggest chunk of new money was Andreessen Horowitz’s growth fund, which brought in $3.75 billion. That money will be invested in late-stage companies deemed close to going public, as well as capital-intensive businesses that require large checks.

Horowitz said in the post that $1.25 billion will go toward infrastructure, including investments in artificial intelligence, $1 billion will go to apps, $600 million will go to games, and another $600 million will go to the company’s American・He stated that the money will be allocated to “founders and companies” which he calls dynamism. It supports the national interest. ” This includes aerospace, defense, education, and housing.

The company initially aimed to raise $6.9 billion from investors for a series of new funds, including two focused on AI, Bloomberg previously reported. While AI investment is hot in Silicon Valley and elsewhere, the overall market is in the doldrums.

Venture investors have been closing their wallets since 2021 saw a record surge in tech IPOs and startup investments. Soaring inflation and rising interest rates in 2022 have forced investors to retreat from risky assets and forced cash-hungry startups to drastically cut costs. Even as the stock market recovers, venture deals remain sluggish.

U.S. venture capital trading volume in the first quarter fell to its lowest level since 2017, according to data released by PitchBook earlier this month. The situation is similar around the world, with global trading volumes reaching their lowest since 2016 and total trading volumes falling to levels not seen since 2019.

Meanwhile, there have been almost no technology IPOs since the end of 2021. Reddit and Astera Labs went public in the first quarter, making them the first venture-backed technology companies to debut since September. According to PitchBook, these accounted for 73.4% of total exits in the U.S. over the same period.

Horowitz did not mention the market slowdown in his post. He also did not suggest that the new funds would be earmarked for cryptocurrencies. Cryptocurrency is an area in which Andreessen Horowitz was especially bullish during the crypto boom that pushed the price of Bitcoin to a record in 2021. The company raised a total of $4.5 billion in cryptocurrency funds in 2022. Raised $7.6 billion for investments in cryptocurrency and blockchain.

Andreessen Horowitz plans to raise more money for its cryptocurrency fund and a separate biotech fund, people familiar with the matter told Bloomberg. The company did not respond to requests for comment.

One of Andreessen Horowitz’s most notable bets over the past few years involved controversial WeWork co-founder Adam Neumann and his new startup, Flow. Andreessen Horowitz wrote a check for $350 million to the company, which is new and has not yet entered the residential real estate market.

Andreessen Horowitz said in a blog post at the time that Neumann’s efforts to redesign WeWork’s office experience were “often underappreciated,” and that the company “repeatedly has grown from the lessons of its founder and He said he loves “watching the successes build.”

clock: CEO says Adam Neumann deserves a second chance