12 minutes ago

China’s March industrial production and retail sales statistics are lower than expected

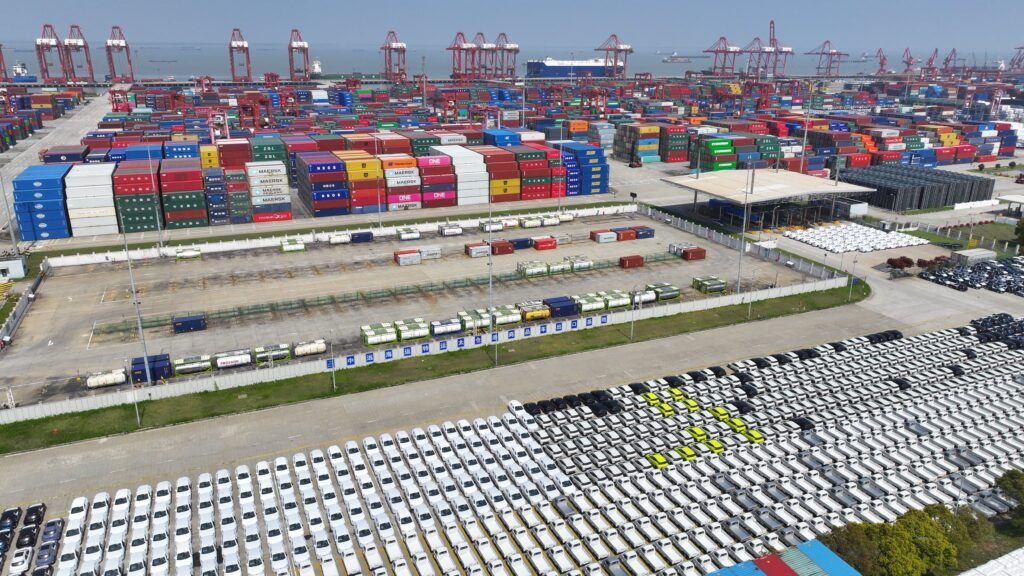

China’s industrial production rose 4.5% in March from a year earlier, falling short of the 6% expansion expected by Reuters.

According to the National Bureau of Statistics, China’s manufacturing industry grew by 5.1% and mining by 0.2%. The country’s electricity, heat, gas and water production and supply industry rose 4.9%.

The country’s retail sales, an indicator of consumption, rose 3.1% from a year earlier, lower than the expected 4.6% increase. Growth also slowed down from the 5.5% increase in the previous month.

—Li Yingshan

38 minutes ago

China’s economy grew 5.3% in the first quarter, beating expectations

China’s economy grew 5.3% year-on-year in the first quarter, beating the 4.6% growth forecast by economists polled by Reuters.

Data released by China’s National Bureau of Statistics showed gross domestic product (GDP) in the January-March period grew 5.2%, faster than the 5.2% growth in the fourth quarter. On a quarterly basis, China’s GDP increased by 1.6% in the first quarter.

The Chinese government has set a growth target of around 5% for 2024.

—Lim Huijie

47 minutes ago

China’s new home prices fell 2.2% in March, the biggest decline since August 2015

New home prices in China have fallen for nine consecutive months, falling 2.2% in March compared to the same month last year.

This is faster than February’s 1.4% decline and the biggest decline in home prices since August 2015, according to LSEG data.

On a month-on-month basis, the prices of new houses in first-tier cities fell by 0.1% from the previous month, while sales prices of new houses in second- and third-tier cities fell by 0.3% and 0.4% from the previous month. each month.

First-tier cities include the capital Beijing, as well as Shanghai, Guangzhou, and Shenzhen.

— Lim Huijie

2 hours ago

The yen has fallen to its lowest level since June 1990, exceeding $154 against the dollar.

The Japanese yen has fallen to more than 154 yen against the US dollar, its lowest level since June 1990.

Since the Bank of Japan raised interest rates on March 19, the yen has remained firmly above the 150 yen mark, and Japanese officials have said that “all options are on the table” to counter excessive yen movements. “Yes,” he repeatedly said.

According to Reuters, former currency diplomat Hiroshi Watanabe said on April 4 that authorities would not intervene until the yen rose above $155 against the dollar.

3 hours ago

CNBC Pro: These 10 oil stocks are most and least sensitive to price changes amid Iran-Israel tensions

Oil prices were volatile in April due to heightened geopolitical risks.

CNBC Pro screened stocks in the MSCI World Energy Index that are highly correlated or inversely correlated with the international benchmark Brent crude oil price over the past week, month, and year.

CNBC Pro subscribers can read more here.

— Ganesh Rao

22 hours ago

CNBC Pro: Morgan Stanley names global ‘alpha’ stock candidates for April, giving one stock more than 30% upside potential

Asian markets have had a mixed start to the year, with investors focusing on India, Japan and increasingly China.

Looking ahead, those looking for opportunities in the region can look to Morgan Stanley’s Alpha stocks. Alpha stocks are stocks that have the ability to beat the market.

CNBC Pro subscribers can read more here.

— Amara Balakrishna

7 hours ago

Oil markets ignored Iran’s attack.What happens next depends on Israel

An Israeli Sikorsky helicopter flies near Ashkelon as an oil rig is seen in the background during the ongoing conflict between Israel and the Palestinian Islamist group Hamas, November 14, 2023, in Israel. November 14, 2023.

Amir Cohen | Reuters

Oil markets on Monday ignored Iran’s air attacks on Israel over the weekend, with both U.S. crude and global benchmarks settling slightly lower.

West Texas Intermediate’s May contract fell 25 cents, or 0.29%, to settle at $85.41 per barrel. Brent futures for June fell 35 cents, or 0.39%, to settle at $90.10 a barrel.

Markets had already priced in the risk of a telegraphed attack by Iran for several days, and traders breathed a sigh of relief after Israel and the United States intercepted nearly all of the missiles launched.

What happens next will depend on how Israel responds.

“In our view, what is not priced into the current market is the possibility of continued direct conflict between Iran and Israel,” Maximilian Leighton, Citi’s head of commodity research, said in a note to clients. Depending on how Israel responds to the attack, oil prices could exceed $100 a barrel, analysts wrote.

— Spencer Kimball

7 hours ago

Nasdaq Composite Index falls below 50-day moving average for first time since November

The major indexes resumed their decline on Monday, with the Nasdaq Composite Index down about 1.7%, below its 50-day moving average.

This is the first time since November 3, 2023 that the tech stock ratio has fallen below this important threshold. If the stock closes below this level, it will be the first time since November 2, 2023. The index is up more than 30% in 2023. Last 12 months.

The 50-day moving average is a technical indicator that traders look at to assess short-term trading trends. A closing price below this level can signal an upcoming downtrend for the asset.

— Darla Mercado, Nick Wells

7 hours ago

British investment bank expects oil prices to hit $100, stock market to correct by 10%

Coralian Energy’s ENSCO-72 drilling rig operates at Poole Bay, Poole Bay, UK, February 15, 2019.

Finbarr Webster | Getty Images News | Getty Images

The turmoil in the Middle East could cause dramatic movements in financial markets, with oil prices rising to $100 and stock markets undergoing a major correction of as much as 10%, according to British investment bank Liberum Capital.

“In our base case of Israel retaliating, this could result in a 5-10% stock market correction and further USD appreciation, in a limited way to prevent further escalation of the conflict.” 2007 Client He said this in a memo to:

The company has identified clear near-term winners, including defense contractors.

— Yun Lee

14 hours ago

Retail sales data beats economists’ expectations

Shoppers walk around Twelve Oaks Mall on November 24, 2023 in Novi, Michigan.

Emily Elkonin | Getty Images

Stock futures rose after March retail sales data came in better than expected.

The indicator increased by 0.7% in the same month, according to data from the U.S. Census Bureau. This beats the Dow Jones consensus estimate for a 0.3% rise and confirms the trend of continued spending despite rising prices in the United States.

— Alex Harring, Jeff Cox